Climate Biennial Exploratory Scenario

01 July 2021

This month the Bank of England (BoE) became one of the first central banks, globally, to launch an exercise with local financial institutions based on climate change scenarios. The participants in the exercise are UK’s largest lenders and insurers covering 60-70% of the UK financial sector. This is a new exercise for financial institutions, introducing a step change to data and modelling requirements for risk management. Analysts are rapidly upskilling for the use of geospatial and carbon footprint data and the development of new modelling capabilities, with an increasing convergence between the risk assessment for insurers and banks.

The exercise is intended to assess the magnitude of losses that might be expected from different climate-driven pathways. This will further understanding of the challenges to business models from climate change risks and what this means for the provision of financial services. The exercise is also meant to assist in enhancing the management of climate risks and encouraging boards to take a strategic, long-term approach to managing these risks.

The way climate change risk will be reflected in IFRS 9 and capital models is still unclear. Will climate change feed into expected losses, with IFRS 9 and capital models adjusted to reflect risk through so called ‘climate change scalars’? Or will banks be required to hold additional capital buffers to protect themselves against risks arising from climate change? The BoE has suggested that it is still at the exploratory phase of understanding the impacts of climate change on the financial sector. Once it has visibility of the climate scenario results from the largest financial institutions, it will decide on the most appropriate way to factor the financial risks from climate change into its macroprudential policies. The aggregated results of the exercise across the UK financial sector are expected to be published in May next year.

This is a strong signal to lenders and that now is the time to be investing in development of the basic capabilities to identify, assess, measure and fundamentally better understand how climate change impacts their own businesses and portfolios. Organisations who wait to this time before they more fully mobilise their resources will have quite a mountain to climb. There are several activities that require a material effort to get started – one is accessing and organising the underlying data and the other is developing a basic means for measuring physical and transition risks.

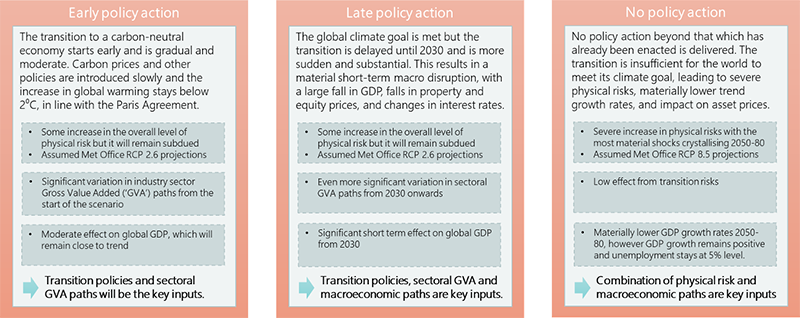

The Climate Biennial Exploratory Scenario exercise is based upon three climate change scenarios – early policy action, late policy action and no policy action scenarios with a modelling horizon of thirty years (2021 – 2050). There are challenges to calibrating any model of credit risk over 30-50 year time horizons. Historically banks have focused on short and medium term forecasting to ensure they would survive historic stresses in the implicit belief that we are in a stationary system where past events are good proxies for future stresses. This will no longer be adequate given the scale and breadth of long-term interactions that need to be modelled.

In the early policy action scenario, countries around the world take decisive and coordinated action towards reducing global carbon emissions earlier in this decade. This results in an orderly adjustment of the global economy, with a slowing down of GDP growth through the 2020s, which then returns to trend growth by the 2030s. The Paris Agreement targets are met.

In the late policy action scenario, tackling climate change is delayed by around 10 years and is considerably more abrupt and severe to achieve Paris targets. This results in a disorderly economic transition. There is a global economic recession in the early 2030s, before the global economy returns back to trend growth. In the UK, this recession is similar in magnitude to the financial crisis of 2008-2010. To achieve the Paris agreement targets, the early and late policy action scenarios assume that the UK consumption of oil, gas and coal, as a percentage of overall energy consumption, would fall from about 75% currently to about 5% by 2030.

The no policy action scenario assumes no actions over and above existing policies to tackle climate change. Carbon emissions soar, temperatures rise considerably and by the second half of the century, the world suffers from the disastrous consequences of climate change with sea levels rising, frequent and intense storms, floods, and wildfires. Economic growth slows down considerably and does not return back to normal.

The BoE have highlighted that they expect the no policy action scenario to show the highest magnitude of losses. The scenario shows a slowdown in GDP as opposed to an economic contraction, with unemployment staying at 5% throughout the scenario. Current stress testing models are calibrated to work with deep economic recessions as opposed to subtrend economic growth, and so they are unlikely to be able to capture a material deterioration in losses in this scenario. The expectation is therefore that these additional large losses from physical risks will be modelled through the new climate models that are being developed by financial institutions.

The participants in the climate scenario analysis exercise will be expected to model the impact on credit losses from their retail and corporate exposures. Elements that will need to be factored in include,

-

impact on household finances from increased gas and electricity bills as well as increased insurance premiums and physical damage repair costs

-

impact on property values from required retro-fitting of properties to required energy standards, as well as from increased physical risks

-

for at least the 100 largest and most material corporate counterparties, impact from disrupted supply chains, physical damage, cost and price shifts, stranded assets, and legal liabilities from failure to adapt

-

residual value losses for car finance portfolios

-

pass-through of asset-side transmission channels which affect insurance liability valuation

-

change in frequency and severity of general insurance claims through physical risks

-

indirect impacts from wider economic developments (e.g. due to unemployment, shocks to inflation, lower productivity, depleting capital stock, supply shock, labour supply impacts, lower consumption/investment, etc).

The impacts of the climate scenarios will be assessed on credit losses (as well as on risk weighted assets, albeit at a high level). There is little immediate experience of credit defaults as a result of climate change, resulting in limited opportunities to leverage traditional credit risk approaches that model ‘bad’ outcomes directly. Instead, the methodologies will focus on modelling probability of default and loss given default indirectly. In these models, the impact of climate change in terms of both physical (e.g. rainfall, geology etc) and transitional (e.g. increased taxation on fossil fuels) is mapped to their impact on property prices, profitability and affordability measures based on granular econometric assumptions. In addition to this equilibrium modelling approach, it is also important to account for the expectation that climate change will be associated with possible ‘structural breaks’ in existing credit relationships and that the economic response may not continue in a smooth progression at all.

There is also a requirement for the participants to complete a ‘qualitative’ questionnaire, describing their risk management practices and adaptation plans. This is in line with the message from the BoE that ultimately the purpose of all the analytical work is to understand the challenges of climate change to business models, and the development of adaptation strategies to mitigate the impact of climate risks in the financial sector.

For more information on how 4most can assist you in developing climate change risk measurement and scenario modelling solutions, please get in touch with ivelina.nilsson@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance