Economics Update: May 2022

05 May 2022

Our Head of Economics, Keith Church, shares his latest thoughts on the changing economic landscape…

For more of Keith’s thoughts, Why not follow us on LinkedIn

May 5, 2022

Given the rise in petrol prices since Russia invaded Ukraine, it is possible inflation in April was around 9%. That would be the highest rate since the index was first complied in the late 1980s.

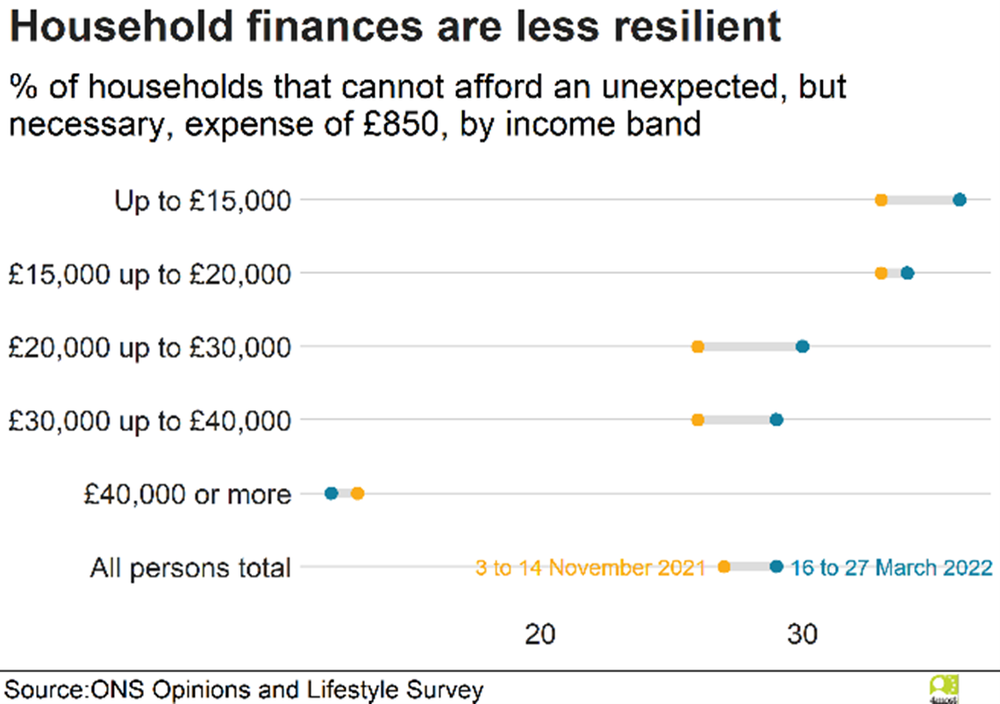

Even before the big rise in energy bills in April, around a third of UK households could not afford an unexpected expense of £850. This proportion has risen since last year; the real income squeeze may be coming to a head now, but the crisis has been building for some time.

Although the Bank of England increased interest rates on 5 May, that will have little impact on the period of stagflation we now appear to be in. And with 80% of residential mortgages on a fixed rate, this rise will not have much impact on the ability of borrowers to make their payments. But over half of renters are already struggling.

Do you have any questions? Please contact info@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance