Economics Update: December 2021

21 December 2021

Our Head of Economics, Keith Church, shares his latest thoughts on the changing economic landscape…

For more of Keith’s thoughts, why not follow us on LinkedIn?

December 21, 2021

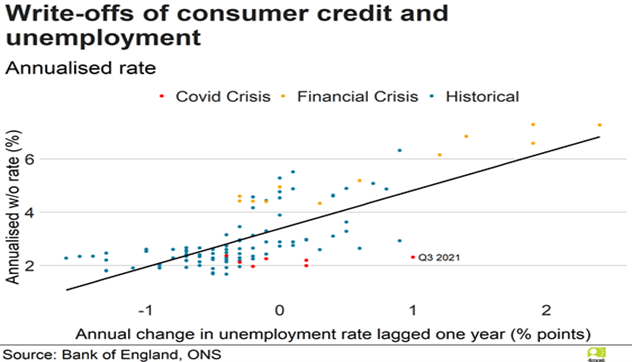

Consumer credit write-offs

Labour market remains resilient indicating the success of vaccines and furlough scheme but write-off rates remain flat so far.

It is now clear that the peak unemployment rate during the crisis was 5.2% in October-December 2020. This is a much better outcome than anyone was expecting a year ago and is testimony to the success of both vaccines and the government’s furlough scheme.

Even though the rise in unemployment was muted, it would be expected to have some impact on write-offs of consumer credit given the historic relationship. But the write-off rate, as yet, has been remarkably flat.

At the margin, the rise in Universal Credit at the start of the pandemic provided some extra support for those losing their jobs. There may be some stress to emerge from the removal of this support, but a more optimistic view would be that this time it really is different. Most of those that lost their jobs are now back in employment. The single month estimate of the rate was just 4.2% in October.

Recent employment data suggests that finding a job was easier compared to previous recessions but downside risks for credit losses include higher long-term unemployment and SME’s debt burdens.

It has been much easier than in previous recessions for those losing their jobs to find new roles given record levels of vacancies. The combined 331,000 increase in payroll employment in Oct/Nov confirms no nasty surprise at the end of furlough.

It is not quite time to say that the crisis was a non-event in terms of consumer credit losses. Long-term unemployment is higher. And the big uncertainty of how many SMEs will fail under their higher debt burden remains. These companies provide c60% of private sector employment.

Do you have any questions? Please contact info@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance