4most’s Latest Economic Echoes

18 November 2021

Our Head of Economics, Keith Church, shares his latest thoughts on the changing economic landscape…

For more of Keith’s thoughts, why not follow us on LinkedIn?

Latest update: Nov 15, 2021

Mortgage arrears fell again in Q3 2021. The experience is testament to the success of the furlough scheme, which ended on 30 September, and the forbearance offered by lenders in the form of mortgage payment holidays.

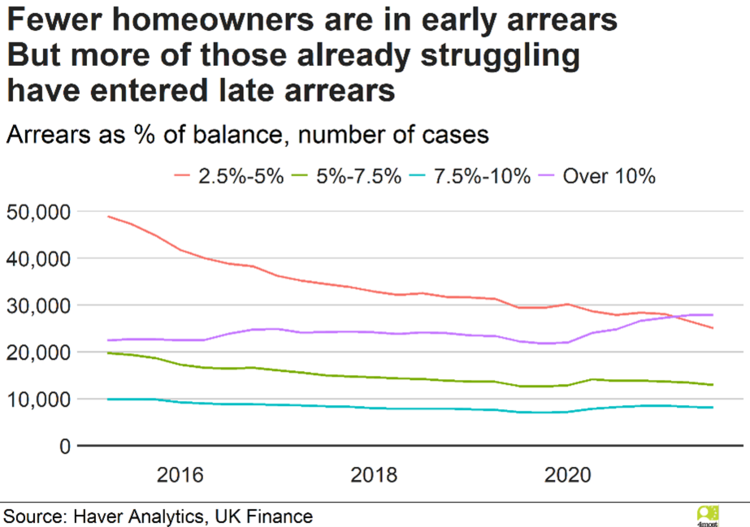

Underneath the headline fall, there are two main trends.

First, the number of people in early arrears continues to fall. With job vacancies at a record high, it has been easier for people to get back into employment if they lose their jobs than in previous downturns.

But second, those who were already in difficulty before the crisis have missed more payments. Given restrictions on possessions, this means the number of homeowners in late arrears have grown.

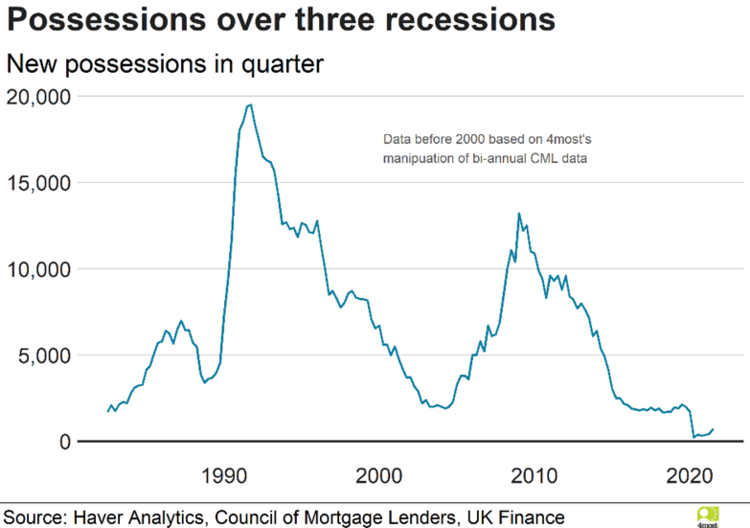

What will happen next? It looks like furlough did its job. Unemployment may not have risen at as it ended. But there will now be a rise in possessions as the backlog over the last year is cleared. However, it is quite possible the total over the course of the pandemic will be lower than might have been forecast in 2019.

Longer term there is question of how governments and the industry react to future economic downturns. Furlough has been costly, but in this case, prevented a more damaging outcome. There may well be pressure for similar support in the future, but the pandemic was probably a special case. From an industry perspective, this is the second recession where forbearance was asked of lenders. On both occasions it turned out to be in their interest. It now feels like it will be normal practice – not least because regulators may see it as a way of preventing the amplification of shocks through the financial system.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance