COVID-19: An Insurance update

07 April 2020

Where does COVID-19 leave insurers?

The UK’s death toll indicates that we are still not at the peak of the outbreak yet, with a daily high of 569 deaths reported on 1 April. The impact on the economy has been stark, with businesses worldwide affected. The insurance industry has not escaped unharmed.

Mortality isn’t the only worry for life insurers

As the pandemic heightens, the global death toll from COVID-19 has exceed 53,000 and is rising every day. The UK has the 7th highest fatality rate in the world and sadly further deaths are imminent. [1]

Life insurers are likely to be less concerned about how these fatalities are directly affecting their business because mortality is often heavily reinsured. Fitch Ratings has revised the Life insurance sector outlook down to “negative” and it is easy to see why. [2] Since the virus gripped China in late January, global equity markets have fallen, government bonds have fallen and as corporate bond spreads widen, the risk of default and downgrades on these bonds has grown. Due to the nature of their liabilities, Life insurers are often heavily invested in long term government and corporate bonds. Since year-end, the value of these assets on the balance sheet will have seen a sharp fall. Moreover, unit-linked business tends to have a large equity exposure. The falls here, along with the secondary impact of lower charges collected, again are set to negatively impact a Life insurer’s balance sheet.

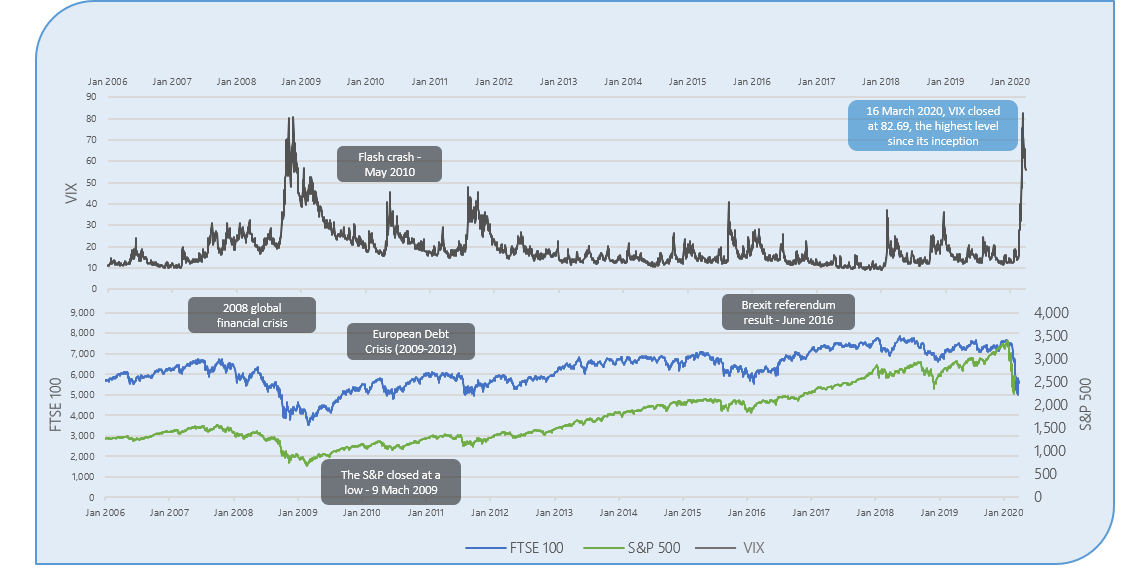

Covid-19 has shocked global market indices – a historic track of the VIX, FTSE 100 and S&P 500

Source: https://uk.investing.com

It is not just traditional asset classes that are affected either. Many insurers have large commercial real estate holdings. With a large number of businesses forced to close or work remotely during the lockdown, the ability to generate revenue and thus pay rents is impacted. Moreover, with the UK government granting a ban on evictions for commercial tenants who miss rental payments, there is little, owners of such assets can do in the short term. In the long term, the value of such assets may be depreciated due to decreasing demand and increased uncertainty. Anecdotal evidence from the US commercial market suggests that without intervention an increase in borrower defaults could potentially impact the entire real estate market and the US economy as a whole.

This negative impact on assets should however, be considered in parallel with the liabilities. The values of life insurers’ liabilities, for example, are likely to fall due to changes in the yield curve. Ultimately, the impact on the solvency coverage depends on how well matched the assets and liabilities are. We are experiencing the worst quarter fall in the FTSE 100 since 1987 and many are likely to have considered these falls purely as shock events and will not be perfectly matched for such market movements.

With this in mind, capital and solvency positions will be high on the agenda of insurers who will be particularly looking to release any capital prudency or future dividend supporting capability in this current environment.

Reporting regulations have been relaxed but will more need to be done?

COVID-19 has impacted everyday life for us all. Business operations and governance processes are having to adapt to new ways of working. While firms continue to work hard to minimise disruption as much as possible and limit the impact from COVID-19, we are seeing some changes to services. Keeping people safe is paramount and many firms are limiting roles to key workers in offices and focusing on existing customers and claims where possible. IT teams will undoubtedly be under immense pressure as workforces look to accommodate a new way of working, remotely from home.

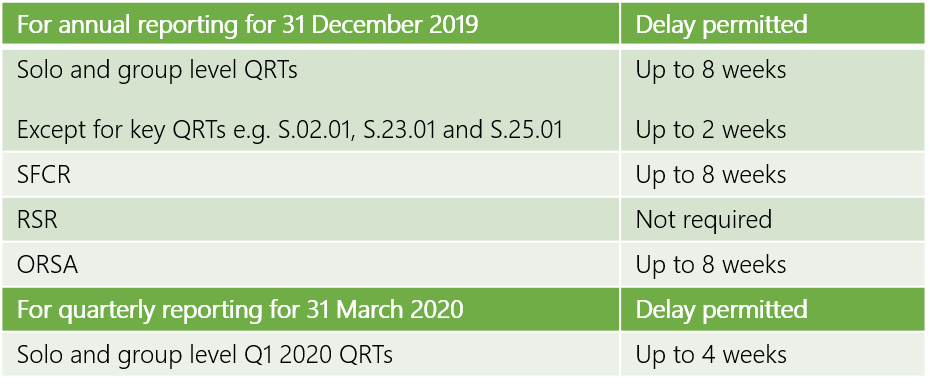

Reporting delays permitted by the PRA:

Source: www.bankofengland.co.uk

To ease the pressure on UK insurers in these unprecedented times, the PRA has accepted the EIOPA suggestion and has granted extensions on the deadlines for supervisory reporting and public disclosures. This however, now includes a requirement that information relating to the effects of COVID-19 should also be published within the SFCR. We are observing numerous insurers analysing the emerging data and carrying out initial impact and scenario analysis across different teams, including pricing, capital and reporting. We expect this analysis to flow through into future SFCR commentary.

In terms of IFRS 17 implementation, we expect firms will be continuing where possible to stick to original plans, albeit with the anticipated one-year delay to January 2023.

Are there any positives for insurers?

The impact of the pandemic will be felt for years and decades to come. It is likely to see shifts in the way insurers and consumers operate. Many Chinese insurers are already reporting that they have seen sharp increases in life and health insurance premiums:

-

China Life Insurance saw premium income increase by 21% in January and February, year on year

-

Ping An Health Insurance experienced an 83% increase in premiums in January and February, year on year and,

-

New China Life saw premium income grow 44% in February. [3]

Such increases were also seen after the 2003 SARS outbreak. Moreover, many governments are covering costs related to COVID-19 e.g. testing costs which have limited the impact on health insurers. While such increases may be less prominent in the UK, due to the NHS, the pandemic may increase the target market for life and health insurance products.

Many insurers, particularly those offering business interruption and event cancellation insurance, are also not seeing as high claim costs as would be expected – lessons learnt from the 2003 SARS outbreak mean that many policies do not cover losses from communicable diseases. Many travel insurance providers, who are likely to be one of the worst affected in the insurance industry, have already reacted to remove pandemic-related claims from their cover. Reactions such as these should be considered in line with the FCA’s statement issued on 19 March, which outlines an expectation of insurers to “consider very carefully the needs of their customers”. [4]

With a similar message, EIOPA issued a statement on 1 April which urged that access to and continuity of insurance services should be considered essential in the context of the breakout. [5] There is a risk of a negative image emerging of the insurance market for not meeting policyholders’ needs. There is a balance to be struck however, as EIOPA also alludes to in their statement, that the solvency of an insurer is equally key for ensuring policyholder protection.

The UK insurance industry is one of the largest insurance industries in the world. It is well regulated and largely well capitalised. A pandemic of this level however, was not something any insurer could have predicted. The impact on assets will have hit many insurers, particularly Life insurers’ balance sheets hard. The disruption of day-to-day business operations will be felt by everyone and it is still unclear when or how this will end but lessons will be learnt by all.

References:

[1] www.worldometers.info [2] www.fitchratings.com [3] www.insuranceerm.com [4] www.fca.org.uk/ [5] www.eiopa.europa.eu

Do you have any questions? Please contact Keith at keith.church@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance