COVID-19 Weekly Update: 30 March – 2 April 2020

03 April 2020

4most’s weekly update on the Coronavirus (COVID-19), providing insight on the economic impacts of the pandemic.

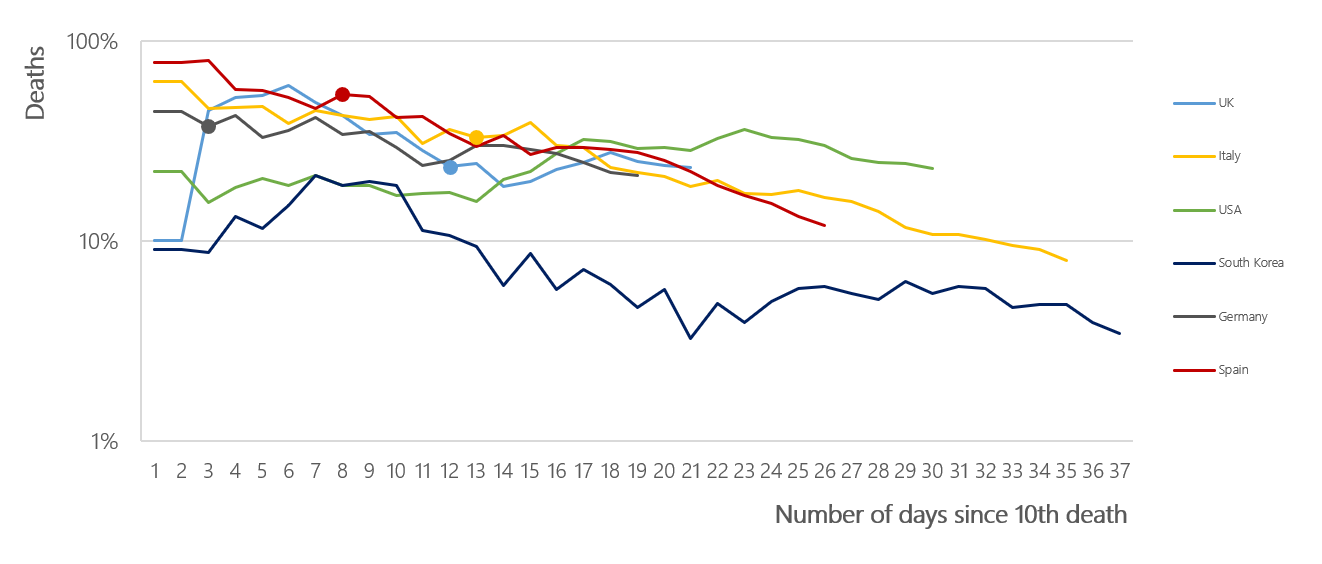

The UK’s death toll implies that we are still not at the peak of the outbreak yet, with a daily high of 563 deaths reported on 31 March. It is too soon to see what impact the recent lockdown has had. Our current position puts us at a rate growing marginally faster than Spain and Italy at the same stage in their progression through the pandemic.

Percentage daily growth in cumulative deaths (using a geometric average) since 10th death, as at midnight on 31 March 2020

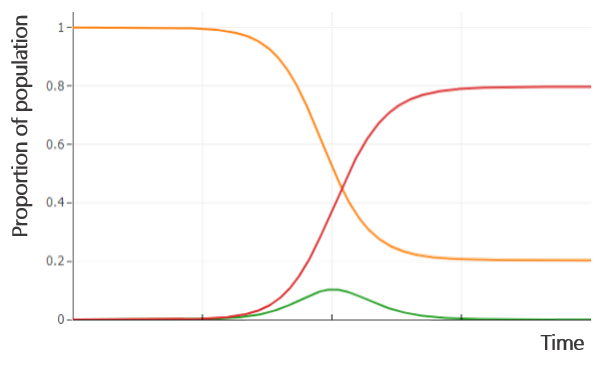

The projections below have been modelled using a modified Susceptible-Expose-Infectious-Recovered (“SEIR”) model.

Evolution of Covid-19 in a typical population with no control measures

Without the lockdown, the infection would have continued until c.80% of the population had been infected. (See * below in 4most insight: Implication of lockdown periods on COVID-19 Epidemiology)

Impact of length of lockdowns on the proportion infected

As long as there is a large proportion of the population susceptible, the epidemic will resume once the lockdown is lifted. (See ** below in 4most insight: Implication of lockdown periods on COVID-19 Epidemiology)

“We’re going to test 25,000 a day” – Boris Johnson

Economic Developments

The risk of permanent economic damage grows:

-

950,000 people successfully applied for Universal Credit (UC) between 16-31 March, consistent with a current unemployment rate of 6.7%

-

A survey indicates 20% of SMEs could run out of cash in the next four weeks. SMEs employ circa 23m people.

4most Insight

Key concerns:

-

Some are falling through the gaps. This includes newly-self employed, self-employed who took income as dividends rather than salary, and workers with heavily reduced hours.

-

Schemes are not working as hoped. Firms are laying workers off rather than retaining them, partly because the loan scheme is not working well operationally. Changes to soften loan terms are likely.

-

Those turning to UC have been hit hard. The income replacement rate for those falling into UC is typically 20%.

4most insight: “Where does this leave life insurers?”

Key thoughts:

-

Mortality isn’t the only worry for Life insurers. Life insurers are likely to be less concerned about how these fatalities are directly affecting their business because mortality is often heavily reinsured. Since the virus gripped China in late January, global equity markets and government bonds have fallen, and corporate bond spreads have widened. The impact on the solvency coverage depends on how well matched the assets and liabilities are, but with the falls observed, many are likely to consider the current situation areas a shock event and will not be fully matched for such market movements. Consequently, capital and solvency positions will be high on the agenda of insurers at present, particularly looking to release any capital prudency or future dividends supporting capability in the current environment.

-

Reporting regulations relaxed, but will more need to be done? Business operations and governance processes are having to adapt to new ways of working. To ease the pressure on UK insurers in these unprecedented times, EIOPA has granted extensions on the deadlines for supervisory reporting and public disclosures. In terms of IFRS 17 implementation, we expect firms will be continuing where possible to stick to original plans, albeit with the anticipated one-year delay to January 2023.

-

EIOPA have urged that access to and continuity of insurance services should be considered essential in the context of the breakout. It echoes the FCA’s recent statement on the expectation to treat consumers fairly at this time.

4most insight: implication of lockdown periods on covid-19 epidemiology

Key thoughts:

-

Prior to the lockdown, the UK was in the exponential growth phase of the epidemic. Without the lockdown, the infection would have continued until c.80% of the population had been infected. At this point, hosts for the virus become too dispersed and herd immunity is achieved. A typical evolution of the virus in a population allowed to move freely can be observed in the graph on the far left. (*See chart above Evolution of COVID-19 in a typical population with no control measures).

-

While the lockdown is in place, the proportion of infected people will stabilise and decline. As long as there is a large proportion of the population susceptible, the epidemic will resume once the lockdown is lifted (as shown the graph to the left). This long term risk will remain until a vaccine becomes available. (**See chart above Impact of length of lockdowns on the proportion infected).

-

Longer term lockdowns have a multifaceted benefit: final proportion of the people who are infected (e.g. from c.80% to c.60%) will be reduced; the strain on the NHS will be spread over a longer period and; ultimately there will be a lower number of deaths from COVID-19.

Market Update

Key changes:

-

A number of the UK’s largest banks have stated that they will scrap 2019 dividends, amounting to almost £8bn.

-

The Dow Jones Industrial Average and FTSE 100 have suffered the worst quarter since 1987, falling by 23% and 25% respectively, over Q1 2020.

-

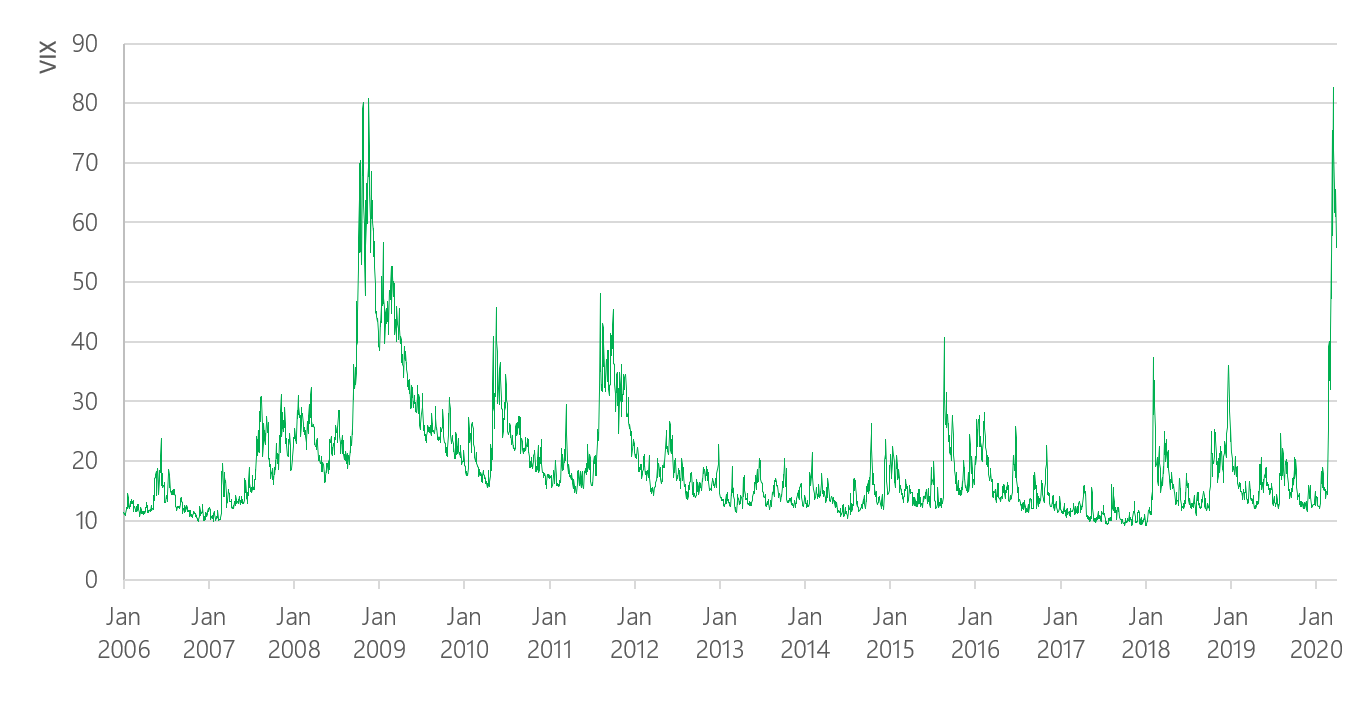

The VIX index closed at 82.69 on 16 March – the highest level since its inception and has remained high since.

Do you have any questions? Please contact Keith at keith.church@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance