COVID-19 Weekly Update: 16-19 March 2020

19 March 2020

4most’s weekly update on the Coronavirus (COVID-19), providing insight on the economic impacts of the pandemic.

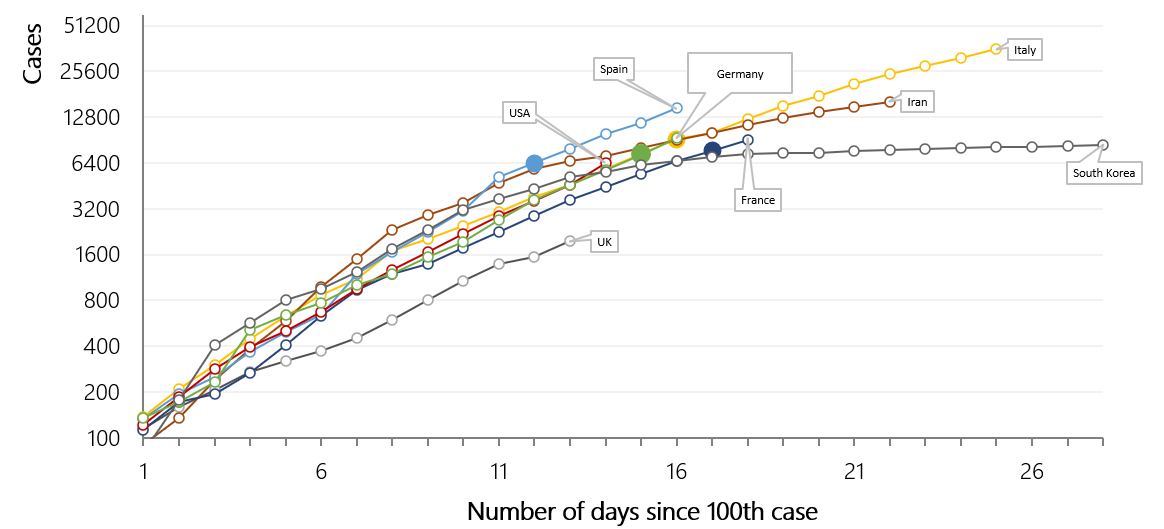

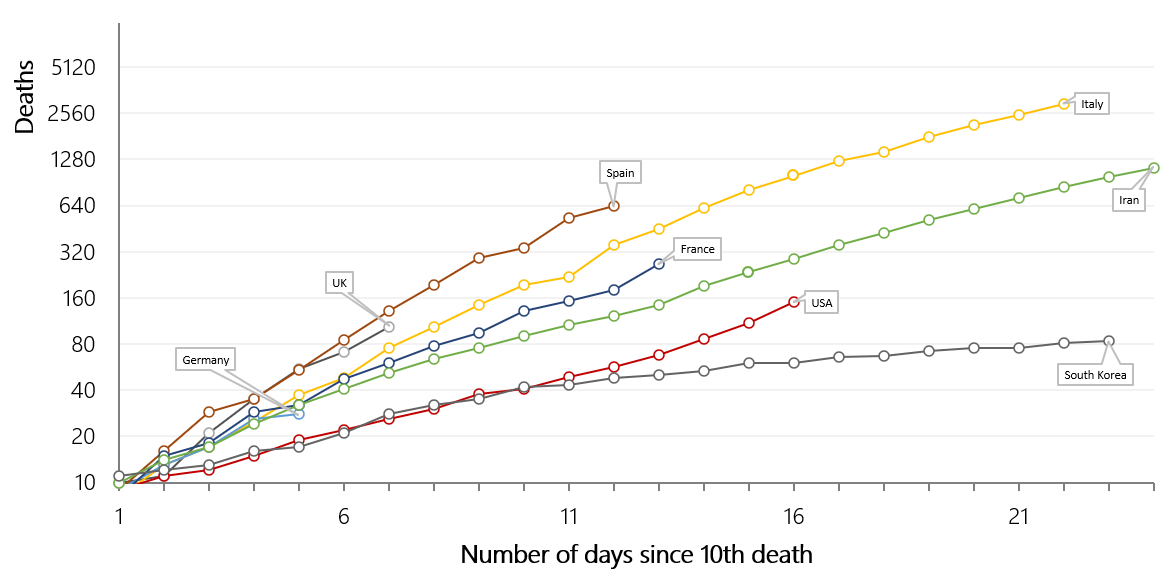

Despite the widespread lockdown put in place in Italy and Spain (as indicated by the heavy dots on the graph below), cases appear to still be growing at alarming rates. This is in contrast to South Korea, where without a hard lockdown, there has seen a significant slow down in cases. South Korea has tested more people per million people than any other country (bar Bahrain) and has continued in contact tracing throughout the pandemic. Time will tell whether this approach is more effective in containing the spread or simply delays with future outbreaks.

Cumulative cases from days since 100th confirmed case as at 18 March 2020

Cumulative deaths from days since 10th death as at 18 March 2020

Source: UK Public Health England, https://www.worldometers.info/

UK Government economic response: “We will do whatever it takes“

UK Government response

On 17 March, the UK’s Chancellor of the Exchequer announced a set of measures in order to further support the initial £30bn support package announced as part of the budget on 11 March. Further daily updates have also been made. For businesses this includes:

-

£330bn available in government-backed guaranteed loans for small and large businesses.

-

For small and medium-sized businesses, a £5m business interruption loan scheme with no interest due for the first 6 months.

-

For businesses in the retail, hospitality and leisure sector, they will pay no business rates this year and can receive an additional cash grant of up to £25k each.

-

For the UK’s smallest businesses, there will be £10k cash grants available from local authorities.

These measures of grants and tax cuts are thought to be worth more than £20bn.

4most insight

The measures announced by Government as of 18 March still leave the UK economy and financial sector vulnerable.

-

The loans offered by Government are still loans distributed by banks. If businesses in the leisure/hospitality industries use these to keep staff on as is intended over potentially many months of low/zero trade it is unclear if they can then afford to repay.

-

At the moment there are too many individuals about to suffer a severe income shock. Ideally the government will pay them a wage.

-

Our expectation is that the government will soon be forced to use the tax and benefit system to distribute funds to firms and then onto workers.

-

We already expect a rise in unemployment from 3.8% to 4.8% in the next couple of months even if the government follows through on “whatever it takes”.

-

The current delays are dangerous. Anecdotal evidence suggests small businesses are cutting jobs already because the government ‘insurance’ is not in place.

Market insight

-

Financial markets continue to be volatile in these unprecedented times. Last week, several central banks announced changes to their monetary policies including a 50bps cut by the BoE and 100bps cut by the FED. ECB announced £700bn bond purchases.

-

According to an article in the Financial Times (FT) millions of jobs are at risk in the UK in exposed sectors from the shutdown of social activities. Boris Johnson has stated that schools will close as of next week and increased restrictions will be placed on the UK.

-

Andrew Bailey held conference calls this week stating that the financial sector is in better shape to support the wider economy during this crisis than it was when the financial crisis hit in 2008. He noted that the BoE has room to loosen monetary policy further if needed.

-

The British Pound fell to its lowest level against the U.S. Dollar in 35 years this week. A potential reflection of the economy’s exposure to the disruptions and the role of the dollar as the currency of international trade.

-

Bloomberg noted European Banks took $130bn made available by the FED. This is cited as the biggest use of crisis-era swap lines since 2008. UK lenders took $15.5bn

-

Banks took c.109bn Euros from the ECB in order to prevent markets from seizing up citing the new operations will “provide an effective backstop if necessary”

-

The FED has announced emerging lending programmes and Canada has announced $27bn in direct support to businesses and $55bn to meet liquidity needs.

Do you have any questions? Please contact Keith at keith.church@4-most.co.uk

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance