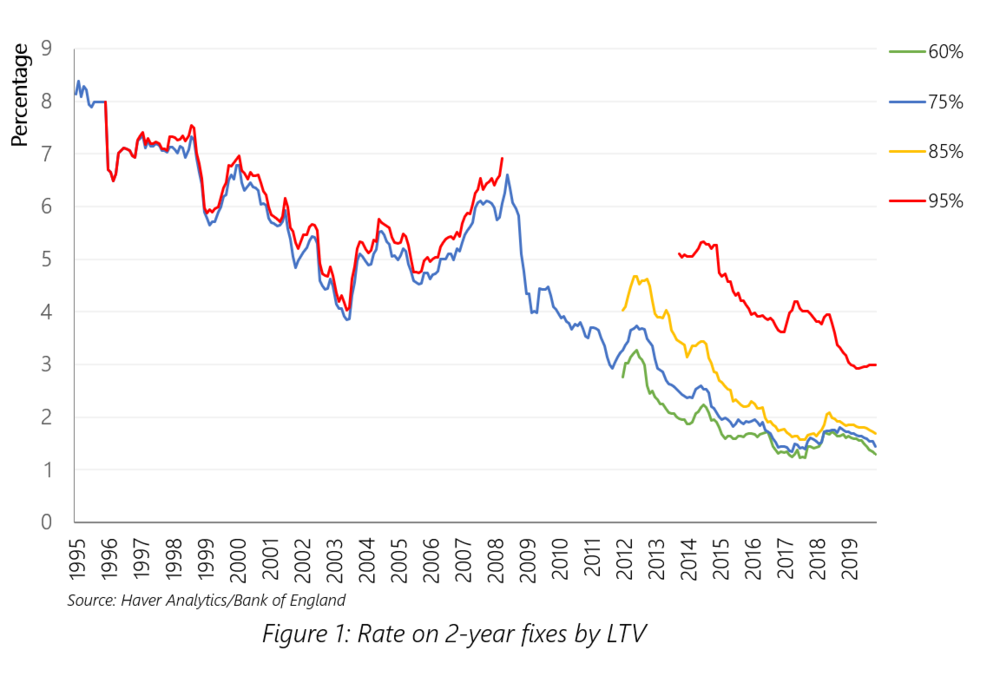

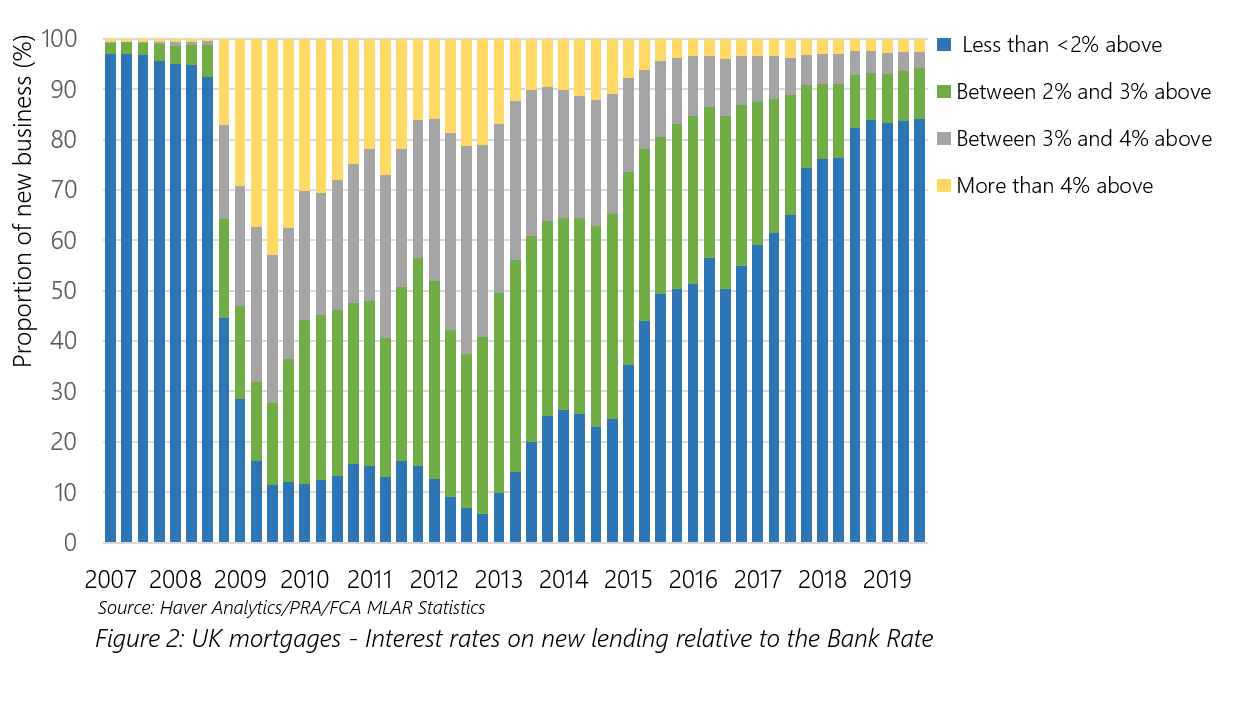

The main challenge for lenders this year will be achieving reasonable margins. In 2007, £358bn of mortgages were approved. In 2019, a market of around £260bn was as good as it got. Yet the number of lenders and products means the degree of competition is greater than ever. This competitive environment is reflected by low product rates (and low spreads between product rates) and the Bank of England’s bank rate.

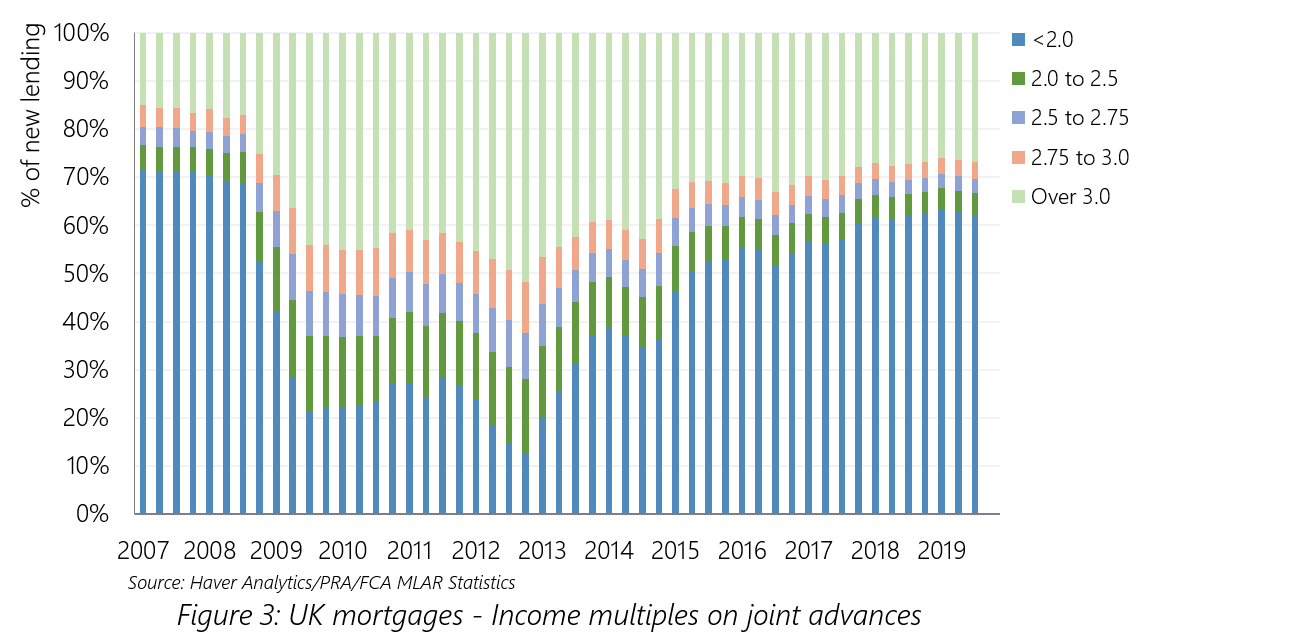

But how will this squeeze on margins, play out? For some lenders, taking on more risk will be an option. The regulator’s rules limit the proportion of business that can be written at high Loan-to-Income (LTI) ratios. The proportion of loans written at an LTI above three did rise slightly in Q3 2019, but across the market as a whole, there is limited scope to pull on this lever. Firms that do have room in this segment may well find expanding business here is rewarding – debt service costs remain low and interest rates are going nowhere anytime soon.

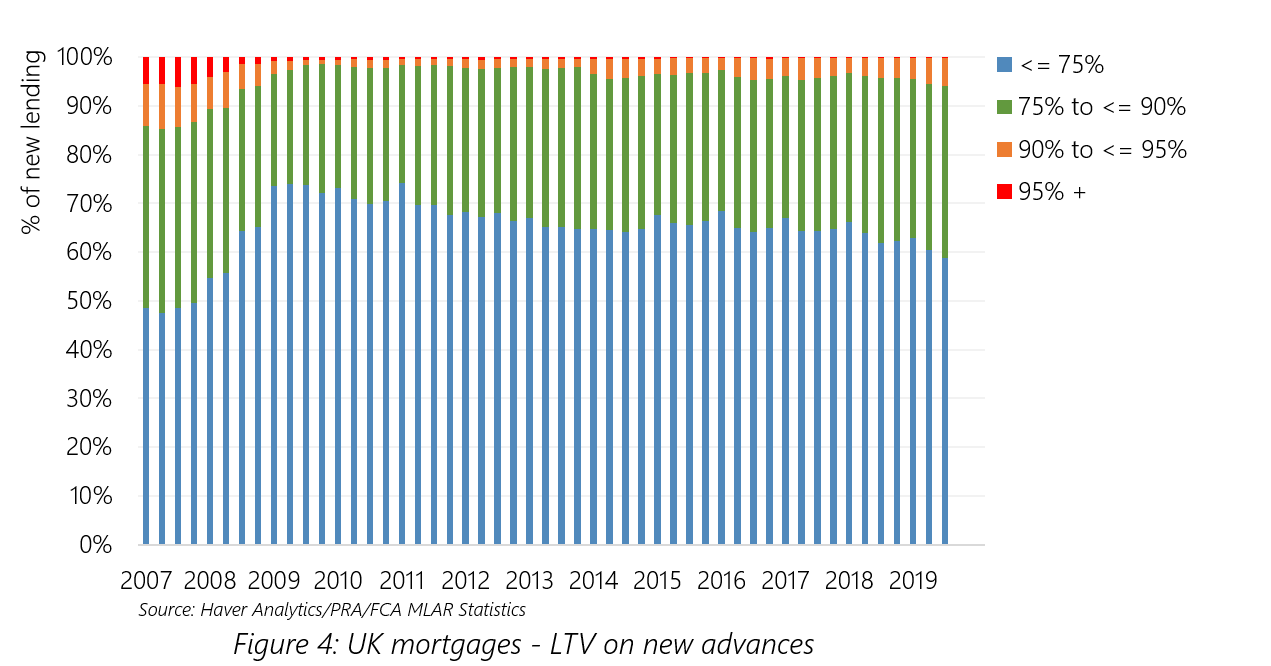

The other direction the market may head towards, is in more business at higher Loan-to-Values (LTV), although this is costly in terms of allocating capital. In Q3 2019, the share of mortgages written at LTVs above 90% was 5.7%, the highest proportion since Q4 2008. But the numbers at 95% are still small by comparison to that period. There is a stigma about high LTV lending that is perhaps undeserved. Plenty of first-time buyers that are good prospects are locked out of the market because high prices mean they are unable to raise sufficient deposits.

With so many lenders chasing share in a stagnant market, it is unclear whether there is a place for all of them, and some consolidation seems likely. Those that prosper will look to unlock underserved parts of the market. Inevitably, lending into retirement will grow. And those set to retire in the next decade may have plenty of housing equity but disappointing Defined Contribution pension pots – a growing problem, looking for a solution.

As usual, the macroeconomic environment will be crucial. A disruptive Brexit could push unemployment up and house prices down; both of which would make even good lending look bad. But it is possible to make a positive case as we dive into 2020. Unemployment is close to historically low levels and real wages are finally growing. House prices are high, but the low interest rate environment arguably means that in most regions they are not overvalued. As ever, avoiding own goals in policy making looks like the main challenge.

For further information, please get in touch with Keith at keith.church@4-most.co.uk