Emerging consumer trends: the challenge of modelling affordability

20 October 2024

Back in August (2024), the ONS released the latest Living Costs and Food Survey (LCF) for the financial year ending March 2023. Compared to the previous year, the ONS reported a nominal increase in household expenditure by 7%, but a decrease of 4% in real terms.

We dig a bit deeper into the survey results and pull out some interesting insights around consumer behaviour which highlight the challenges lenders face when trying to use ONS data to accurately model affordability.

The key highlights

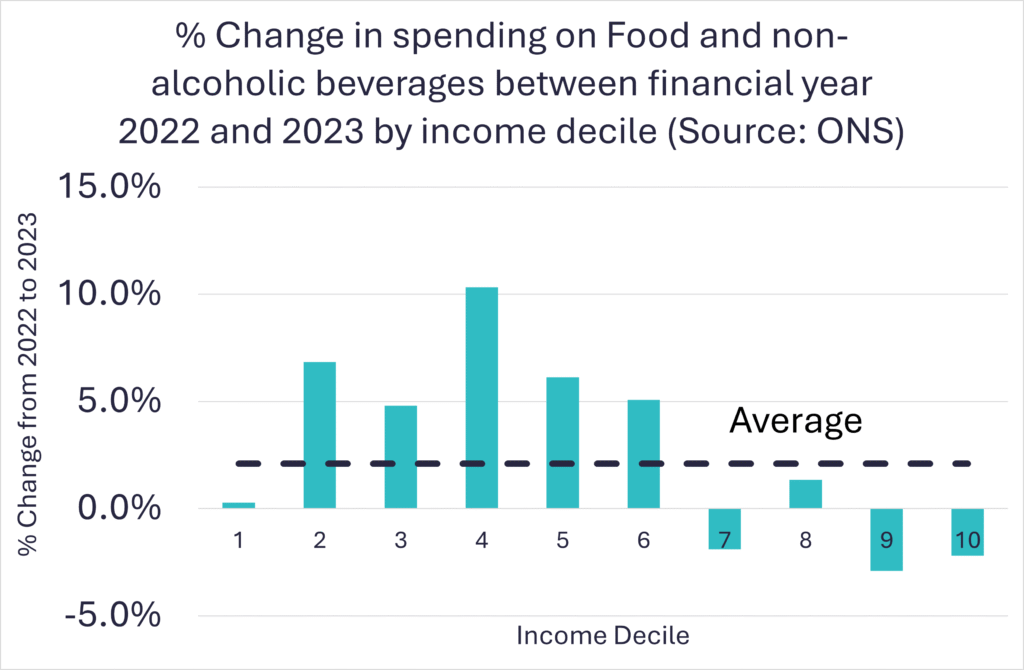

The chart below shows that while spending on food and non-alcoholic beverages increased by around 2% overall, those in the higher income deciles were able to reduce expenditure in nominal terms (and therefore significantly more in real terms) despite the increase in prices.

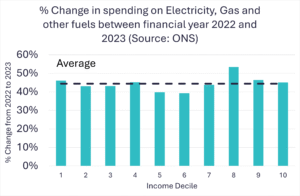

In contrast, expenditure on domestic fuel (electricity, gas, and other fuels) increased significantly in all income deciles broadly in line with the average.

This can be rationalised by the ability of those who spend more on food making savings by switching brands and / or retailer, whilst there is less flexibility for consumers in domestic fuel.

A key question lenders need to ask themselves is, to what extent expenditure increases when prices increase – can consumers adapt and, if so, was the expenditure previously recorded “essential.” It may well be that lenders applying headline inflation to all categories have overestimated essential spend for some customers.

The challenge of accurately modelling affordability

Recent periods of financial instability, created by both Covid and the Cost-of- Living Crisis, have created a need to better understand customer behaviour and improve models, beyond the use of tailored averages, the accuracy of which are difficult to monitor and gain an understanding of model accuracy or the true efficacy of the lending decision.

Due to the role expert judgement plays in modelling expenditure, another key challenge facing stakeholders is trying to gain a reliable set of model outputs that provide an accurate view of what reasonable value for essential spend for customers is.

Incorrect decisions could mean lending to customers that cannot sustain payments or missing out on opportunities to lend by being excessively prudent. This is often a point of disagreement across Commercial and Risk decisions, and it requires a level of detail to resolve empirically which ONS publications cannot support.

Timely and representative data is needed…

4most has proprietary access to granular income and expenditure data from our partners, IE Hub. This is collected from customers who have contacted their creditors due to financial difficulties and, as such, is reflective of what customers spend when presented by these circumstances and have made reasonable adjustments.

Updated monthly, we use this data to produce our quarterly Affordability Insights Report, build expenditure models for our clients, and challenge / benchmark lenders’ existing ONS-based models, aligned to SS1/23 Model Risk Management Principles.

4most insights vs ONS data

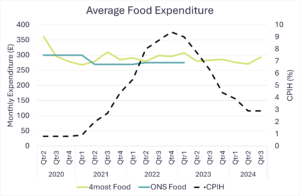

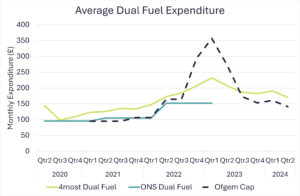

The following examples, taken from our quarterly Insights Report show Average Food Expenditure and Average Dual Fuel Expenditure compared to the recent ONS update.

The timelier generation of this data provides significant advantages over the data provided by ONS, not only in terms of granularity and coverage (IE hub has ~2000 new customers’ data added per month, as opposed to ~500 underpinning the ONS survey) but also because the data reflects the adjustments that many people will make in their finances in times of stress.

The data reflects current-day reality, rather than outdated survey data with inflationary overlays applied. It provides up-to-date insights to internal stakeholders, can be used in decisioning models or as a challenger providing a shadow estimate. This data can provide much needed reference points and be used to monitor performance to ensure estimates remain (and can be tested as being) reflective of the prevailing economy.

Establishing affordability is complex but there are benefits to be derived from evaluating approaches and challenging assumptions considering the insights recent volatility has brought, both for customers and lenders.

Get in touch

If you are interested in learning more about how our quarterly reporting service can support your organisation’s affordability modelling, send us an email – info@4-most.co.uk.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance