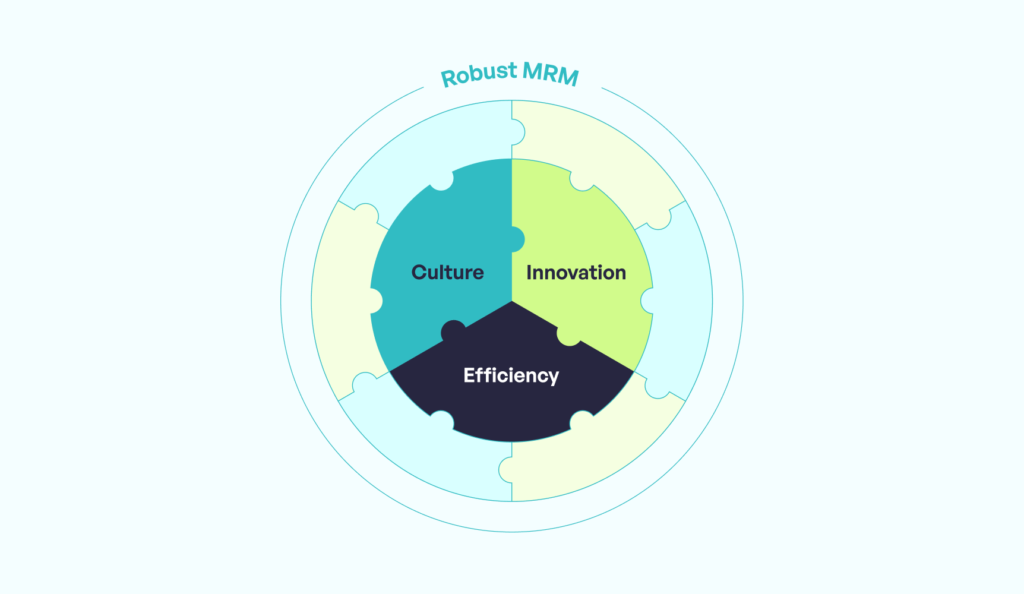

The three core elements of robust Model Risk Management

07 November 2024

Written by Lucy Worsley

Model Risk Management (MRM) plays a critical role in banking, helping to ensure optimal and efficient outcomes when performed successfully.

As such, the use of models in financial services is becoming increasingly common, driven by big data and emerging technologies. But it’s also becoming more complex, leading to a greater demand for skilled resources — and higher costs too.

Now more than ever, financial institutions must strike a balance between cost management and the need to allocate adequate resources for the identification, development, and validation of models. It’s critical that enhancements are introduced in an efficient and cost-effective manner, while compliant controls are also established to mitigate various model risks and uncertainties.

Individual model errors may seem insignificant, but their collective impact across an expanding model landscape presents substantial risks — all of which can result in significant financial, regulatory and reputational damage. In this rapidly evolving environment, a long-term, scalable approach to MRM is no longer just preferable. It’s essential.

We discuss the three core elements which we believe provide the foundations of robust and future-proofed Model Risk Management.

Or, for more in-depth insights, you can download our specialist Model Risk Management Guide. Learn more about the guide from this link, or read it straight away by clicking here.

What are the three core elements of robust Model Risk Management?

To enable long-term regulatory compliance and a controlled cost base, there are three key elements every bank needs to consider.

- Establishing a positive model risk culture.

- Keeping pace with the changing risk landscape through controlled innovation.

- Introducing efficiencies and working faster, smarter and better.

Core element #1 ~ Culture

A “positive model risk culture” ensures everyone in your organisation sufficiently understands what models are — as well as their associated risks. Models rarely exist in isolation, often part of a complex web of automated and manual dependencies. If everybody knows how their actions fit into the bigger picture, they’ll be less likely to introduce unknown model risks.

More importantly, this culture needs to be driven from the top. It’s essential that board members and senior decision makers understand and champion the benefits of investing in MRM. This will allow for successful embedding across the organisation.

That’s why one of the main themes of MRM regulations around the globe, (such as those issued by the CBUAE, FED and PRA) is encouraging senior stakeholders to improve their firm’s model risk culture.

For more advice on establishing a positive model risk culture, read our in-depth blog.

Core element #2 ~ Innovation

As with any business function, controlled innovation is key to ensuring long-term MRM success. The model risk landscape is evolving rapidly; if you don’t explore new opportunities to improve, you may find it hard to keep up.

Generative AI and large language models (LLMs) can bring substantial benefits, introducing tangible cost savings and efficiencies. However, there is a caveat. It isn’t just AI in risk that matters. Use cases of AI that feed into a repeatable decision or external communication will fall under the realm of MRM. These models are NOT exempt from being explainable.

That’s why having both of these first two core elements in place (culture and innovation) is so important. Because only if everyone understands the potential implications of each innovation can you safely keep pace with the broadening landscape, introduce relevant controls and maintain regulatory compliance.

For more examples of how you can innovate within MRM, read our in-depth blog.

Core element #3 ~ Efficiency

Preventing cost escalation is critical. Whether it’s a case of hiring the right expertise, regulatory deadlines or validating new model types, successful MRM comes at a cost.

The trick is to control that cost by constantly improving efficiencies. Your philosophy should be to regularly review the way you’re managing model risk, and identify what you can do faster, smarter and better.

Sometimes, it can be as simple as planning your resources more effectively, ensuring the right person is briefed at the right time and preventing unnecessary duplication. It could be leveraging AI-generated reports, automating standard processes, or outsourcing to specialists.

Whatever it is, the more efficiently you manage model risk, the better the outcomes.

For more advice on the actions you can take to improve MRM efficiency, read our in-depth blog.

Bringing it all together…

More awareness of model risk leads to less risk when investing in innovation, which in turn offers new opportunities to improve efficiency. Regulatory compliance is attained and costs are controlled, ultimately making it easier to highlight the benefits of MRM to the board.

How can 4most support?

Some banks have already started future-proofing their MRM. But if you haven’t, it’s not too late to start. At 4most, we can support you through every key stage, embedding the necessary cultural changes, introducing the right tools, and providing expert services to improve efficiency.

We have a broad understanding of how MRM is evolving across international markets, and our model risk leaders are experts in everything from IFRS 9 to model development and validation, which means we can provide the exact insights and experience you require.

What’s next?

For more guidance on achieving robust MRM, you can read our in-depth blogs on…

- Establishing a positive model risk culture

- Keeping pace through controlled innovation

- Improving MRM efficiency

Or you can read our specialist guide…

… and get the latest best practice guidance for MRM. You can learn more about the guide here, or you can read it straight away by clicking this link.

Think you need specialist Model Risk Management support? Fill in our short contact form to let us know how we can help you.

Need specialist Model Risk Management support?

Get in touchInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance