An insurance perspective on model risk management

24 June 2025

The insurance industry relies on models for a variety of critical functions, including pricing, reserving, capital assessments, and forecasting. Technological advancements have increasingly enhanced model accuracy and scope, while also heightening their complexity, making model risk governance processes vital for insurance firms to have in place.

Recent developments in technology including the artificial intelligence revolution have emphasised the need for robust Model Risk Management (MRM) to address emerging risks associated with progressively sophisticated tools.

The Prudential Regulation Authority (PRA) released a supervisory statement (SS1/23) on MRM for banks, focusing on structured governance, validation, and independent oversight. Although currently targeted at banking firms, these principles are expected to shape similar regulatory expectations for insurers in the long term.

This article explores the foundations of MRM focusing on specific risks & mitigation, model validation and overarching governance, and outlines the key principles from the PRA’s MRM supervisory statement which went into effect for banking in May 2024.

Importance of Model Risk Management

Model risk refers to the risk of loss or other adverse outcomes arising from errors in model design, implementation, or use. It can arise due to variety of reasons, including:

- Fundamental errors

- Data limitations

- Inaccurate assumptions

- Incorrect interpretation of methodology

- Process defects

- Inappropriate use of the model results

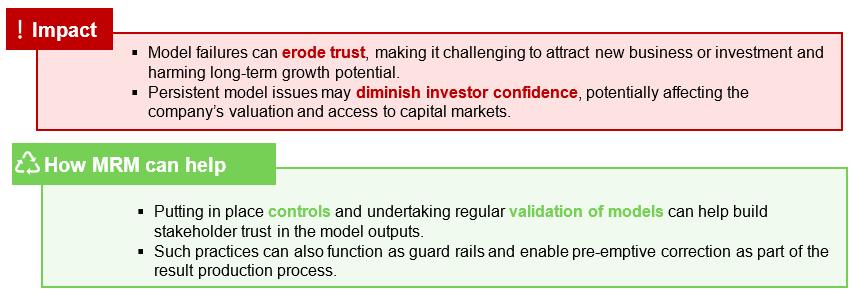

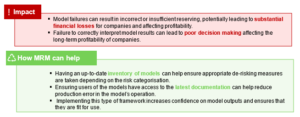

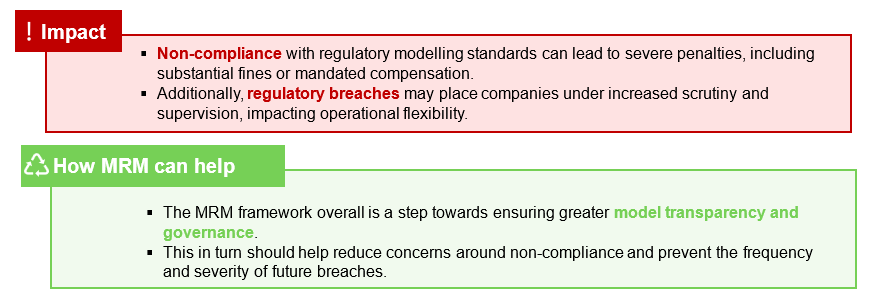

MRM frameworks are therefore used to reduce the risk of adverse outcomes arising from model failure. Below are some examples of model risk consequences, and how the existence of a robust MRM framework can mitigate these risks.

SS1/23 Principles

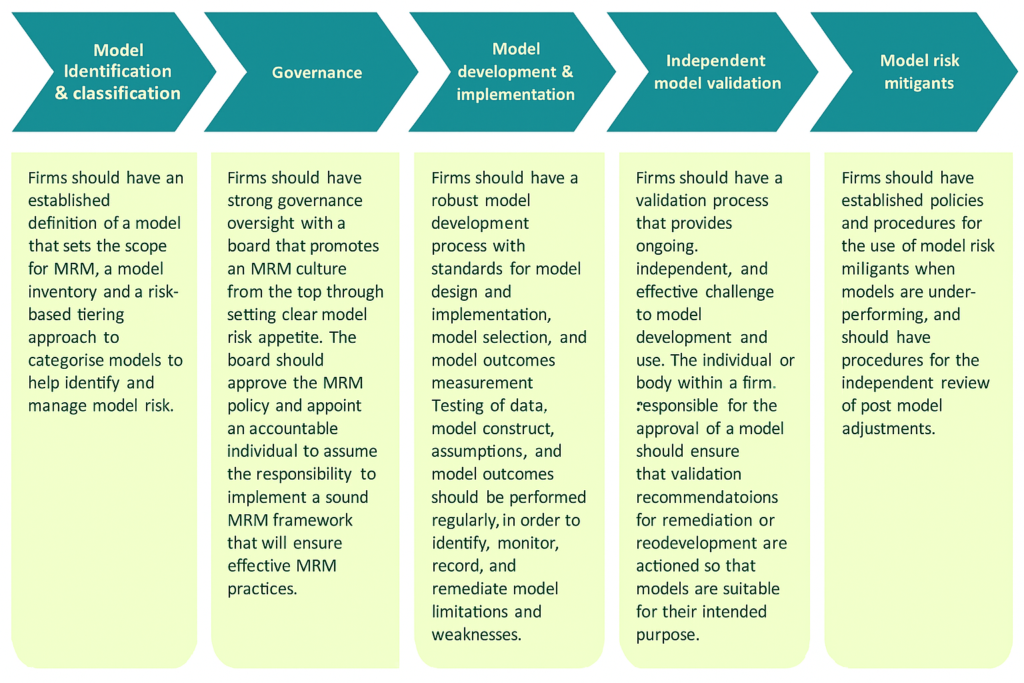

The PRA’s MRM supervisory statement is principles based and gives a comprehensive view to effective model management. Although the guidance is targeted specifically at the banking industry the table below outlines the key features which remain relevant within an insurance context.

As identifying, understanding, and managing model risk has long been a key theme in the actuarial space, be it the Actuarial Control Cycle or the more formal TAS (Modelling) standards, insurers may feel that they might already be complying with the majority of the principles outlined in the Supervisory Statement.

However, if the principles outlined in SS1/23 are formally extended to insurance companies, there are some aspects and challenges worth further consideration:

- The actuarial function might already be following sound model management principals, but companies will need to take a more holistic view considering other functions and practice areas such as data science teams, accounting etc. With new and complex modelling methodologies and standards (IFRS 17, SUK etc), there is an ever growing need to have alignment in the model risk management practices across teams.

- The assumptions feeding into life actuarial models usually have a significantly longer time horizon than those used in banking. Thus, greater consideration is necessary to ensure that the derivation of such assumptions is based on sound fundamentals. This may be further complicated by the need to adjust for changing frequency of black swan events such as climate change implications, wars and conflicts, pandemics etc.

- Models based on machine learning algorithms and AI will need more frequent monitoring to ensure that they remain appropriate and fit for use. Increased complexity alongside a reduction in transparency of models will prove increasingly challenging to validate and maintain confidence in results. There are also ethical considerations to ensure they remain free from bias.

Overall, the principles outlined in SS1-23 reflect MRM evolution rather than revolution but seek to formalise the requirements for market best practice. Insurers, although currently unimpacted, should anticipate similar requirements to apply in the future, and therefore should assess their current compliance against MRM principles, including the ability to articulate their governance structures and frameworks to regulators and auditors.

Need more guidance?

At 4most, we have a wealth of modelling experience within the insurance and banking industries. Our model validation experts have supported many firms with model review procedures and transforming governance frameworks to future-proof their MRM.

You can learn more about our model risk management services here or send us an email if you are interested in learning more about how we can support your organisation – info@4-most.co.uk.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance