In the UK financial industry, affordability models typically do not consider the energy efficiency of borrowers’ current homes or the properties they intend to buy. However, given the growing emphasis on climate risk, this topic is becoming more crucial for lenders.

Energy performance certificates (EPCs) are a standardised document – with domestic and commercial variants – prepared by an energy assessor, measuring the energy efficiency of a building. In addition to an efficiency rating, they present some estimated energy costs (e.g. lighting, heating, hot water) for the next three years. An EPC is required whenever a property is either built, sold, or rented. The certificate remains valid for 10 years and displays a building’s ‘efficiency rating’ – ranked ‘A’ (most energy efficient) through to ‘G’ (least efficient). Typically, they also include recommendations as to how the owner can make the building more energy efficient.

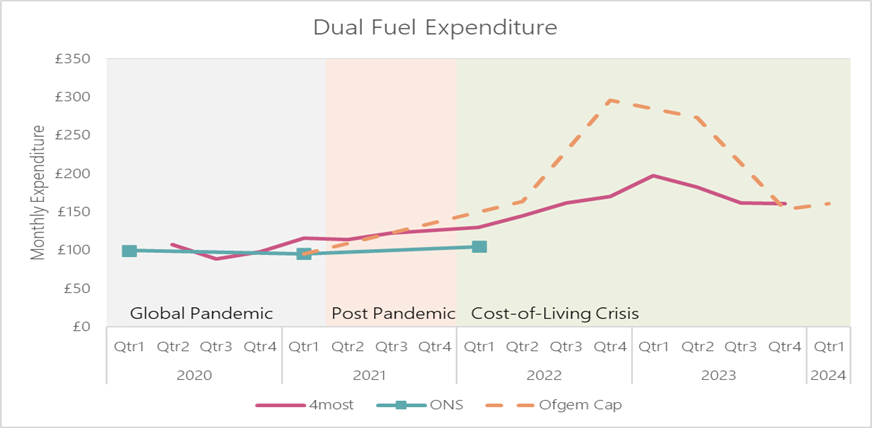

Whilst being a legal requirement in a housing transaction, an important question is, how can lenders leverage EPCs to improve their affordability assessments and better reflect the true impact of essentially unavoidable consumption costs to a borrower, something which has become increasingly poignant over the course of the ‘Cost of Living Crisis.’ The Office for National Statistics [1], cite energy costs as one of the major drivers of Cost-of-Living impacts, alongside a 90% increase in food shopping bills; gas and electricity bills have increased, on average, by around 85%.

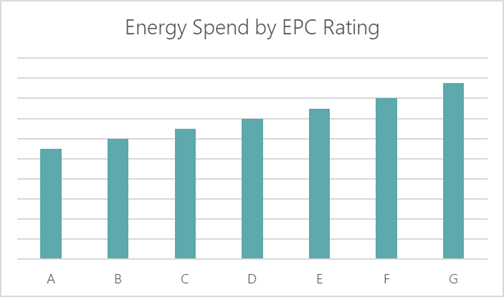

This is something 4most have corroborated using our proprietary data source from our partners, IE Hub, which we use within the affordability modelling services and reporting we provide to our clients. It provides significant insight over and above the prevalent ONS industry source for modelling, due to the granularity provided in transactional level data alongside the up to date nature of the data collection. In addition to this, there are significant variations around this average, driven by house composition (adults and dependents) and tenure type (owner / tenant), plus the property type and energy efficiency rating.

1 Public opinions and social trends, Great Britain – Office for National Statistics

Within the mortgage industry, lenders are seeking to embed climate related factors into their lending criteria and strategies including affordability assessment sin mortgage lending. Several approaches have been used, which factor in EPC ratings; some have offered discounted product rates, for example, if the property purchased has an ‘A’ or ‘B’ rating. However, now that inflationary pressures upon households show signs of settling, albeit at a higher level than prior to the Cost-of-Living crisis, it seems intuitive to now evaluate energy spend levels by EPC rating alongside household composition / tenure type and consider adjusting affordability assessments leading into loan size offerings accordingly.

* Visual is for illustrative purposes but does reflect observed trends and conclusions derived.

4most can embed EPC rating data with actual energy spend trends, and factor this into essential expenditure model calculations which subsequently determine an affordable loan size. By undertaking such analysis and reflecting in models, this can evidence increased accuracy in expenditure modelling, reflecting both Cost-of-Living impacts and climate considerations within your decisioning strategy.

Get in touch if you would like to learn more about how we can support your organisation – info@4-most.co.uk.