The Bank of England Raises Interest Rates to 5%: How accurate is your modelled expenditure during these fast-changing times?

21 July 2023

Over the last year or more, there has been a direct need for lenders to improve their ability to reflect changes in the cost of living in their affordability assessments. Incorporating present economic impacts on expenditure would result in lenders being able to estimate borrower expenditure more accurately. However, in many cases the models used are not providing a reliable or validated assessment.

Essential expenditure costs have proven particularly difficult to estimate with a current and accurate view. For some time, the Office of National Statistics (ONS) estimates have been the industry standard for sourcing this information, but with Covid 19 and more recent stresses in the wider economy, the ONS averages may no longer be reflective of current times.

To address this gap, 4most has identified and procured a proprietary source of reliable and sustainable data and built a real-time essential expenditure model, that incorporates present economic impacts on expenditure. The result is a robust and validated model that lenders can use to gain more accurate estimates of borrowers’ expenditure.

Not only do we have the unique data source to develop up-to-date essential expenditure models, we also support clients in ensuring they can remain up to date with their affordability assessment through our subscription service. This service includes regular reports as well as discussion workshops from the tracking in our monitoring tool – LUMOS. Each client implementation is tracked separately as expenditure definitions may vary. To further support clients we will perform more in-depth model validation each calendar quarter, with any resulting recalibration offered to clients as part of the service.

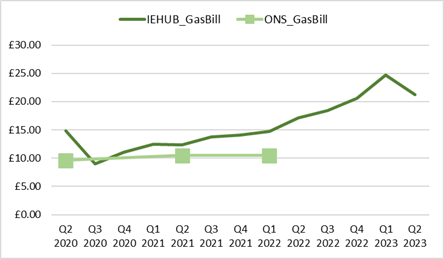

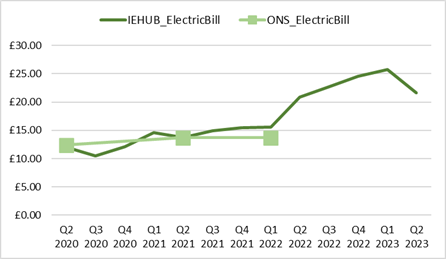

Case Study: Energy price cap to fall from July 2023. 4most Expenditure Data vs ONS: Electricity and Gas Bills.

The energy price cap is due to reduce in July 2023, but where have households been in the meantime in terms of rising energy bills, and how are energy costs reflected in the most recent ONS release from May 2023?

The examples below show real-time data, sourced from data collected by IE Hub, on how the impact of recent events has affected people’s electricity and gas bills compared with the most recent ONS estimates.

Note: Three ONS points used for comparison from the living expenses survey for financial years 2020-2021 and 2021-2022. The survey data covering 2021 – 2022 was released in May 2023. All data included sourced from the ONS table A1 and for IE Hub, data collected from June 2020 to June 2023.

The charts clearly illustrate how actual energy expenditure has increased significantly, compared with the ONS figures. To close this gap, most lenders would apply an overarching post model adjustment, however, these overlays remain judgemental and could introduce inaccuracy into affordability assessments. With 4most’s real-time model, we can help lenders take steps towards reducing the uncertainty associated with the expenditure part of the affordability equation at a more granular level. Something which is particularly relevant now with fluctuating essential expenditure and many households with low disposable income buffers.

Relevant links: https://www.bankofengland.co.uk/explainers/why-are-interest-rates-in-the-uk-going-up

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance