Tackling the Vulnerable Customer Challenge

29 September 2023

Predictive modelling and analytics in lending has developed over the last decade with new requirements and techniques, particularly in the area of a lender’s credit risk exposure.

However, a current key focus area for further enhancement, partially triggered by the FCA’s Consumer Duty, is that of the identification of vulnerable customers.

This has always been a challenging area due to limited data availability across both candidate discriminatory data and that of the ‘target’ variable i.e. who is defined as vulnerable? In truth, there has never been (nor should there be) a binary view of vulnerability – a view shared by the FCA “Our view of vulnerability is as a spectrum of risk which is increased when consumers have characteristics of vulnerability. These could be poor health, such as cognitive impairment, life events such as new caring responsibilities, low resilience to cope with financial or emotional shocks and low capability, such as poor literacy or numeracy skills”. However, generally within the modelling community, there is greater experience and comfort in dealing with definitives – good/bad, default/non-default, loss/no loss, so how do we approach this problem? One option is to considering vulnerability on a spectrum, as specified by the FCA, and modelling it as such without a defined outcome variable. Although, some validation of any developments can be done through the use of markers such as the Vulnerability Registration Service.

The team at 4most have been undertaking extensive R&D, using industry data and through partnerships with third parties, to develop vulnerability scores based on income and expenditure (I&E) profiles in comparison to the wider population. Whilst it is acknowledged that this is not an infallible data source containing the full profile of a customer and all their vulnerabilities, the use of I&E data allows an insight into the customer’s habits, priorities and constraints. Ideally, access to a whole new range of data sources such as social media accounts, pulse surveys and transcripts from contact points would allow the development of a far more sophisticated vulnerability identification toolkit. However, the regulation, systems and customer buy-in for this to occur in any meaningful way is still some time in the future for a problem that needs addressing today. Therefore, the I&E data can be seen as a starting point on the journey to understanding vulnerability in a consistent and systematic way.

The approach we have adopted considers advanced cluster analysis to identify homogenous populations across numerous I&E variables. With a cluster (notionally called ‘0’) being identified as the least vulnerable based on the overall population concentration and characteristic assessment.

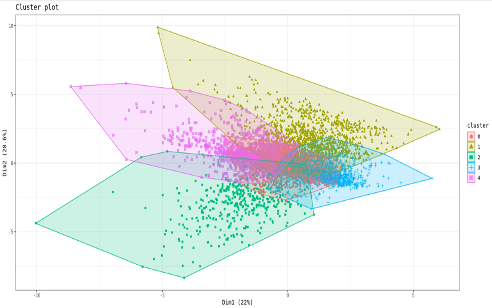

This approach can produce useful descriptive modelling outcomes that can be represented in multiple formats. For example, a simple 2-dimensional plot of certain key variables can give an indication of the clusters identified.

Figure 1: Example of clusters based in simple 2-dimensional space

However, a large amount of information is lost and there is not an obvious quantifiable definition to each of the customers within the plot. Clearly, for practical usage, this information needs to be distilled into an easy-to-understand metric that can be presented to the end user e.g. collectors.

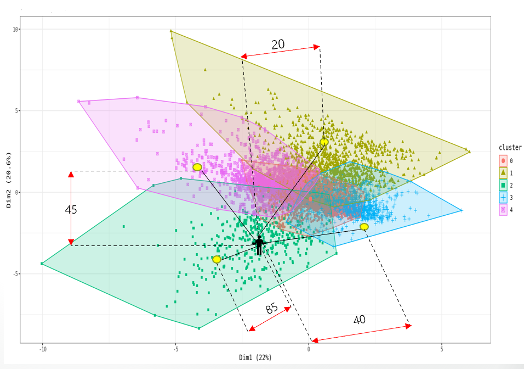

The approach we have developed is to produce two scores based on each individual account’s distance from other clusters and grouping around its own closest cluster. This score provides a quantifiable indication of vulnerability (based on distance from the main population) and the likelihood of a particular vulnerability based on proximity to and from more vulnerable clusters.

Figure 2: Composite Factors of the Vulnerability Scores

This information can then be used in key operations e.g. collections and manual underwriting, to provide greater customer outcomes, whether that be through the identification of the most appropriate treatment or simply by the directing of a conversation to increase the likelihood of insightful questioning and advice.

In our R&D samples, away from the mainstream cohorts, we have identified customers with ‘standard’ financial difficulties, e.g. income reductions, from those with more nuanced behaviours such as relatively large healthcare expenditure, customers with financial naivety and those who seemingly have financial difficulties with no underlying cause. Whilst the aim of these assessments is not to drive automated actions, these comparisons and insights allow banks to delve further into the root cause of the trends identified in a targeted manner, e.g. specific collector scripts/questions and therefore take more appropriate action.

The usage of the data for this technique, in terms of development and application, can come from a range of sources such as internal manual I&E collection, third party manual I&E collection, internal transactional data and open banking data. In addition, the development of the models can be supplemented with further third party data to ensure that the spectrum of vulnerability is not skewed by the portfolio mix and/or the operational source of the data, e.g. the sole use of collections data and, therefore an entire population based on those more likely to exhibit some form of vulnerability.

This technique, along with others being tested, will undoubtedly evolve over the coming years as newer data sources become available and optimal usage practices are developed. However, we feel the early adoption of these practices will ensure that large-scale developments of both models and practices are less necessary over time as the lending industry and the regulation around it move forward.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance