Credit Risk Market Update – March 2023

10 March 2023

Read our latest Credit Risk Market update for the month of March covering the potential for the Chancellor’s Spring Budget to aid in household bills, the FCA’s recent letters to firms and CEOs regarding the implementation of the Consumer Duty, and a Hybrid PD update.

Download or read the update in full below.

The Chancellor has room to help households with energy bills in the Spring Budget – Keith Church

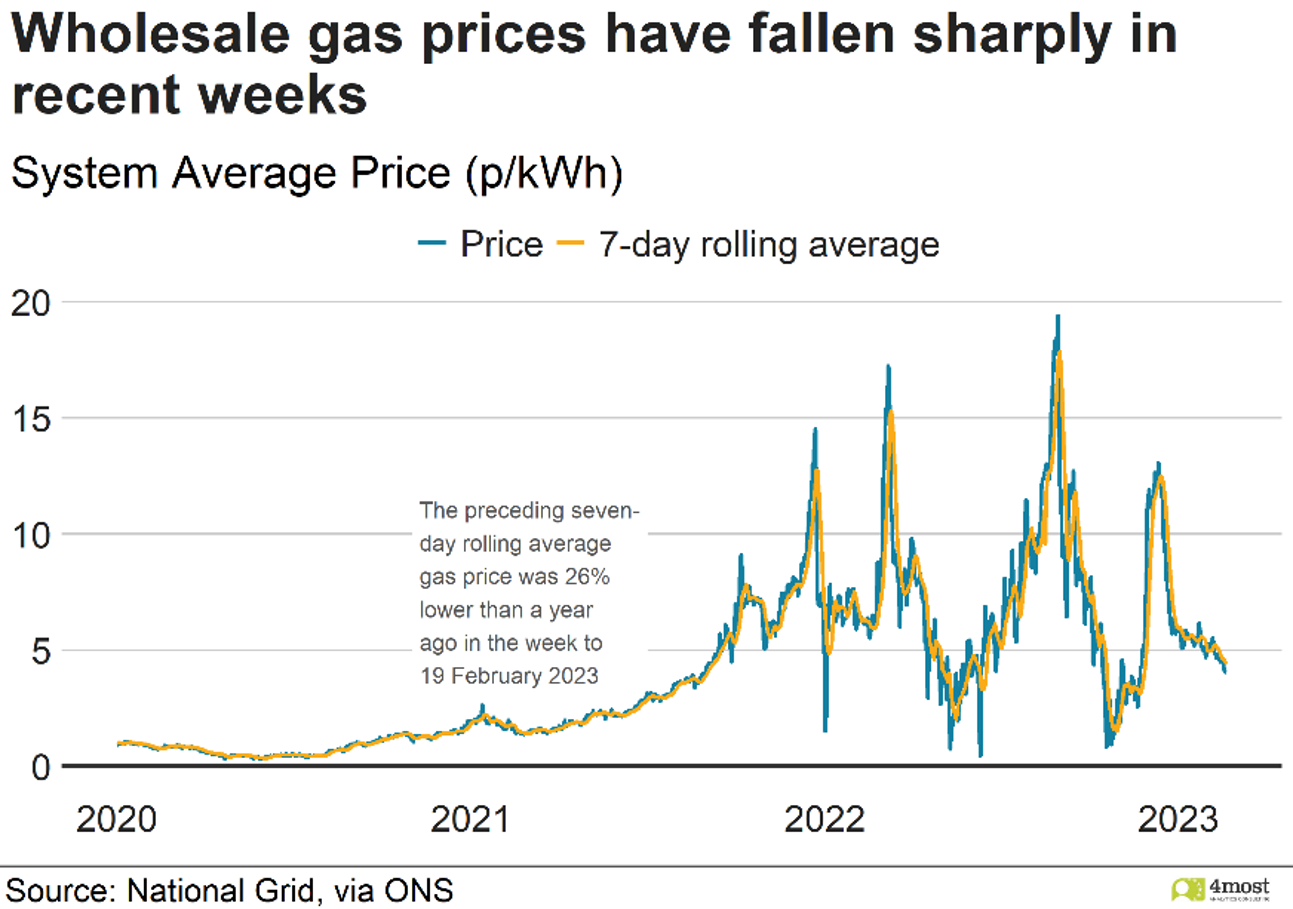

Slightly better news on the public finances and tumbling expectations of gas price in the year ahead means that Chancellor has a little more short-term room for manoeuvre in the Spring Budget. But there is also a good chance the OBR becomes gloomier about the UK’s potential for growth, which limits the scope for big policy announcements.

Currently, the domestic energy price cap set by the government, which leaves the typical domestic user with an annual bill of £2,500 is set to rise to £3,000 in April. This is still below the £3,280 that would prevail without intervention, but the difference between the two figures, which determines the level of government subsidy, is much lower than expected a few months ago. Estimates produced by Cornwall Insight suggest the level of prices in Q3/Q4 will drop further, to around £2,100.

The scheduled increase in the cap represents a double whammy in terms of the hit to household incomes. First, the potential £500 in annual bills and second, the loss of the £400 support that has been paid though suppliers since October. However, keeping bills at £2,500 would be relatively cheap for the government. And the low ratings in the opinion polls may also be a factor in this decision. Scrapping the rise now feels inevitable.

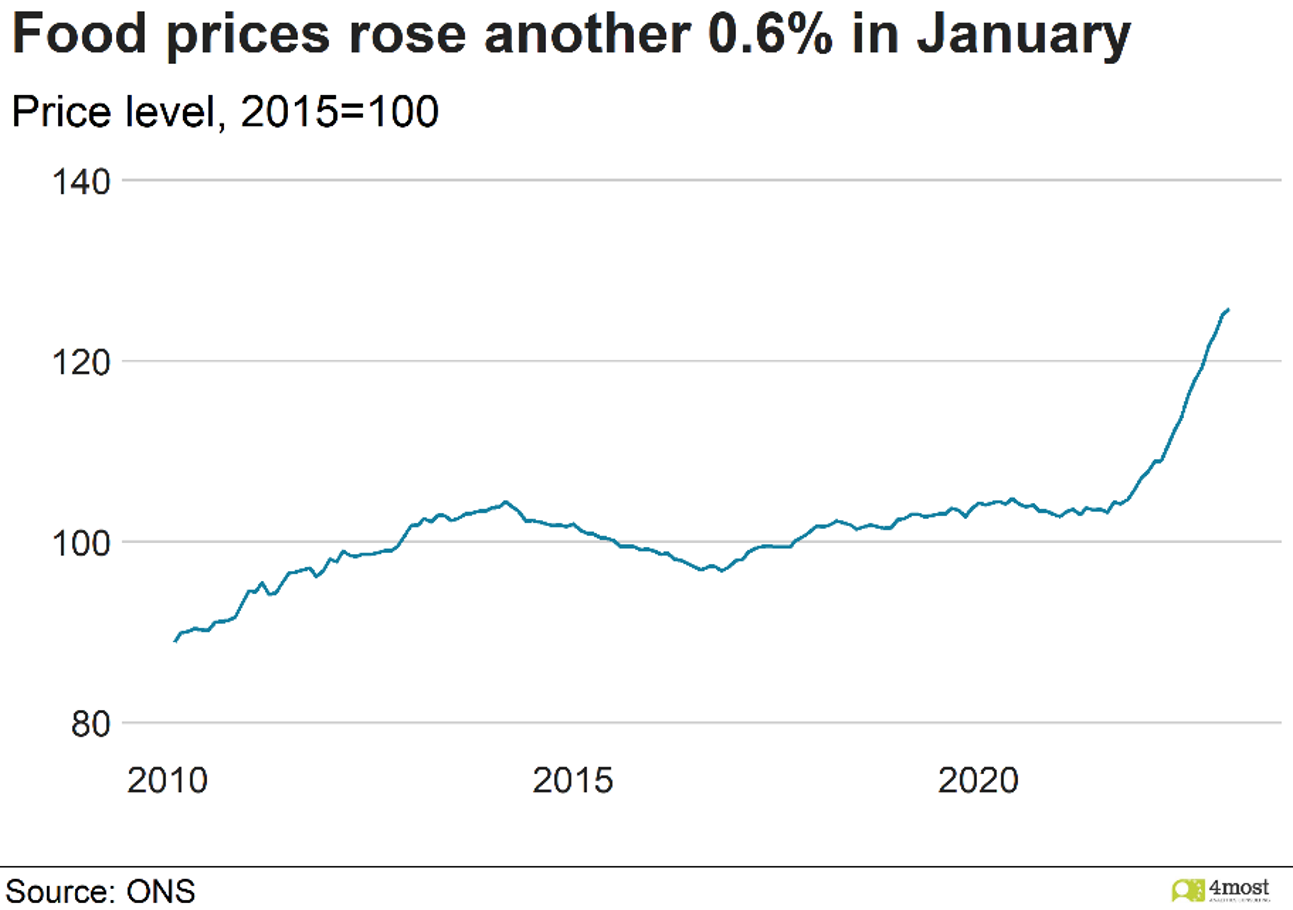

Doing this would mechanically reduce the inflation outlook. The 4most view is that inflation will fall to around 3% in December but is perfectly possible to make a case for a rate around the 2% target by then. Consumer prices usually fall in January and the drop this year was slightly more than in most years as prices of clothing and footwear were discounted sharply. Food prices are still a key source of inflationary pressure given well publicised shortages of some items.

Although lower transport costs offer some scope for falls in food prices, it is unlikely all the damage will be undone. Even if households managed to muddle through this episode, the resilience of their finances to further shocks will be more long-lasting.

FCA’s Consumer Duty Update – Thomas Hirst

The FCA recently sent letters to CEOs and Directors of firms across various sectors regarding the implementation of the new Consumer Duty (the Duty). The FCA has called it a “significant shift” in its expectations of firms, as outlined in its Finalised Guidance published in July 2022.

After reviewing firms’ implementation plans, the FCA has identified that some firms may not fulfil their obligations within the expected timeframes, which is a cause for concern. The FCA has observed that some firms may be complacent about the customer outcomes they currently provide or what the Duty requires. Some firms are overestimating their progress, while some smaller firms may be underestimating the Duty’s requirements.

The FCA stresses that all firms, regardless of size, must implement the standards and be aware of the scale of data needs associated with the Duty. Firms must design high-quality granular dashboards and reports to evidence consumer outcomes and establish mechanisms for governance and review to ensure prompt and appropriate action.

The FCA recommends that firms ensure they have adequate resources available to tackle the task at hand and plan ahead to address any potential shortfalls. If necessary, investing sensibly in support or advice from third-party experts where required.

Overall, the FCA’s letter underscores the importance of firms understanding and meeting the expectations of the Duty to ensure fair treatment of consumers.

Hybrid PD Update – Chris Warhurst

The long running IRB residential mortgage redevelopments in the UK are beginning to come to a close for most firms, with the majority of Tier 1’s models having already being submitted to the PRA and feedback beginning to be received. The next wave of submissions from tier 2s’ are now being progressed with some further PRA interaction occurring on the finer points of the developments.

It is coming up to 7 years since the PRA’s publication of Consultation Paper (CP) 29/16 (Residential Mortgage Risk Weights) outlining their plans to introduce a new approach to PD and some refinements to LGD in an aim to improve consistency in mortgage risk weights across the industry. Gone were the stable, unresponsive, variable scalar approaches as well as the procyclical ‘point in time plus buffer’ approach and instead the concept of a hybrid rating system somewhere between the two philosophies was introduced. Following the CP, Policy Statement (PS) 13/17 was released in June 2017 with greater clarification and a stylised example of how to implement the approach.

With this information firms began developing models aligned to the stylised example in preparation for submission to PRA. However, it soon became clear that the rigid adoption of the stylised example was not in line with the PRA’s expectation and had the undesired impact of resulting in highly cyclical rating systems which would result in highly cyclical capital requirements, a feature the PRA were keen to avoid and the principal reason for the removal of a ‘point in time plus buffer’ option.

After extensive review by the PRA of firm approaches this resulted in a 2nd wave of models being developed with far closer continual engagement from the PRA thereafter, a process which has been widely seen as challenging for each firm and delivering varying levels of success by firms, in our experience. Throughout the last 18-24 months, we have been engaged in a number of these redevelopments, which has provided interesting first-hand experience of the emerging thought process and understanding of the challenges being faced. It would be fair to say that this journey has been shared by both the firms and regulator in an effort to deliver a solution that addresses the firm specific challenges, whilst also trying to ensure consistency across the industry. These include variations across firms in:

-

the paucity of data history and its impact on back casting approaches and cyclicality

-

calculations;

-

historical variable availability and the ability to build and back score a ‘fit for purpose’ scorecard

-

without excessive concentration;

-

historical changes in portfolio mix and its impact on the relationship with external time series;

-

collections treatments offered and the relevant default categorisation.

There have however been some consistent changes seen across firms that should help with levels of consistency, these include what is seen as a suitable level of cyclicality (subject to the period it is measured over), the optimal number of risk grades, alignment of grade boundaries between Owner Occupied and BTL, the removal of segmentation from grading scales, the removal of bureau scores from behavioural scorecards, the implementation of greater segmentation in default LGD modelling and the consideration of voluntary sales for downturn LGD calibrations.

Without a doubt, the removal of the polar opposite rating system philosophies deployed in the UK (variable scalar and ‘point in time plus buffer’) will lead to greater consistency in the residential mortgage risk weights and in particular how these will move over an economic cycle. However, it is clear that the range of models that are likely to be implemented, at least over the next 12 months, will still demonstrate firm specific variations and therefore firm specific risk weight variations will to an extent remain.

This does then raise the prospect that further refinements might be needed should the PRA see this as not yet fully addressing a key source of risk weight variation. The industry will hope, as a whole, that these are not extensive and that there is some respite before any further work is required as there is a clear case of ‘hybrid fatigue’ across the UK credit modelling landscape but in reality this will depend upon the results and, in particular how risk weight levels move as the economy fluctuates.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance