Consumer Duty Update

10 March 2023

What is the Consumer Duty?

The Consumer Duty (‘the Duty’) is a set of rules a guidance that establishes the standard of care that firms should provide to consumers in retail financial markets. In July 2022 the Financial Conduct Authority (FCA) published its ‘Finalised Guidance’, which provides firms with a full detailed explanation of the requirements of the Duty, including a number of examples of good and poor practice.

Why is the Duty needed?

There are two main aspects of the needs of the Duty. Firstly, more financial decisions are now in the hands of the consumer. With the rapid increase of a more complex digital environment, as well as household finances under increasing strain, it’s vital that consumers can make good financial decisions.

Secondly, the FCA has recognised firms not delivering as they should. Whether that be from misleading or difficult-to-understand information, products and services sold to customers that aren’t suitable or are not at a fair value, or even barriers in place to make it difficult to switch products or services. The Duty aims to protect these consumers from unsuitable products and poor customer service and supports the needs of customers with characteristics of vulnerability.

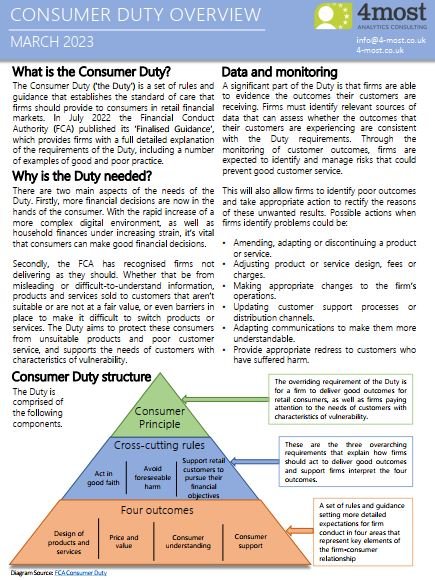

Consumer Duty structure

The Duty is comprised of the following components:

Consumer Principle – the overriding requirement of the Duty is for a firm to deliver good outcomes for retail consumers, as well as firms paying attention to the needs of customers with characteristics of vulnerability.

Cross-cutting rules – These are the three overarching requirements that explain how firms should act to deliver good outcomes and support firms interpret the four outcomes.

-

Act in good faith

-

Avoid foreseeable harm

-

Support retail customers to pursue their financial objectives

The four outcomes – a set of rules and guidance setting more detailed expectations for firm conduct in four areas that represent key elements of the firm-consumer relationship:

-

Design of products and services

-

Price and value

-

Consumer understanding

-

Consumer support

Data and monitoring

A significant part of the Duty is that firms are able to evidence the outcomes their customers are receiving. Firms must identify relevant sources of data that can assess whether the outcomes that their customers are experiencing are consistent with the Duty requirements. Through the monitoring of customer outcomes, firms are expected to identify and manage risks that could prevent good customer service.

This will also allow firms to identify poor outcomes and take appropriate action to rectify the reasons of these unwanted results. Possible actions when firms identify problems could be:

-

Amending, adapting or discontinuing a product or service.

-

Adjusting product or service design, fees or charges.

-

Making appropriate changes to the firm’s operations.

-

Updating customer support processes or distribution channels.

-

Adapting communications to make them more understandable.

-

Provide appropriate redress to customers who have suffered harm.

Timeline for introducing the Duty

– July 2022: The FCA published their final rules and guidance for firms and provided a timeline for implementing the Duty.

– October 2022: By the end of October firms’ boards should have agreed on their plans for implementing the Duty.

– April 2023: Manufacturers should have completed all necessary reviews to meet the outcome of the Duty and shared necessary information with their distributors.

– July 2023: The Duty comes into force on 31 July 2023 for new and existing products or services that are open to sale or renewal.

– July 2024: The Duty comes into force on 31 July 2024 for closed products or services.

Implementing the Consumer Duty in Life Insurance

Products and services that are within the scope of the Duty include; pensions, long-term savings and retirement income, and pure protection. For existing products, firms must ensure that by 31 July 2023:

-

Products and services: are designed to meet the needs, characteristics and objectives of a specified target market and that they are not sold outside of that target market. These need to be tested and monitored to ensure they work as expected.

-

Price and value: Products and services provide fair value with a sensible relationship between the price consumers pay and the benefit they receive.

-

Consumer understanding: Firms communicate in a way that supports consumers to make effective, timely and properly informed decisions.

-

Consumer support: Firms provide the support that meets consumers’ needs throughout the life of the product or service.

It should be at least as simple and easy to switch products or leave a service, as it is to buy the product or service in the first place.

It should be at least as simple and easy to switch products or leave a service, as it is to buy the product or service in the first place.

The FCA has expressed concerns that life insurers are underestimating the level of work required for closed products and the possible challenges it could bring, such as; quality of data, high product variation, disengaged customers, and legacy systems. FCA has challenged firms to provide granular detail on the implementation of the Duty ahead of the 2024 deadline. The key focus areas are:

-

Assessment of fair value.

-

Customer journey mapping.

-

Review of customer communications.

-

Development of market information to monitor the outcome.

Source: Finalised Guidance for firms on the Consumer Duty | FCA

You can download the formatted PDF below.

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance