4most Wins National Credit Awards Prize for Best Use of Technology – Significant Advancements in Modelling Borrower Affordability in Lending Decisions

23 October 2023

The team at 4most are delighted to have been awarded the National Credit Awards prize for the development of their Essential and Basic Quality of Life Expenditure Model, an innovative solution developed using a new data source, forming part of their wider specialist Affordability Review and Modelling Services.

Reflecting a sea change in expenditure from pandemic driven home and office working patterns, further compounded by Cost-of-Living pressures which continue to place pressure upon households, lenders have been looking to ensure an accurate view of expenditure trends within their affordability assessments. Being able to reflect rapidly changing economic impacts on expenditure into Application Processing Decision Engines would result in lenders being able to assess borrowers’ ability to service their credit commitments more accurately. However, in many cases the prevailing approaches have not provided a reliable or validated up-to-date view, undermining confidence in the decisions.

Changes in essential expenditure costs have proven particularly challenging to estimate with a current and accurate view, with examples including energy and vehicle fuel costs. For some time, the Office for National Statistics (ONS) survey estimates have been the industry standard for sourcing this information, but with the pandemic and subsequent ongoing stresses in the wider economy, that data is well out of date. As a result, lenders often need to apply subsequent adjustments to ONS published averages based upon internal judgements about inflationary factors and changes in borrower behaviours.

To address this gap, 4most identified and procured a proprietary source of reliable and sustainable data from our partner IE Hub and built a real-time essential expenditure model, that incorporates present economic impacts on expenditure at a granular household composition level. The result is a robust and validated model that lenders can ’plug into’ their processing systems’ affordability assessments to gain more accurate estimates of borrowers’ expenditure. In addition to installing this component, it and the underlying data source is also able to be used to validate and benchmark lenders’ existing approaches as part of 4most’s wider Affordability Review and Modelling Services.

4most receives a monthly update of borrower data to calibrate an up-to-date essential expenditure model and provide bespoke reviews. For those clients who do embed the model into their systems, we also provide ongoing support to clients in ensuring they can remain up to date with their own affordability assessments through our subscription service. This service includes regular reports as well as discussion workshops from the tracking in our monitoring tool – LUMOS. Each client implementation is tracked separately as definitions may vary, and to support clients further we will perform more in-depth model validation each quarter, with any resulting model recalibration offered to clients as part of the service.

Case Study: The Impact of Energy Costs and the Ofgem Price Cap Upon UK Households

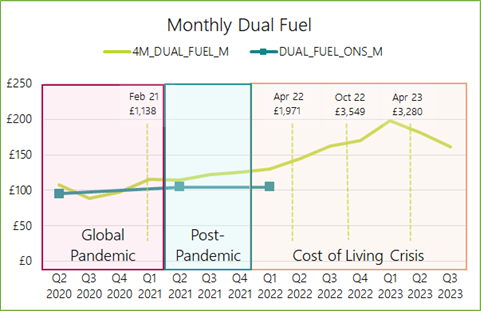

4most Expenditure Data vs ONS: Electricity & Gas Bills

Rises in wholesale prices, partially controlled by Ofgem’s energy supplier price cap, have been passed on to UK consumers over the course of the Cost-of-Living crisis. The imposition of the price cap, and levels at which it has been set over time, are correlated with the subsequent cost to consumers and allow us to better predict future impact, with the latest change in October set to manifest in Q4 data updates.

The examples below show real-time data on how the impact of recent events has affected household’s fuel bills compared with the most recent ONS estimates. The first graphic below highlights the dilemma lenders face – the incumbent approach using ONS data is significantly lower and does not incorporate changes in the last year. The 4most model estimates overcome this gap with an up-to-date accurate estimate.

Note: Three ONS points used for comparison from the living expenses survey for financial years 2020-2021 and 2021-2022. The survey data covering 2021 – 2022 was released in May 2023. All data included from the ONS table A1 and from 4most from June 2020.

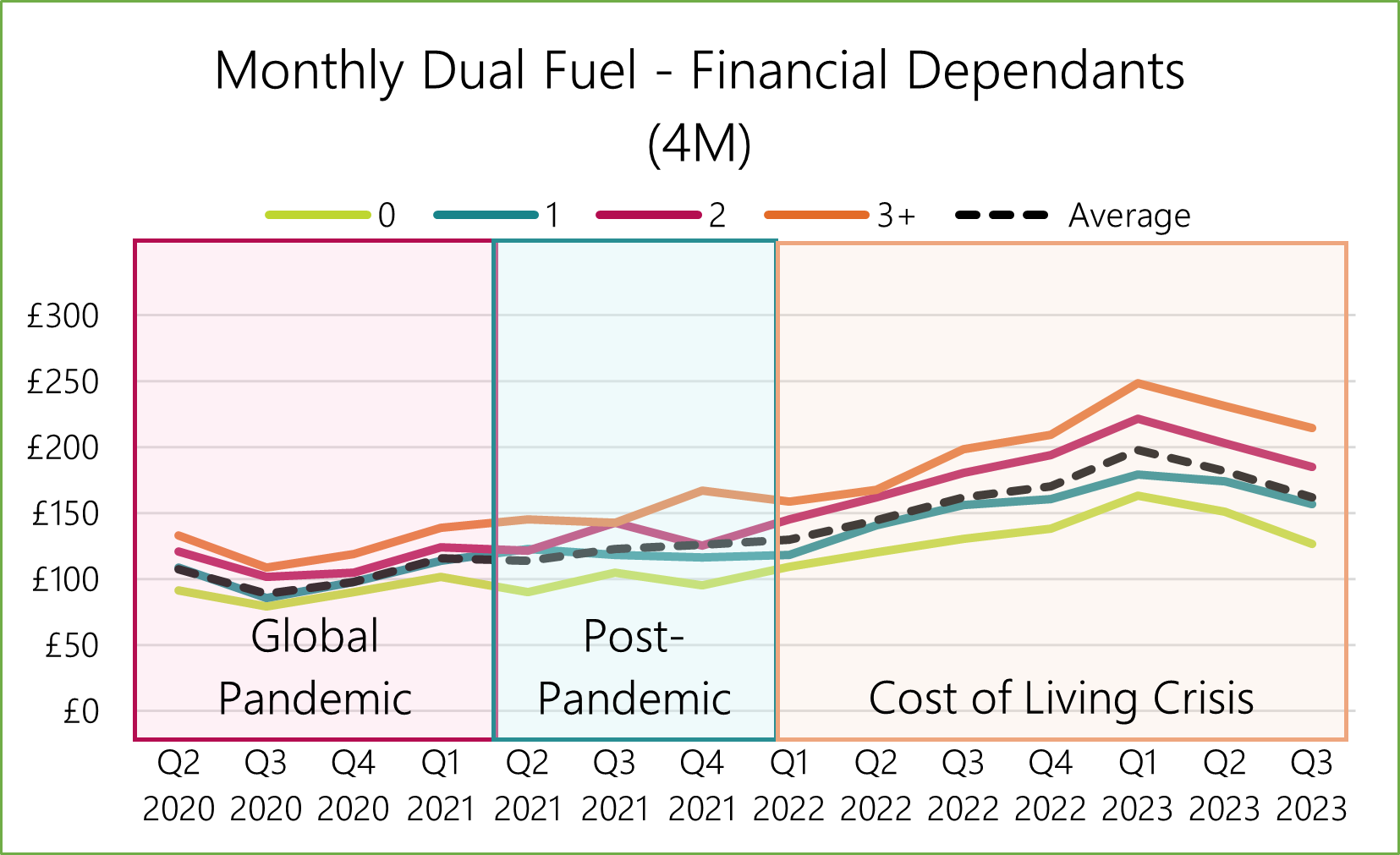

The charts clearly illustrate how actual energy expenditure has increased significantly, with trends aligned to the caps, compared with the ONS figures. To close this gap, most lenders would apply an overarching post model adjustment, however, these overlays remain judgemental and could introduce inaccuracy into affordability assessments across household compositions (numbers of adults and dependents) and income ranges. The second chart clearly, but intuitively, illustrates that households with multiple dependents have felt a greater impact – and the impact is widening. With 4most’s real-time model, data source and range of associated affordability services, we can help lenders take steps towards reducing the uncertainty associated with the expenditure part of the affordability equation at a more granular level. Something which is particularly relevant now, when essential expenditure fluctuates, many households might have a very low disposable income buffer – something which our research and experience supports.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking