A new Consumer Duty: FCA’s final rules and guidance

08 December 2023

Overview

This article provides a summary of the FCA’s policy statement: A new Consumer Duty (“The Duty”) which sets out the final rules and guidance for firms. Putting customers’ needs first is the corner stone of the policy, and the FCA wants firms to focus on customers’ experienced outcomes and to help them have better access to information and facilitate assessing that information. The FCA plans to measure success through monitoring complaints, product suitability, and consumer confidence.

Our summary of “The Duty” is presented in the following sections:

-

Why is FCA proposing a Consumer Duty

-

Structure

-

Measuring Success

-

Governance & Accountability

-

Consumer Duty Timeline.

Why is FCA proposing a Consumer Duty

Consumers don’t always get the products and services that meet their needs or the outcomes they might reasonably expect. And firms may not always compete effectively to drive up quality and bring down costs in consumers’ favour. Some examples of practices that cause consumer harm include:

-

Firms providing information regarding products and services which is misleading or difficult for consumers to understand.

-

Products and services that are not fit for purpose in delivering the benefits that consumers reasonably expect.

-

Products and services that do not represent fair value for money.

-

Poor customer service that hinders consumers from taking action to make use of products and services.

To improve consumer outcomes in the markets, the Consumer Duty would set clearer and higher standards for the culture of firms and the conduct FCA expects of them.

The Consumer Duty – Structure

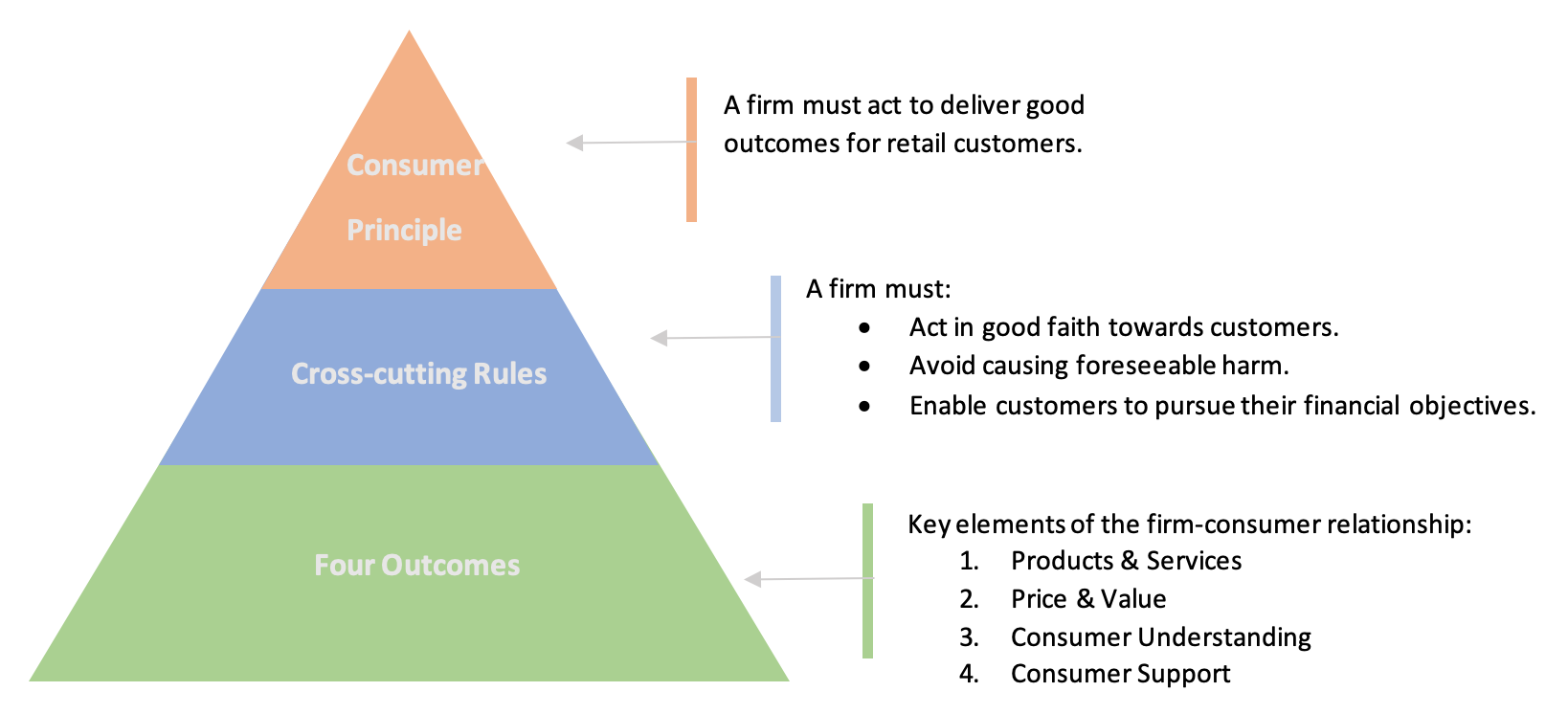

The Consumer Duty would be a package of measures, comprised of:

-

A new Consumer Principle that provides a high-level expectation of conduct and associated outcomes

-

A set of Cross cutting Rules and Outcomes that support the Consumer Principle by setting clear expectations for firms’ cultures and behaviours.

-

Rules relating to four outcomes FCA wants to see under the Duty. These represent key elements of the firm consumer relationship which are instrumental in helping to drive good outcomes for customers.

Measuring success

FCA will measure the success of their proposal by monitoring key outcomes for consumers. One way to achieve this is through tracking complaints about fees or charges or inappropriate product or service sales. The products and services consumers use will also be monitored and their levels of trust and confidence will be measured. Data from a variety of sources will be used, including supervision and authorisation activities, firm management information, and complaints data. As the Consumer Duty is being implemented, further metrics will be developed.

The aim is to see consumer experience improvements under the following areas:

-

Fair value for products and services.

-

Suitable product and services designed to meet customers’ needs.

-

Suitable treatment to consumers leading to a reduction in the number of complaints.

-

Increased consumer confidence in the financial services markets

Governance and accountability

The FCA expects the focus on acting to deliver good outcomes and will be at the heart of firms’ strategy and business objectives. To support this, FCA proposed amendments to the SM&CR rules and requirements on the management or board of firms to ensure that firms comply with the requirements on an ongoing basis. The new Consumer Duty would also emphasise the fundamental changes FCA wants to see at all levels of management and expect the Duty to be reflected in firms’ strategies, governance, leadership, and people policies.

Consumer Duty Timeline

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking