Affordability Due to Rising Fuel Prices

06 May 2022

The cost of home energy inflation on UK’s most stretched consumers is focussed on homeowners without a mortgage in inefficient properties.

Annualised inflation is now expected by the Bank of England economists to reach 8% in spring 2022 and potentially higher later this year, well above their mandated target of 2%. A major contributor to higher prices is energy costs and within that home energy costs. This places further strain on household budgets, and our analysis suggests it is those who do not have a mortgage, both homeowners and tenants, that will be impacted the most. The key driver of price rises in energy costs are natural gas and wholesale electricity prices. Both have risen to all-time highs in recent weeks; the wholesale spot price of gas is circa five times higher than March 2021. According to future market indicators this is unlikely to be a short-term spike. The price of gas to be delivered next winter is trading five times higher than the baseline spot price average from 2018 to 2021 with similar magnitude moves for electricity.

For consumers, Ofgem currently caps prices on a six-monthly basis. The most recent price cap increase was in this month, April 2022, set at 54%. Some analysts are predicting a similar scale further increase in October this year. This will acutely impact those consumers whose gas and electricity costs amount to a large proportion of their existing expenses. In addition to general tariff increase caps, many consumers were still on fixed term preferential tariffs below the current cap which were widespread before the recent increases in price. As these come to an end in the coming months, or possibly where the consumer’s energy supplier fails and they must migrate to a tariff with a new supplier, they will experience additional relative price increases. This impact will be felt by households throughout 2022, and this will occur alongside increases to National Insurance contributions, which have hit April pay packets. The combination of these dynamics means that households will have a reduced net pay alongside increased energy expenditure, arising in a cost-of-living squeeze.

To assess the potential impact on consumer households, we have analysed customer level data from IE Hub, which is an online tool that helps customers share their income and expenditure information with creditors. It captures granular data of customers essential spend, including gas and electricity bills. The data captured is from debtor customers who are experiencing some form of financial difficulty. As such it offers an insight to those who are most sensitive to material changes in outgoings.

One of the key benefits of obtaining customer level data is the use of the data in affordability modelling. The result is a statistically significant model giving an alternative to the current industry standard of using ONS expenditure data. With greater granularity comes greater flexibility of data analysis and modelling possibilities, leading to tailored modelling results.

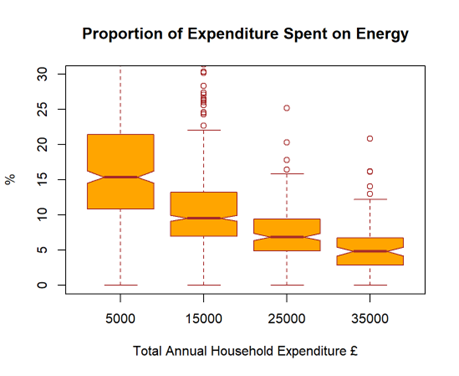

Some analysis completed recently, shows that for those individuals whose expenditure is less than £10,000 per year and who are not supported by living with their parents, their energy costs amount to 15% of their annual expenditure. An increase in this energy cost of circa 50% has increased the effective inflation rate for this group from circa 8% anticipated nationally to around 15% for this group. This is very likely to surpass any reasonable budget tolerance and be unmanageable for lower income households.

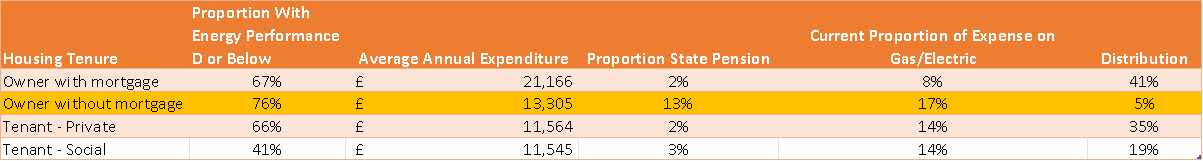

The table below shows the percentage of expenditure from gas and electricity for different housing tenures of those in financial difficulty. The group highlighted, are homeowners without a mortgage – traditionally viewed as a potentially affluent group. This analysis highlights however that around 5% of customers currently experiencing affordability problems own their own homes outright, and that the impact of significant rises in energy bills will be most pronounced for them. Interestingly, this group are the most likely to be older in age and live in fuel in-efficient (older), properties, below EPC grade C; hence they own their homes outright and are more likely to have a State pension.

Do you have any questions? Please contact info@4-most.co.uk

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking