The Bank of England is taking decisive action to place climate change at the forefront of the financial industry’s agenda.

In the coming months, subject to constraints driven by the current coronavirus pandemic, the Bank of England (BoE) plans to test the resilience of the largest UK banks and insurers to different climate change scenarios and assess the financial risks arising from these. A recently published Discussion Paper sheds light on the scenarios and methodologies that the BoE will require banks and insurers to use for this test.

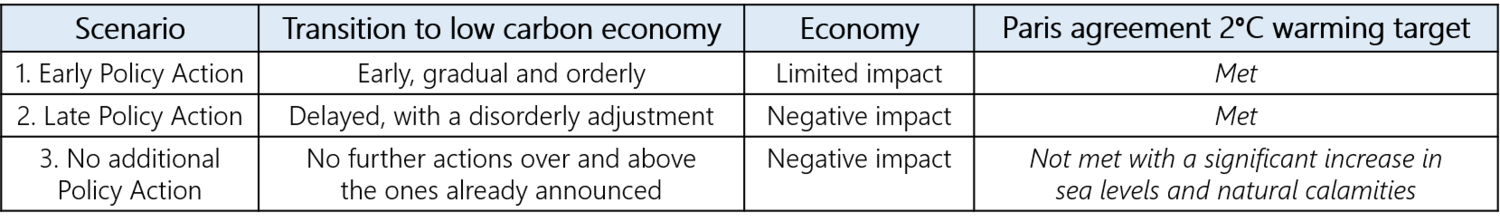

Below are the three scenarios which are proposed to be tested over a 30-year horizon:

What is missing however, is a scenario in which the physical risks from climate change resurface earlier than the current central projections. The modelling of climate change pathways uses a number of assumptions and is associated with uncertainties. There are studies which plausibly conclude that a 2°C global warming could occur as early as 2030, with a significant increase in sea levels, wildfires, storms and floods in the next ten years.

Banks and insurers will be required to assess the scenarios at a significant level of detail. For example, they will need to assess the cash flows for each individual corporate counterparty for 80% of their total exposure to corporates. Property portfolios will need to be assessed for flood risk at a regional granularity of no less than a four-digit postcode.

To facilitate the assessment, the BoE proposes to distribute physical variables (e.g. temperature and sea level changes), transition variables (e.g. carbon pathways), macroeconomic variables (e.g. GDP, inflation, unemployment, corporate profits, property prices), and financial market variables (bond yields, equity prices, exchange rates, base rates).

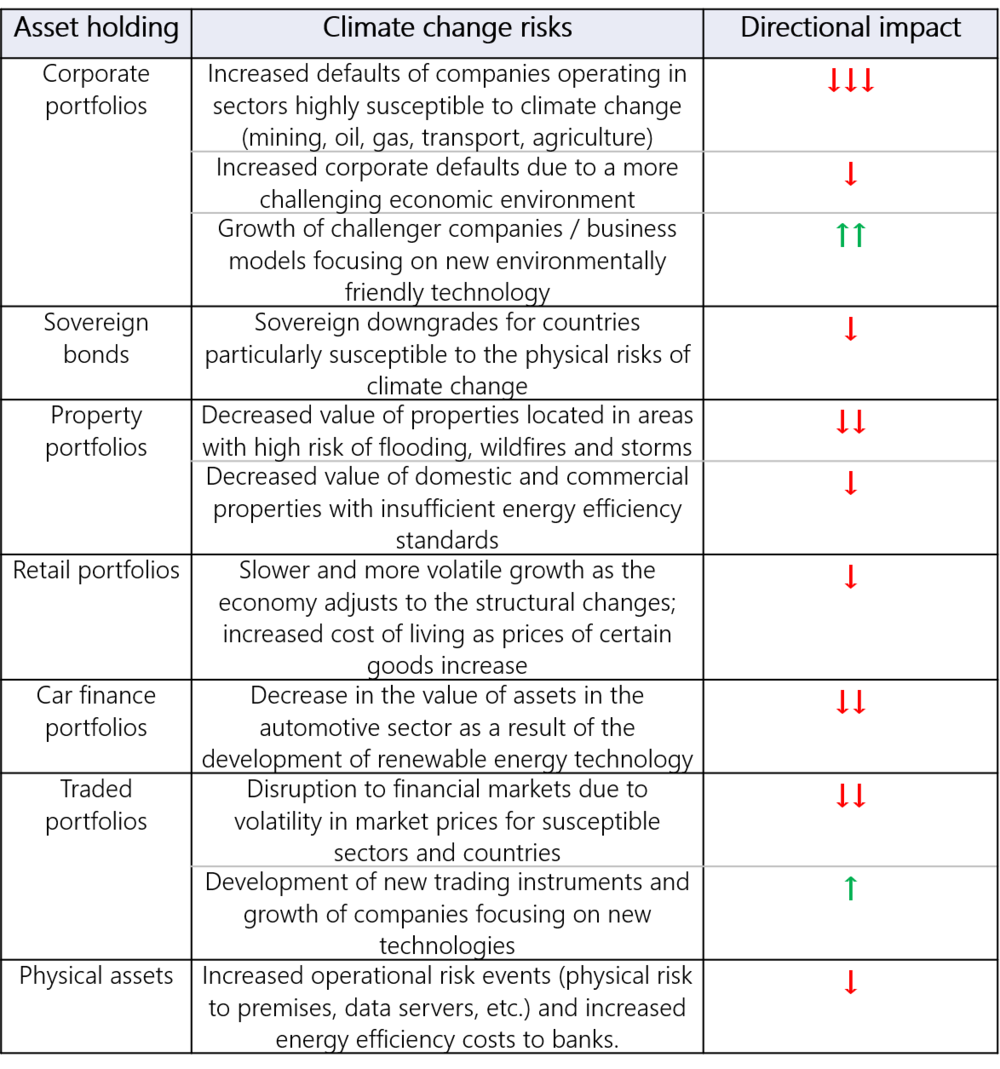

4most’s own assessment of the financial risks from climate change, suggests impacts on the following bank asset holdings:

4most’s key challenges

It will be resource intensive

One of the biggest impacts is expected on corporate exposures and it is no surprise the BoE requires a lot of precision for this assessment. Assessing 80% of corporate counterparties is expected to be highly resource-intensive and would very likely require direct conversations with individual companies. It is uncertain, however, whether any alternative methods of assessment at a less granular level would provide sufficient value.

Detailed assumptions required

To enable a successful and consistent assessment at the required granularity, sufficiently detailed physical and transition assumptions and variables for the scenarios will be needed:

-

A description and timing of the likely policy actions in each scenario. For example, there could be a mandated phasing out of diesel and petrol cars, gas heating or airplanes with fossil fuel engines, especially in the late policy action scenario

-

Narratives for the industry sectors which are considered vulnerable to climate change and how they will be affected in each scenario

-

Changes to flood risk that can be directly used in models (e.g. increase in flood-related insurance claims or an average risk of flooding for a UK property rather than increase in precipitation)

-

Disaggregated prices for properties with different levels of flood risk (for example high, medium, low, or very low, as per the UK Environment Agency definitions)

-

Assumptions around the future in each scenario of FloodRe, the joint initiative between the Government and insurers, which aims to make the flood cover part of household insurance policies more affordable.

Through our Economics Service, we have developed capabilities to translate scenario narratives into elements that are tailored to our clients’ specific needs and exposures, which ensures easy interpretation of the scenarios.

Does using a static balance sheet affect the plausibility of the exercise?

The 30-year assessment of each scenario will be done for a static balance sheet – i.e. an assumption that the portfolios holding will be the same as today even in year 30 of the scenario. This could be seen as unrealistic by the senior management of the banks and insurers participating in this exercise, which could affect the plausibility of the exercise.

Translating qualitative judgments into quantitative assessments

Banks and insurers will be required to include in their assessment judgements about companies’ current mitigation and adaptation plans. But how can qualitative judgements be translated into a quantitative assessment? 4most has developed an approach using a scorecard with sets of factors and subfactors around the 1) impact on income streams; 2) impact on cost streams; and 3) existing mitigation and adaptation strategies. The weight of each factor and subfactor is based on expert judgment, and the ultimate score is linked to the company’s probability of default.

Adverse selection for small banks?

And finally, by proposing to test only the UK’s largest banks and insurers, this exercise may cause adverse selection for smaller banks. There are smaller banks that may be overly exposed to sectors particularly sensitive to climate change risks. These exposures could be exacerbated if larger banks develop better techniques to manage their risks through this exercise. Future iterations of the exercise could include smaller banks with concentrations, or these risks could be captured through the internal capital adequacy assessment process.

4most has developed a number of methodologies to assess climate change risks across different exposures, including corporate exposures, property portfolios, and car finance portfolios.

For more information or for any questions, please get in touch with Ivelina at ivelina.nilsson@4-most.co.uk