Bulk Purchase Annuities: Looking ahead to 2025

09 October 2024

Bulk purchase annuities (BPA) have been an essential part of the UK financial industry for many years, whereby defined-benefit pension schemes have off-loaded liabilities and assets to specialised life insurance companies by transferring their longevity and investment risks.

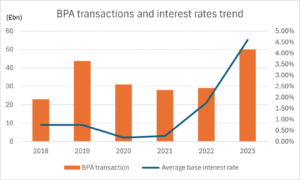

2023 saw a record braking £49.1b worth of risk transferred across 226 transactions by 9+ market players. This surpasses the previous £43.8b peak of 2019.

This article covers some of the factors affecting the market’s outlook, the challenges that the industry needs to overcome to allow it to keep pace with the increased demand moving into 2025, and a few alternative risk transfer mechanisms available to pension schemes based on their current circumstances.

The role of economics

A large increase in interest rates over the past few years has improved the funding ratio for many schemes, although the level of improvement varies depending upon scheme investment and hedging strategies. While the Bank of England (BoE) made the first interest rate cut in 4 years of 25bps in early August, interest rates are likely to remain high, at least in the short term. These high rates make BPAs more affordable for insurers as annuity rates become cheaper. Overall, these factors are poised to sustain and potentially amplify the upward trajectory of BPA deals throughout 2024 and into the short-medium term.

The below graph shows the trend in the BPA market and interest rates movement.

Regulatory Influence

The Prudential Regulation Authority (PRA) has been working on various reforms to Solvency II to deliver a smarter regulatory framework under Solvency UK. A couple of the segments of Solvency UK which will have an impact on BPA business are covered below:

Reduction in risk margin (RM) reforms – December 2023

Life insurers have seen a significant reduction in their risk margin, resulting in increased solvency ratio and release of capital. Insurers are then required to decide what to do with the released capital, which could include: write more business, reduce reinsurance, or invest into more capital-intensive business. Given the booming BPA market, we have seen insurers choosing to invest in the expansion of their BPA business.

Matching Adjustment (MA) reforms – March 2024

The regulator has widened MA asset eligibility to go beyond the previous requirement for fixed cashflows, to allow assets with “highly predictable” cashflows to be included in the MA portfolio (subject to caps), as well as streamlining the application process. Apart from the investment flexibility, the regulator has increased firms’ accountability to now demonstrate more robustly the adequacy of the fundamental spread (FS) relative to the risks in their portfolio and increasing the granularity of FS to consider notched ratings. These changes will have an impact on an insurer’s asset allocation and MA, potentially affecting their pricing for BPAs.

Further information on these reforms can be found here.

The challenges that come with an increased demand for BPAs:

Data: Insurers have been struggling to acquire high quality scheme data to facilitate appropriate pricing and risk assessment, which might be acting as a barrier for many schemes in getting insurers’ participation.

Limited capacity: Due to high volumes and a low number of subject matter experts, insurers are being pushed to run close to full capacity, compelling them to be more selective about which schemes they quote on.

Competition: Increased demand has led to new players entering, and the return of previous players to the BPA market (re-entry of M&G), increasing the need to offer more than just a competitive price. Tailored solutions and competing on advances, such as alignment with pension schemes’ ESG and sustainability targets are considered.

Regulatory scrutiny: There are concerns from regulators over capital adequacy and transparency. In addition, we have seen increased use of funded reinsurance that provides capital to support high transaction volumes, leading to regulators challenging counterparty risk exposure and collateral held.

Alternative risk transfer avenues

A buy-out might seem like the ideal solution for many pension schemes. However, there are many alternatives and complementary options that Trustees can utilise to transfer risks. These include, but are not limited to longevity swaps, capital backed investment plans, and superfunds (Superfunds are consolidated pension funds that take over occupational DB pension schemes with the aim to achieve economies of scale and provide protection to members’ benefits by maintaining a capital buffer).

While these options are gaining momentum and being expedited due to the Labour Government’s plans to further develop the commercial superfund market, it will likely take more transactions to establish understanding and confidence in the offerings for such products. Each option comes with a different set of benefits, regulations, and costs, but offer alternatives to schemes to a full buy-out.

Summary

The outlook for the BPA market remains positive for 2025 with significant growth across both large and small pension schemes. The market is on track to head for further innovation, particularly in response to evolving regulatory standards and the growing importance of ESG considerations and the investment of sustainable assets.

How 4most can help…

Partner with our experienced team of actuarial consultants to benefit from our expertise in modelling, transformation, and data solutions in the BPA.

Please get in touch if you would like to discuss ways in which we can support your organisation – info@4-most.co.uk.

Explore our Bulk Purchase Annuities services

Learn moreInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking