Climate Change and Insurance: An unlikely pair?

06 January 2023

UK REGULATOIN

Part 3: Scenario Analysis for Life Insurance

Introduction

In the first of our climate articles, entitled ‘Insuring the path to a Greener Future’, we introduced the effects and consequences the insurance market can expect due to climate change.

Following this, we released our second article – ‘Managing Climate Risk – From Board to BAU’ – to provide insurers with insight into the challenges and steps required to embed climate risk into their risk management frameworks.

Here, in the final article of our three-part series, we focus on how Scenario Analysis can be used to understand and manage exposure to climate-related financial risk.

The Prudential Regulatory Authority (PRA) has already asked Banks and Insurers to participate in exercises such as the 2021 Climate Biennial Exploratory Scenario (CBES), where three climate scenarios are presented to firms. Each participant had to consider the risks and financial impacts of each scenario on their business over the coming decades, before submitting their results.

As regulators become more familiar with climate risks and how these affect financial companies, it seems likely that these exercises are going to become standard practice. Balance sheet resilience is key to guaranteeing future solvency and providing security to customers and investors, so regulation will have to adapt in the coming years to take account of the increasing impact of climate change. This can already be seen, as it has already been confirmed that the ‘Taskforce for Climate-Related Financial Disclosures’ (TCFD) recommendations will have to be followed by all UK firms by 2025.

From another perspective, there is also motivation for firms to develop their expertise for internal purposes. In areas such as investment management, it would be easy to see how a ‘leader’ in this space could take advantage of the climate-related opportunities arising from an enhanced understanding of the climate-related risks facing their business. Or alternatively, underwriters could benefit from a better understanding of how climate change might impact standard liability-side risks, such as mortality and longevity. A better understanding of these impacts would allow for more accurate (and profitable) pricing, particularly on long-term Life Insurance products.

For these reasons, we believe that Scenario Analysis will become a key tool in a firm’s risk management and chose to focus on this for our final article in this series.

To detail a climate-specific approach to Scenario Analysis, we must project scenarios that quantify an insurer’s exposure to economic and demographic factors such as:

-

Impacts on mortality rates for protection products

-

Impacts on longevity rates for annuities

-

Changes in disease inception rates and exposures to new diseases for critical illness products

-

Varying consumer demand for income protection, savings, and life insurance

-

Volatile equity markets

-

Declining property values resulting from extreme weather patterns

-

Falls in interest rates

-

Increases in bond spreads, and

-

Credit rating downgrades.

Building a relevant scenario

Scenario Analysis is highly beneficial in providing input to strategic decisions and mitigating future risk. However, it is not free from risk as building a relevant scenario is often problematic if the risks under consideration are not fully comprehended. For constructing meaningful scenarios, the Task Force on Climate-related Financial Disclosures (TCFD) recommends that they are plausible, distinctive, consistent, relevant, and challenging in nature.

But what does it really mean in the real world?

-

Plausible: circumstances used to build scenarios should be reasonable and believable.

-

Distinctive: scenarios should be clearly differentiated from one another and represent a combination of key factors commensurate with the characteristics of the business (e.g. complexity of portfolio, main product types, etc.).

-

Consistent: interactions between demographic or economic parameters must be logical and result in coherent outcomes consistent with past experience.

-

Relevant: scenarios selected must have an obvious link to climate-related risk and the strategic or financial goals of the business in question.

-

Challenging: beliefs and assumptions should be probed to uncover feasible alternative scenarios which integrate future climate uncertainty and abnormal economic or demographic conditions.

Defining a quantitative scenario

To harness the power of Scenario Analysis, underlying parameters must be set in line with the five conditions defined above, whilst still accounting for wider economic and social conditions. Existing scenarios can be adapted to focus on the risks posed by climate change, safe in the knowledge that susceptible business lines and known risks have already been identified. Similarly, a firm should look to incorporate specific climate risk factors which have the potential to materially impact any long-term strategic aims.

In 2021, the PRA focussed their Biennial Exploratory Scenario on the physical and transitional risks associated with climate change. This built upon an earlier “exploratory exercise” in 2019 as part of the PRA’s life insurance stress test. Each of these exercises lacked prescription and prompted participants to actively engage on a “best endeavours” basis in the hope this would develop a beneficial approach to such Scenario Analysis in the future.

The Climate Biennial Exploratory Scenario (CBES) set out to explore the resilience of the largest banks and insurers in the UK to the risks of climate change by defining three separate paths based on possible future government climate policies.

For each of the three scenarios (early action, late action and no additional action), banks and insurers were expected to calibrate their own stresses to form a view of their balance sheet resilience. However, due to lack of internal modelling and data, there was significant reliance on data and projections provided by third parties.

The CBES conclusions emphasised that investment in climate risk assessment capabilities must be a priority for financial firms.

There were some limitations in the CBES scenarios, such as excluding mortality risks, and did note in the conclusions that these risks “could be material”.

The next section aims to explore some of the challenges insurers will face when deriving scenarios for analysing financial risk posed by climate change.

Limitations of Scenario Analysis

The inherent worth of a Scenario Analysis is limited by the calibration of underlying assumptions and parameters. But how do market participants set parameters with no substantial precedent? In February 2022, European Insurance and Occupational Pensions Authority (EIOPA) published an opinion on the integration of climate-related risks into Solvency II (SII) Pillar I requirements . It emphasises that these changes ensure that the prudential framework “reflects sustainability risks in the areas of solvency, consumer protection and financial stability in an adequate and risk-based manner”.

EIOPA recognises that climate change could directly affect best estimate cashflows – the extent of which will only be fully understood through emerging empirical evidence. However, asset management fees, expenses and insurance contract options will also be impacted by a market which may undervalue, misinterpret or fail to recognise all elements of climate change risk. An insurer must attempt to assign time points to the emergence of climate change risks, hence should consider the modification of best estimate cashflows much beyond a one-year time horizon. This is particularly problematic given the lack of data available to understand the long-term implications of climate change and leads to a suggestion that an ‘event not in data’ (ENID) provision may be appropriate in the short term at least.

There seems to be an acceptance by EIOPA that currently there are a limited number of approaches adopted by firms to assess these risks. It is no surprise that many in the industry believe insurers may be under-estimating their exposure to climate change when Scenario Analysis is hindered by:

a) Limitations in access and availability of reputable and sizeable data, and

b) An inability to adapt models to capture underlying trends and correlations.

In general, the challenges posed by climate change to determining Scenario Analysis can be summarised into 4 areas:

1) Time horizon – there will be both long-term and short-term effects to analyse (e.g. a warming planet altering underwriting and pricing in the short-term but transition risks driving long-term strategic asset allocation). A Scenario Analysis must ensure ample consideration is given to the entire future landscape.

2) Scenarios – an insurer must seek to build scenarios that are consistent with the advice dispensed by climate experts, regulators, and governments (e.g. moving towards a carbon-neutral economy).

3) Data – inadequate historical data may need to be supplemented by expert opinion, scientific evidence, and internal projections.

4) Tools – techniques must be found to carefully convert upcoming environmental changes into financial impacts bespoke to the life insurance industry.

4most thinking

Scenario Analysis is a widely used technique, utilised by firms to efficiently quantify the possible future financial outcomes presented by scenarios of the future. Whilst building scenarios to understand financial and insurance risk is familiar to many larger firms, identifying, assessing and measuring this form a climate change perspective is new and requires careful thought, judgement and analysis.

4most is working with insurance, lending and banking firms in quantitative measurement and financial risk management, particularly in bringing together solutions that involve commercial and regulatory considerations. The firm has invested time and effort to develop climate change models and techniques that facilitate climate change stress testing and analysis. These models draw on a range of disparate climate data sources such as meteorological, housing and energy, scientific studies, commercial reporting, and other data. 4most has also performed extensive research into the relationship between mortality and rising temperatures, and the potential impact on insurance companies. In Autumn 2022, 4most presented their findings at the IFoA Life Conference, and in The Actuary magazine.

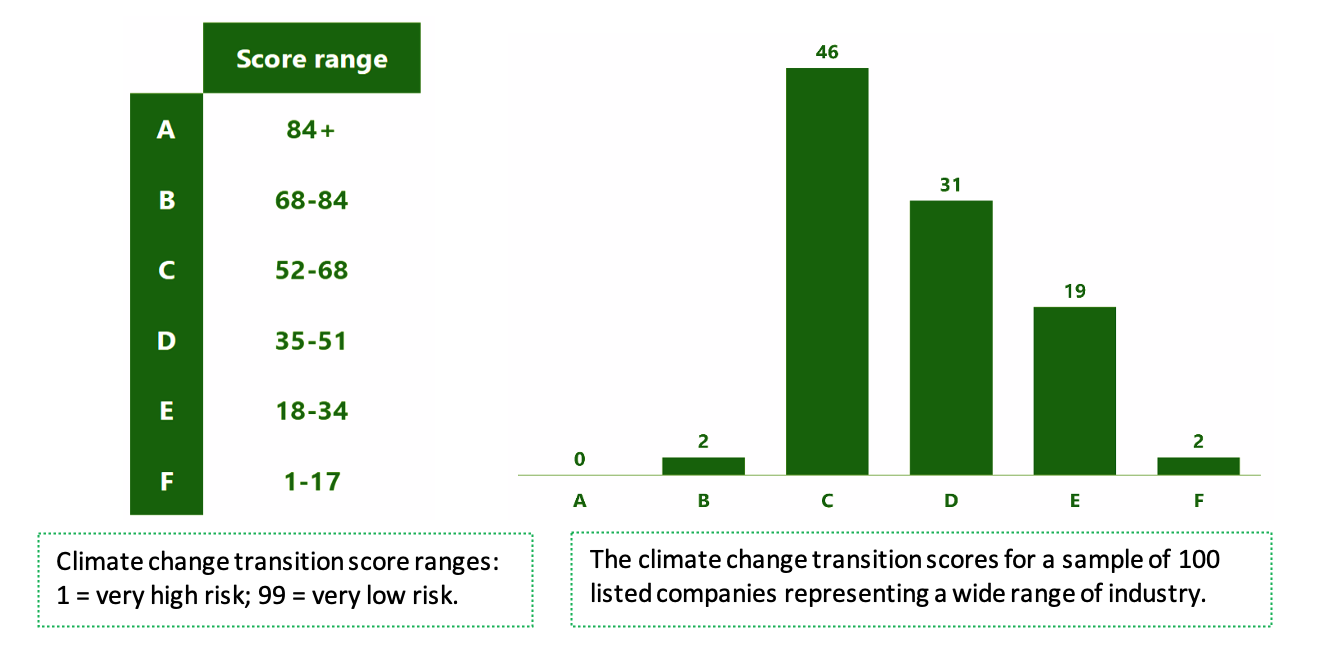

Recent analysis with clients has developed climate transition scoring methodology to be used in Scenario Analysis that assists investment management and to define risk appetite. A score can be set for each industry which accounts for idiosyncratic risk and aims to quantify the transition risk exposure of an asset (e.g. greenhouse gas emissions). If transition scores are set in a consistent manner, scenario testing can yield tangible climate risk outputs which regular credit stresses are unable to do. Consequently, a methodology such as this has the potential to help with understanding existing counterparty exposures and emerging climate-related risk classes.

Summary

The government, regulators, investors, and the industry have recognised the important role we each play in achieving net zero emissions targets and other long-term climate change goals. The Bank of England and PRA have made clear they see Climate Change as a risk to monetary and financial stability. The requirement from them, and the need for our industry, is to raise awareness and capability to manage the risks of Climate Change. Core to capability is measuring the exposure and estimating the potential impacts based on scenarios and other considerations. Data capture and structuring, methods and approaches, and even agreeing with a common language about the best measures are all at a relatively early stage but even in this short time have progressed a lot. We expect the industry will quickly coalesce on what is considered acceptable approaches and minimum capabilities and with that, stakeholders will use this to compare firms in respect of their goals, asking testing questions of firms that are not demonstrating sufficient progress or able to articulate comprehensively their status.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking