Consumer spending on gas and electricity in 2024 was 26.5% above pre-cost-of-living crisis levels

10 February 2025

UK consumers spent an average of 20% more on gas and 33% more on electricity bills in Q4 2024 (26.5% combined average), compared to before the cost-of-living crisis (Q4 2021).

Despite a general decline in inflation over the past year, the latest figures indicate that gas and electricity expenditures are set to remain above historical norms.

According to our latest Affordability Insights Reporting Service (AIRS) quarterly briefing, elevated energy expenditures are likely to persist throughout 2025. While the peak of fuel expenditure may have passed, higher wholesale energy prices, coupled with Ofgem’s 1.2% energy price cap rise at the start of January, signal that elevated costs have become the new standard.

Household composition continues to influence expenditure levels

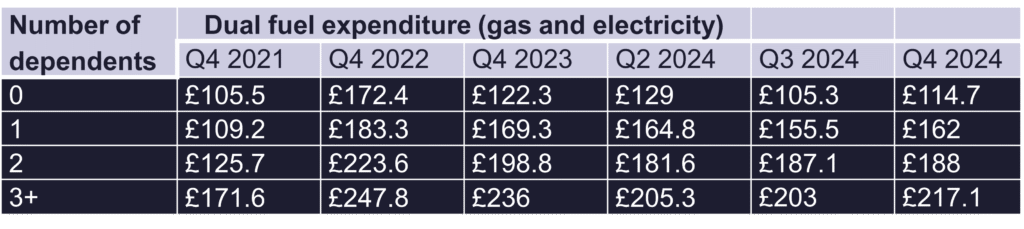

Our quarterly report has again highlighted the varying levels of gas and electricity expenditure, driven by the household composition.

The latest data indicates that households with no or one dependent have seen decreases in expenditure over the course of the second half of the year, while those with two or more dependents have experienced a slight increase.

Interestingly, the Q4 data reveals that households with no dependents are now spending similar amounts on gas and electricity as they did before the cost-of-living crisis.

Andy Johnson, Client Partner at 4most, comments:

“When conducting affordability checks, lenders often rely on datasets that may be over a year old, lacking the granular, real-time insights needed to reflect the constantly shifting economic pressures consumers face. With access to up-to-date data, lenders and financial institutions can more effectively evaluate their customers’ financial circumstances and accurately assess credit risk.”

“Additionally, many borrowers in precarious financial situations might be unaware of support they’re entitled to. By connecting customers with IE Hub, creditors can unearth the grants and subsidies that can make a significant difference for borrowers. It’s a potential game changer for those facing difficulties.”

Dylan Jones, CEO of IE Hub, adds:

“It’s no secret that other affordability publications can’t keep pace with current market trends, leaving lenders in a challenging – and potentially risky – position when calculating affordability assessments.

“At IE Hub, we’re confident that our unique platform addresses this issue by enabling consumers and creditors to share affordability data that is both granular and real time. This approach is essential for delivering accurate assessments and fostering positive outcomes for both lenders and their customers.”

More about our Affordability Insights Reporting Service (AIRS)

4most’s data source comprises detailed, itemised collection of Income and Expenditure assessments, from consumers who have been referred whilst experiencing – or expecting to experience – difficulties in meeting financial commitments.

The widely used Office for National Statistics (ONS) data publications that underpin most affordability calculations for financial institutions, utilities providers, telecoms companies and other credit providers, are published annually for the prior year. In comparison, the 4most Affordability Insights Reporting Service (AIRS) based on unique data from IE Hub provides real-time data across the full range of quarterly consumer expenditure, across categories ranging from energy expenditure, to rent and housing costs, essential travel and other expenditure. In addition to AIRS, the underlying data can be made available to firms who require more granular and timely data to monitor and maintain their models and credit decision processes dynamically as trends emerge.

This allows affordability calculations to be more exact, more reflective of the current pressures on consumers, and more effective at mitigating credit risk – leading to better outcomes for borrowers.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking