Covid-19 impacts on data used in credit risk modelling

02 November 2021

Since Q2 2020 the financial industry has been dealing with the ‘live’ impacts of Covid-19 – setting up payment holidays, preparing stressed projections of losses, applying PMAs to balance sheet impairments etc. Throughout this period the use of data has been cautious with normal objective processes, such as monitoring and recalibration, being paused in favour of management overlays and risk acceptance.

As the impact of the pandemic outlook softens the use of bespoke account management actions and impairment overlays are reducing in line with internal and auditor recommendations. The economic forecasts are returning to a more standard level and the concern of ‘hidden losses’ is reducing. However, the trust in data from the last 18 months is still a point of concern. Across the industry we are still seeing model monitoring triggers at red levels with no action stated and commentary of ‘due to covid’ and with stress testing models still calibrated to the 2008/09 downturn as the last recession.

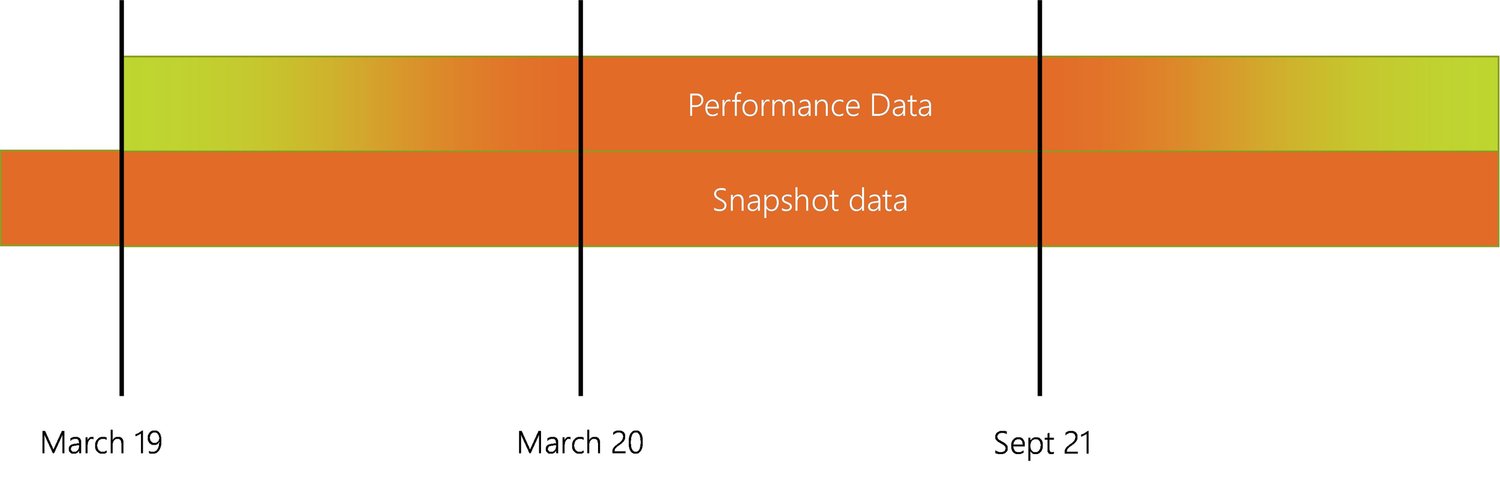

This approach is now being challenged both by internal executive management and auditors with a push to return to normal processes and a clear roadmap as to how and when they can be confident and trust underlying data. This does present challenges, as to ignore the impact of Covid-19 with regards to economic impact alongside bank and government intervention would lead to biased results and incorrect decisions. Additionally, the long-term impacts on consumer behaviour may mean that pre-Covid-19 data is not as reliable as we would like to believe, particularly with some segments of customers. These data problems can be considered in dimensions of time and use, here defined as performance and snapshot data. Performance data is defined as that used to observe a specific aspect of an account over time such as arrears or default emerging in the next 12 months. Snapshot data is often broader with regards to the information analysed and will, mix customers of different origination periods.

Performance data has been impacted by bank and Government measures e.g. payment holidays and furlough, as outcome states (such as arrears or default, or timing of payments) have been changed. Whilst snapshot data is also impacted by bank and government measures, it also will reflect permanent (or prolonged) shifts such as meaningful changes in expenditure, as there is uncertainty whether these behaviours, that drive creditworthiness and affordability, will return to pre Covid patterns. The degree of impact may be layered by customer, age, health comorbidity factors, employment sector and can be quite nuanced to detect, understand and adjust for.

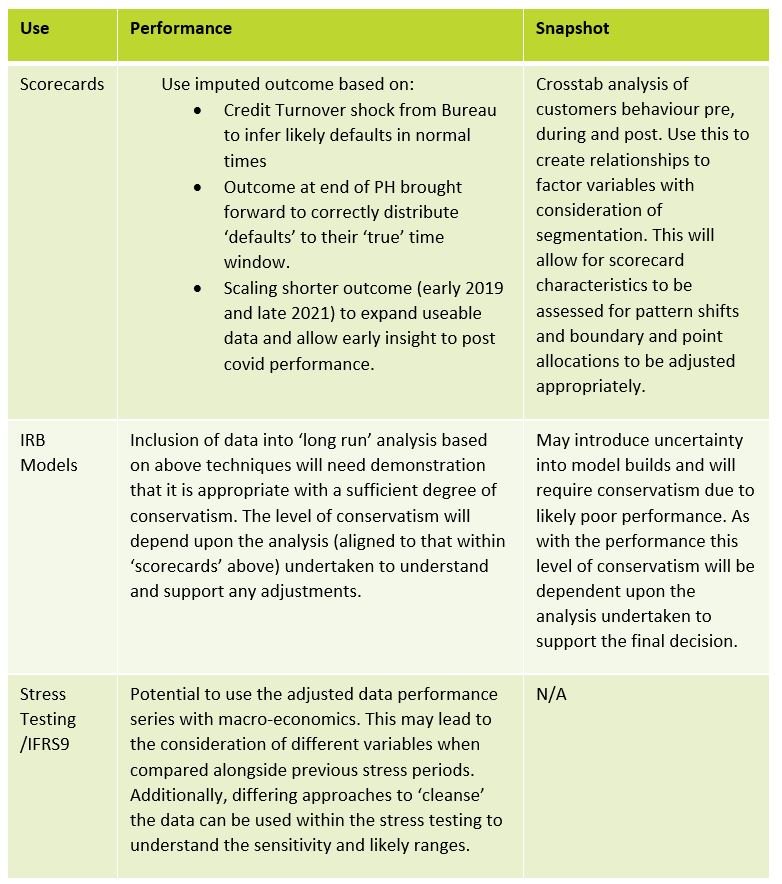

At 4most we have been investigating ways to address these challenges such as cleaning or adapting the data, considering how it is used in various applications. The initial focus has been on data used in operation scorecards, IRB, stress testing and IFRS 9 with split considerations across snapshot and performance data.

As the effects of the pandemic continue to be felt, some interventions are only now tapering down or ceasing, and the data needed to have certainty and clarity of impact is in its infancy. The results of our investigations, to this point, show that already some definitive actions can be taken that will identify and reduce risks and allow functions to build a clear roadmap that will lead to greater confidence and trust in the underlying data:

Our involvement with oversight and senior governing bodies of clients reinforces that having a clear plan with established methods allows them to be more agile in their thinking and understand new trends quicker and take meaningful steps to addressing the most material data issues. This will lead to greater market advantage and foresight of downstream impact of financials with regards to capital and impairment.

If you would like to speak to 4most regarding your data concerns, please contact, please contact christopher.warhurst@4-most.co.uk.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking