The philosopher Heraclitus is said to have written about change, “No person steps in the same river twice, for it’s not the same river and it’s not the same person”. There is relevance here to how lenders might think about their portfolio. Circumstances change and accordingly, the dynamics of a lending portfolio are always changing. The performance of customers will change depending on the macro-economic environment, regulations are modified, and competitor activity can impact customer profiles. As a result, credit risk appetite needs to consider changing conditions. In thinking about this it is important to recognise that whilst the past may provide insight in to how to understand the portfolio, it is not to say it is the same.

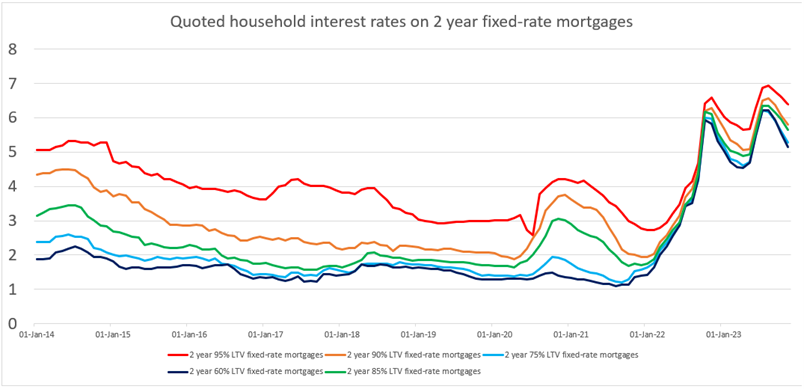

An example of this can be seen with the recent increases in mortgage product rates. The rate changes have the impact of reducing customer affordability via increased monthly payments. A potential solution for some customers and lenders may be the extension of terms (always with due consideration of the best interests of the customer).

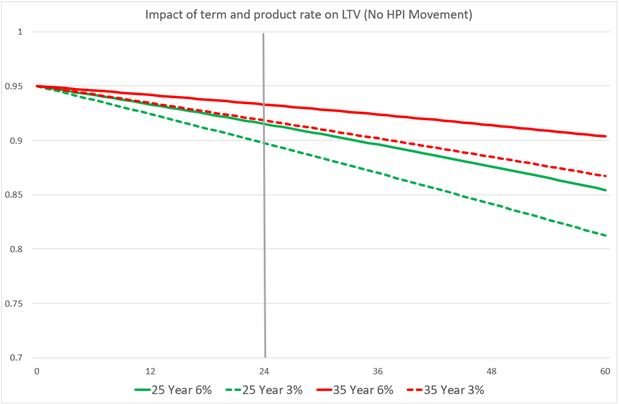

However, extending terms and higher product rates will obviously impact the amortisation of the mortgage balances, the LTV will reduce more slowly in the early years. The assets will “de-risk” more slowly. In the recent past customers may have been able to take a 2-year 95% LTV product with the expectation that the LTV will be below 90% by the time they needed to refix the rate. Changing product dynamics may result in mortgages booked at 95% remaining above 90% after the first 2 years. Referencing historic data of 95% lending may need to be adapted to reflect this change in conditions.

Historically 25-year terms were relatively standard for first time buyers, and at the low rates available (3% used as an example [1]) an LTV booked at 95% would be below 90% after 2 years (even with no HPI movement). A mortgage booked over the same term at 6% will still be above 91%. In recent years 35-year terms have allowed borrowers to afford more, the result being that a 3% rate 95% LTV product after 2 years the LTV would be 90% whilst a 6% product rate would mean the LTV remains above 93% LTV and would remain above 90% after 5 years.

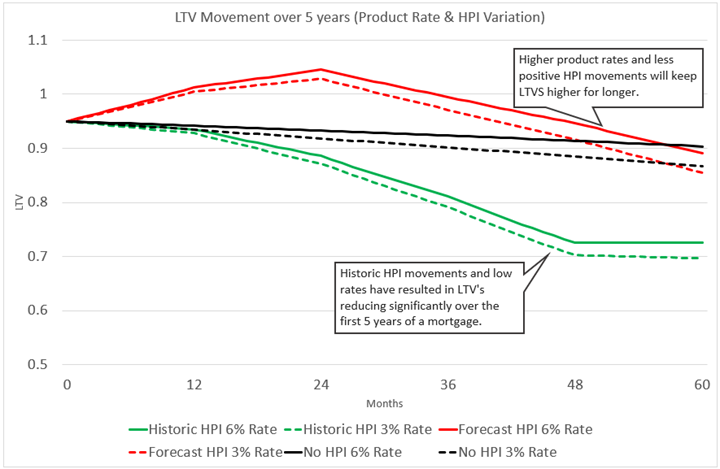

The relative impact of movement in LTV on 95% LTV products (35-year term) is shown in the chart below.

The difference in LTV between a 95% LTV product booked on a 3% product rate 5 years ago (70%) and a 95%LTV product booked today at 6% in 5 years assuming the HPI forecast comes to fruition (89%) is significant.

Whether this should change the profile of mortgages written is debatable, but a conversation regarding how portfolios will evolve differently should be had when considering appetite. Internal expectations and appetite thresholds should be set accordingly.

If you would like to discuss how a credit risk appetite can be developed to support the long-term aspirations of your organisation, please get in touch – info@4-most.co.uk.