Enriched decisions – a more inclusive approach to SME lending

06 July 2020

Enriched decisions – a more inclusive approach to SME lending

As the UK government has taken steps to introduce competition to SME lending, it has increasingly become an area of focus for many lenders, with a proliferation of new entrants attempting to seize market share. Schemes such as the government mandated Commercial Credit Data Sharing (CCDS) scheme and the £775m RBS Alternative Remedies Package (ARP) have supported this strategy through the democratisation of credit information and the distribution of funds to new participants.

More recently, demand for SME loans has surged due to the pandemic and the Government’s associated support packages, such as the Coronavirus Business Interruption Loan Scheme (CBILS). This influx has put huge pressure on lenders to process applications efficiently and quickly as possible, particularly in a digital world where consumers expect ease and speed.

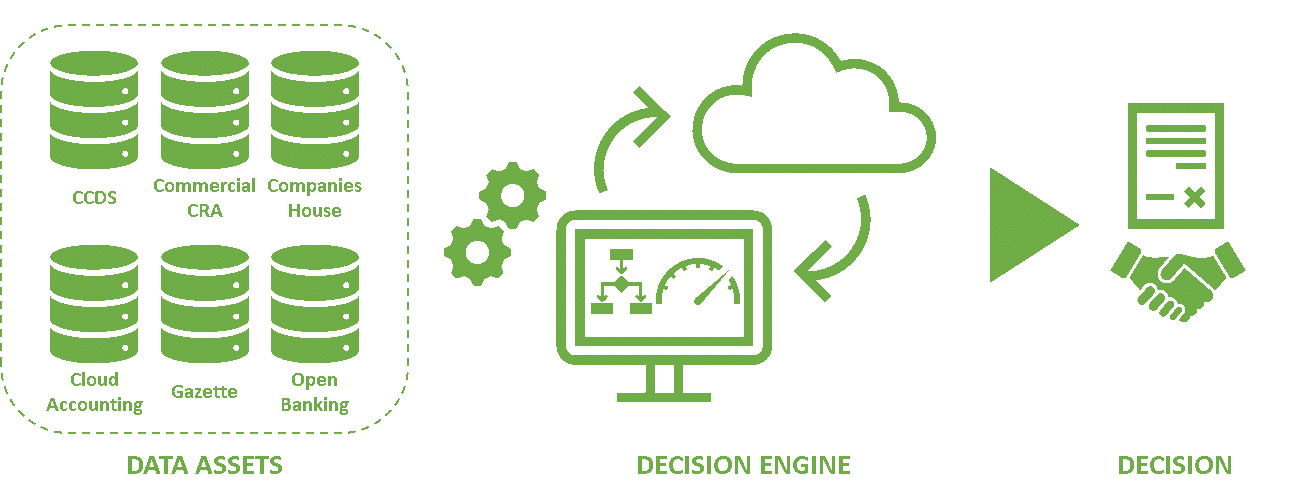

Fortunately, many SME lenders have redefined processes and the digitisation of SME data has reshaped the credit application process, revising the expectations of SME businesses seeking finance. APIs have facilitated the automated access of data assets such as CCDS, cloud accounting packages, Credit Reference Agencies (CRAs), bank transaction data through open banking, and public record data from Companies House and Gazette which have allowed lenders to build new customer journeys, shifting the burden of data collation away from the customer and internal administrative resources.

Fig 1: Illustrated example of Data assets available to support underwriting decision.

These automated data feeds could enable a seamless credit onboarding experience, however one major barrier to this still exists, which is, many lenders still rely heavily on manual underwriting.

Lenders continue in this way due to the perceived challenge of incomplete data profiles (e.g. missing or incomplete financial accounts) and the many contextual data references associated (e.g. industry benchmarks). Their argument being that only the underwriters know how to navigate this scenario, where to interchange data assets when incomplete information persists.

An additional challenge for new market entrants, or growing portfolios, is the lack of suitably available historic data. In both scenarios, there is no doubt that experienced underwriters contribute significant value to the assessment of creditworthiness by applying their expert knowledge within contextual settings that algorithms have yet to comprehend. However, there remains significant automation opportunities to make the SME decision process more efficient, with some pioneers already making headway into this space.

Where these pioneers are succeeding is in the ability to isolate and automate the repetitive and consistent components of the decision process that underwriters perform. Importantly, they are not looking to replace these experts, but rather to release capacity by considering automation for less complex assessments. With data now available to be industrially consumed, at scale and in an automated manner, it is possible to develop risk assessment and approval models that can cater for the complexities of SME lending by fully automating the ‘simple’ decisions, whilst referring the more complex ones to the experts – thereby better utilising the underwriter resources.

“4most’s Knowledge Elicitation Process (KEP) is a unique modelled solution, using a proprietary tool and algorithm, that takes the learning from the experts and replicates their thinking in a structured way”

Regardless of whether historic data is available or not, the key to this approach is to elicit knowledge from the underwriters to create a statistically robust model where less effective expert judgement scorecards or no model may have been used in the past.

Historically, when automating SME lending, organisations focused on the automation of subjective rules using one or two data assets such as commercial CRA profiles. This approach simplified the decision-making process and disregarded important elements of the diverse data assets that an underwriter could consider. This includes information which may have been difficult to include in automated processes previously (e.g. bank statements) but is now readily available in a digitally consumable format. The opportunity now therefore exists to enrich that decision process by considering a much broader range of data assets to both increase resource efficiencies and optimise the customer experience.

4most’s Knowledge Elicitation Process (KEP) is a unique modelled solution, using a proprietary tool and algorithm, that takes the learning from the experts and replicates their thinking in a structured way. The approach is nimble, requiring a relatively low number of observations – which can be real or constructed – to build a statistically robust and rigorous model.

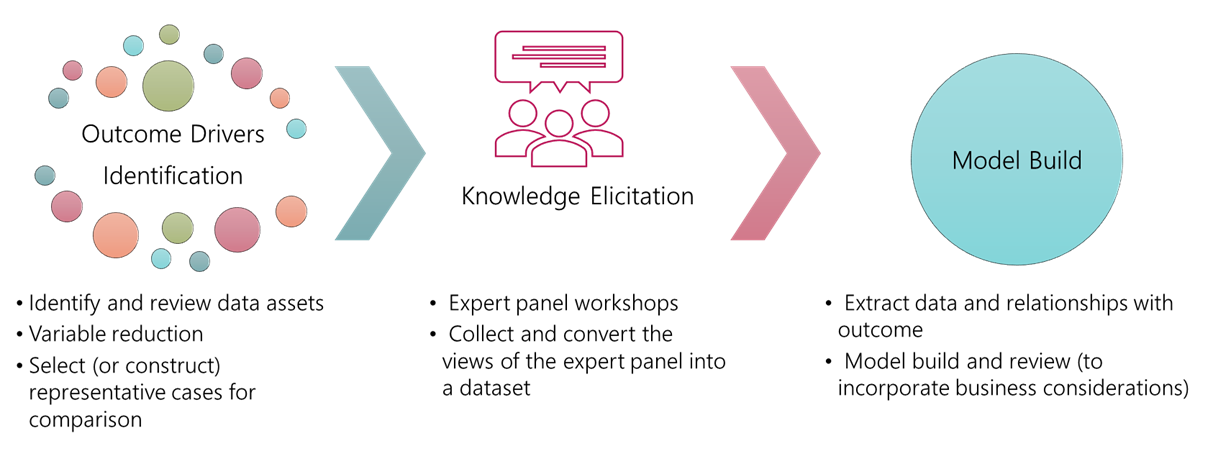

The KEP process starts by considering all relevant data obtained in the onboarding process that can be consumed in an automated manner, consolidating the various sources into a set of key variables representing the expert view, to produce a solution that allows for traditional model monitoring and validation.

Under this methodology, the model builders work alongside the experts to understand segmentations (e.g. sectoral variations) and important drivers of the underwriter decision to derive relationship with the decision outcome. This proven tool and process provides a simple, yet sophisticated three step approach (see fig 2), for which the output is a statistical model that can be measured and optimised over time alongside your existing suite of operational (application and account management) models.

Where this approach differs to most is in its holistic consideration of data and the simplicity of model development. An approach that can be statistically monitored, measured and complimentary to the expert manual underwriting reserved for complex decisions.

Fig 2: The three-stage modelling process of KEP

Do you have any questions? Please contact Stuart on stuart.leak@4-most.co.uk

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking