EPCs in Credit Risk Monitoring and Management

22 February 2023

Relevancy: England and Wales

Background

As part of the UK Government’s commitment to be Carbon Net Neutral by 2050, Energy Performance Certificates (EPCs) have become key to measuring the energy efficiency of residential properties; the 2017 clean growth strategy set future requirements to make as many homes as possible EPC Band C by 2035, highlighting the role EPCs have in both attaining and assessing the Government’s Carbon Net Neutral mission.

4most is working with many lenders to understand how to use EPC data to measure climate transitional risks in their portfolios (including the 2021 climate biennial exploratory scenario (CBES) stress test and supporting the calculation of financial emissions for PCAF submissions.

Part of this work looks to provide key monitoring dashboards and sensitivity analysis of the portfolio to identify areas of risk concentration, both current and future. Set out below are national level results highlighting topics of interest and potential usage in risk management.

EPCs were first introduced in England and Wales in 2007 and are required whenever a property is built, sold, or rented. The certificates reflect the energy efficiency of a property such as the costs involved with heating, lighting, and carbon emissions. They provide both a current and a potential energy efficiency rating, each ranging from A to G, with A being the most efficient. The potential rating is based on recommendations to improve the energy efficiency and performance of a property through modifications that are detailed as part of the inspection. Example suggestions range from improving the insulation of a property to replacing lighting with more efficient lightbulbs. The A-G rating is determined based on a Standard Assessment Procedure (SAP), itself a score which uses a range of information to provide a number between 1-100+ for the given property.

Currently there are EPC ratings certificates available for c.19m properties in England and Wales, covering about 65% of the market. However, a certificate is valid for up to 10 years and as such it may not be the most up to date reflection of a property. This is a key aspect that lenders need to take account of in the interpretation of this data.

Many third-party data suppliers provide the data as part of their additional data services. However, the main source of the data is freely available and from the UK Government (Energy Performance of Buildings Data England and Wales (opendatacommunities.org)). Using the most recent version of the file from January 2023, a nationwide picture can be built of how efficient the property landscape currently is, how this can change going forward, and what changes have been made in the drive to make properties more efficient. Importantly, understanding this evolution, both past and future, can help aid the understanding of emerging risks to the portfolio.

Results

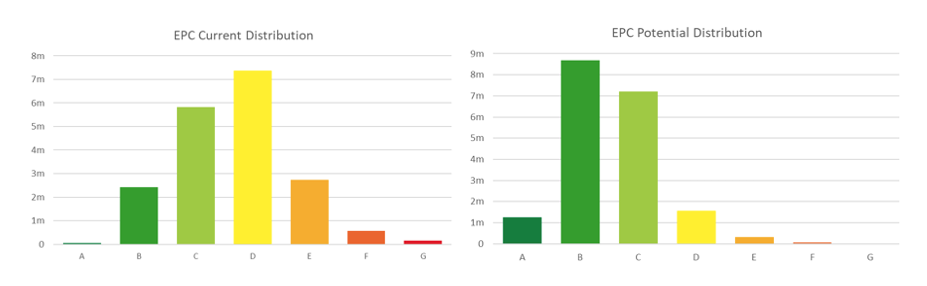

The chart on the left shows the current distribution of EPC ratings. This shows that, of the near 19m properties with an EPC record available, only c.8m (42%) of properties are currently above the UK Government’s target of C or better. Moving forward to the potential EPC distribution (shown in the chart on the right) this jumps to c.17m properties demonstrating that a material improvement in efficiency is identified for many property owners. Despite this, if we look at the least efficient end of the scale, c.100k properties are below the current minimum requirement of an E for rental properties.

This poses a fundamental question as to the future value of such properties if the UK were to align with the CBES guidance whereby “Properties that cannot be improved to an EPC band E or higher (i.e., EPCMAX < E) become unmarketable. For such properties participants should instead consider that the value of the property is reduced to its land value (i.e., the building value falls to zero).” That cut-off threshold may be subject to challenge and appear a harsh treatment for such properties, but it points to the potential risks lenders’ need to consider as new norms of acceptability of emissions and efficiency are established.

Understanding the impact of different thresholds and what influences properties moving, or not moving, is required to measure such risks. The chart on the left shows a regional split of the properties with low EPC ratings. It demonstrates that Yorkshire and Humberside have a greater distribution of inefficient properties based on their current ratings (light green). However, if we look at the potential ratings as a best state future scenario(dark green), it is the South West and Wales that are more exposed. Using this information, lenders can understand how exposed their portfolio is and it is clear EPC data will increasingly provide a rich source of information to further refine appetite and policy to shape the profile of mortgage lenders.

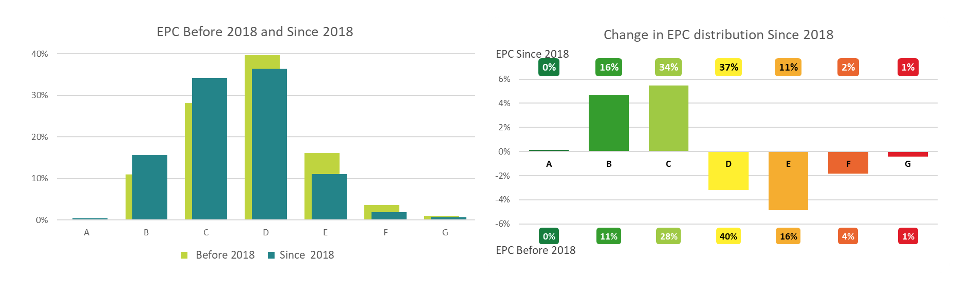

The following charts show the change in EPC rating recorded pre and post 2018 to look at the change in residential property energy efficiency over the last 5 years.

The charts show that there is a notable shift in the efficiency of residential properties with substantial movement in the percentage ratings of C+ which will be predominantly driven by new build properties; although the construction year of a building is available within the data, the field is limited from 2003 onwards.

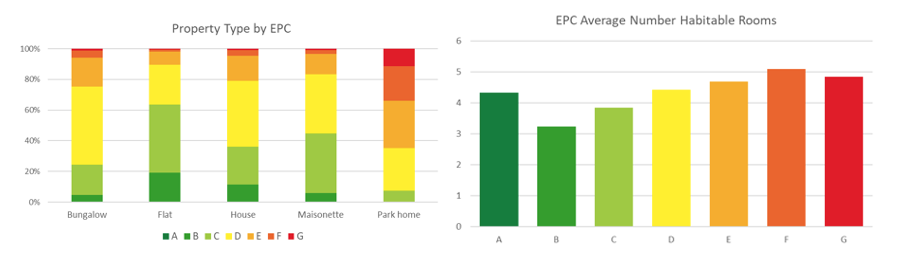

Looking at some of the characteristics of property types, unsurprisingly, flats, with natural layers of insulation are shown to be typically the most efficient type of property. While those least efficient tend to be bigger, older, properties with more rooms. There are also insights to read across into borrower affordability costs, those potentially susceptible to increasing energy bills (expected to increase another 20% in April 2023) driven in part by the energy efficiency of the property.

Conclusion

While EPCs have become a point of contention in stress testing scenarios (consistency, recency, rigour of the measure) it is very much the case that the information can be used in a lender’s portfolio risk management, including assessing these future affordability risks and understanding their exposure to less efficient properties whose future values maybe impacted as government policy evolves.

Many might argue that the EPC rating is a blunt tool in targeting carbon emissions, indeed RICs referred to the ratings as no longer fit for purpose in their recent “Decarbonising UK Real Estate” report and called on the Government to improve the way EPCs are “calculated, presented, and used.” With further effort to improve the assessment processes, it will only continue to embed as the critical piece of energy efficiency information for mortgage lenders.

ANY QUESTIONS? Please contact info@4-most.co.uk

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking