FCA’s Consumer Duty Rules: the impact on insurance pricing practices

15 August 2022

Key messages from this note

As part of its incoming Consumer Duty, the Financial Conduct Authority (FCA) has set out expectations of how firms should act to ensure they are complying with the new rules.

These expectations will have a sharp impact on insurers’ pricing practices, as firms must demonstrate that they are putting consumers at the heart of their business in their pricing decisions, and not seek to exploit customers’ lack of knowledge and behavioural biases when setting differential margins and prices across their products and services.

In this note, we summarise some of the key implications of the Duty to insurance pricing. We believe it provides an opportunity for firms to revise their pricing strategies, and apply sophisticated analytical techniques to generate value, while remaining customer-centric, ensure fair pricing outcomes, and continue to protect customers with characteristics of vulnerability. Our key take-aways from the Duty and guidance are as follows:

-

The Duty represents a welcoming, positive change for customer outcomes, increasing accountability in the financial sector for treating customers fairly;

-

The Duty is also an opportunity for distributors, MGAs and insurers, to review and challenge their own existing pricing practices, define and future-proof new pricing approaches and strategies;

-

The Duty steers the industry to taking a more holistic and analytical approach to pricing, where pricing and margin optimisations across different channels/products/customer groups will influence customer outcomes across different groups and channels. It will drive firms to employ analytical approaches to ensure that margin optimisations are ‘fair’, in the context of customer expectations, market moves, and the benefits that customers realise for similar products, offered across different channels and brands;

-

The Duty does not explicitly define what constitutes ‘fair’, and this assessment is left to individual firms. At 4most we support distributors and insurers evidence that pricing algorithms are ‘fair’ – by ensuring that ‘fair’ is explicitly defined ex-ante, and clearly set out the factors that determine fairness of discrimination in pricing models. Price discrimination is likely fair if it is driven by:

a) Factors controllable by the customer and transparent

or

b) Factors causal of the outcome

Consumer Duty – the new guidelines have now been published

At the end of July, the FCA published the guidelines for the upcoming Consumer Duty rules, which will have to be enacted by financial services firms by July-23 (for active products), and July-24 (for closed books) .

The Duty aims to put consumers at the heart of firms’ business, and focus firms to deliver good outcomes for customers. Financial products and services must be designed to meet customers’ needs and provide fair value, helping them achieve their financial objectives and not cause harm. Firms must also communicate and engage with customers so that they can make “effective, timely and properly informed decisions about financial products and services and can take responsibility for their actions and decisions”.

The Duty is designed to set higher and clearer standards for consumer protection. It includes:

1. A new Consumer Principle (FCA Principle 12), reflecting the overall standard of behaviour expected from firms

2. Three cross-cutting rules, specifically requiring firms to:

- act in good faith towards retail customers

- avoid causing foreseeable harm to retail customers

- enable and support retail customers to pursue their financial objectives

3. Rules relating to four outcomes under the duty, covering the firm-customer relationship:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

The duty will apply to all financial services firms which can influence, or determine, retail customer outcomes. This includes the design or operations of products, their price, value, and distribution. The application is underpinned by the concept of ‘reasonableness’, in that the firm’s obligations should be interpreted in accordance with the standard expected of a prudent firm carrying out the same activity – taking into account customer needs and characteristics, and the target market.

Value-for-money as an input to pricing decisions

A significant part of the Duty guidance relates to price and value. As per the Duty, firms are expected to avoid foreseeable harm, by:

-

Ensuring that products and services are designed to meet needs of customers

-

Ensuring that products are being distributed and remain consistent with the needs of the target market

-

Considering whether charges – and the retail price – represent fair value for different groups of customers, and taking action when this is not the case

The Duty guidance is explicit that “Firms charging different prices to different groups of consumers are not necessarily in breach of the Duty”. However, the expectation and scrutiny applied to pricing practices is significantly higher than in the past. In particular: “where firms charge different prices to separate groups of consumers, they must consider whether the price charged for the product/service provides fair value for customers in each pricing group, while having regard to whether any customers who have characteristics of vulnerability may be disadvantaged”.

The Duty guidance also makes reference to FCA’s 2019 Pricing in Financial Services Feedback Statement . In the document, FCA are explicit in defining price discrimination, whereby firms charge different prices to different customers, who cost the same to serve, based on differences in the customers’ price sensitivity. This is commonplace and is not deemed unfair.

However, the Duty also highlights that complex charging structures, or differential pricing, may carry greater risk of poor outcomes, and will therefore require thorough fair value assessments. In addition, segmented, sophisticated pricing approaches may not seek to exploit customers’ behavioural biases, lack of knowledge or characteristics of vulnerability. This will require appropriate controls and monitoring around elasticity-based pricing, to ensure that less price-sensitive customers are not charged a higher price due to any of the factors above, and that these customer groups are still charged a price which is representative of the benefit they enjoy from the product. These controls go beyond the application of pricing caps.

Despite the above, the Duty does not expect or require firms to move to unsegmented ‘cost-plus’ pricing, nor does it aim to prevent differential pricing or cross-subsidies between products (as per the guidance and the ‘Feedback to CP21/36 and Final Rules’ ).

Under the Duty, if customers do not get value-for-money from the products and services provided then they will ‘experience harm’. This could be an indication of firms not acting in good faith. Among the factors that could drive unfair value are:

-

High price

-

Unsuitable features that can lead to foreseeable harm

-

Poor communications and consumer support

The key aspect about price in the context of the Duty is that this must be ‘reasonable’ compared to the overall benefits. The Duty’s intention is not to set an expectation that products should be offered at a low price.

As an example, a product or service designed to meet the needs of its target market, transparently sold, and where customers are able to exercise choices to switch or exit, is likely to offer fair value. This is because:

-

Customers receive the expected benefits

-

Customers have the information they need about the benefits and limitations of the product or service they are buying

-

Customers have the ability to pick something else should they prefer

In this scenario, firms should still ask questions such as:

-

Are there elements of the pricing structure that could lead to foreseeable harm?

-

Are there fees or charges or rates which appear unjustifiably or unreasonably high compared to the benefits of the product and other comparable products?

-

Should/have any changes in the benefits of the product been reflected in the price?

-

Should/have any material changes to assumptions that underpinned pricing (e.g., costs of servicing) been reflected in changes to the price?

Existing products and services are also in scope of the Duty. Firms must review these against all aspects of the Duty both before the end of implementation and on an ongoing basis.

As with new products/services, existing products or services must also not exploit consumer lack of knowledge and/or behavioural biases and enable unfair prices to be charged. In addition, complex pricing and terms must not make it harder for customers to assess value and there must be a reasonable relationship between price and benefits of the product or service.

The Duty’s impact on insurance pricing

It is crucial that insurers and distributors adapt their pricing practices to enact the Duty ahead of July-23. To do this, firms should focus on two key aspects:

-

Defining ‘fair value’ in the context of the Duty, and implementing this when designing pricing strategies, pricing models, and executing pricing changes

-

Monitoring ‘fair value’ under changing market conditions

For distributors in particular, assessing whether value is fair depends on the margin charged, and pricing models and optimisations employed to define the margin. Fairness is broader than the application of pricing caps – as explained in the guidance, the new Duty does not operate as a cap, and even if one is in place that is not a guarantee that prices are necessarily fair if under the cap.

-

Defining ‘fair value’ in the context of the Duty, and implementing this when designing pricing strategies, pricing models, and executing pricing changes

Defining and assessing fair value is done by the firm and the Duty does not prescribe how this should be accomplished. Firms have the discretion to decide the factors informing the value assessment and if price is reasonable compared to benefits. The table below indicates some of the factors highlighted in the guidance, and how they could inform insurers and distributors’ pricing strategies.

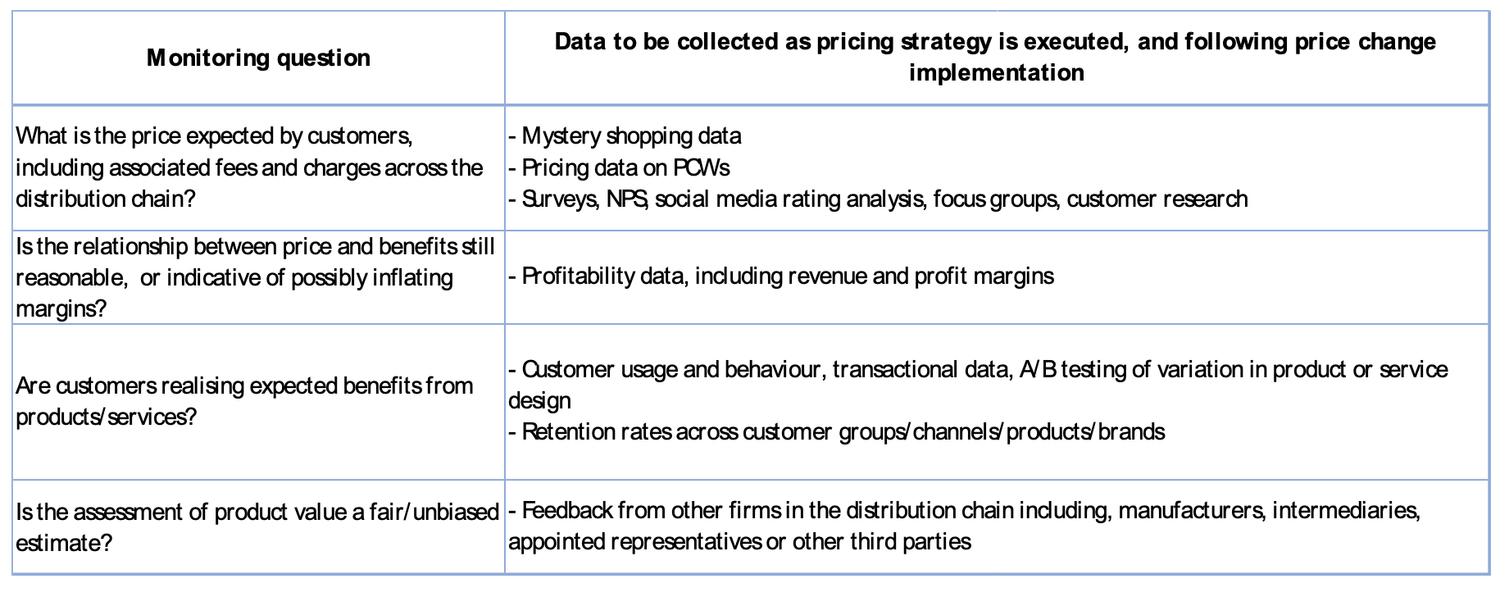

2. Monitoring ‘fair value’ under changing market conditions

Firms can use multiple factors and data sources to monitor if they are meeting expectations. The table below lists different monitoring questions, and the data required to address them.

4most insurance pricing support

Insurers and distributors should ensure that prices are ‘fair’ before these are offered to customers. At 4most, our pricing practice is supporting clients develop and adapt their pricing strategies in accordance with the Duty, ahead of it coming into force in July-23. We work with clients to develop analytical frameworks to define fairness, define pricing models and strategies, and ensure that clients have robust evidence supporting that pricing outcomes are fair.

The Duty is, however, not explicit in its definition of ‘fair’. This assessment is left to the individual firms and to determine FCA’s view on fair pricing we must refer to FCA’s 2018 Discussion Paper .

As discussed in this note, higher prices for some insurance products can be considered fair and justified for several reasons. At a high level, and in order of robustness, we would include:

1. Enhanced product features

2. Increased costs to manufacture or distribute (e.g. offline vs online sales)

3. Increased product risk (e.g. underlying mortality risks for life insurance)

4. Increased probability of lapse, or moving to another supplier at term

5. Increased convenience for the customer

6. Price sensitivity reflecting willingness by the customer to pay more for a brand

Whereas the factors below are likely unfair:

7. A material cost difference between equivalent products, without transparency for the customer, and driven by low customer sensitivity to price

8. Lack of clarity (or misleading information) on the price or features, leading the customer to take up more expensive products than they need/want

9. Identifying customers who are vulnerable and pricing them higher than equivalent customers who are not vulnerable.

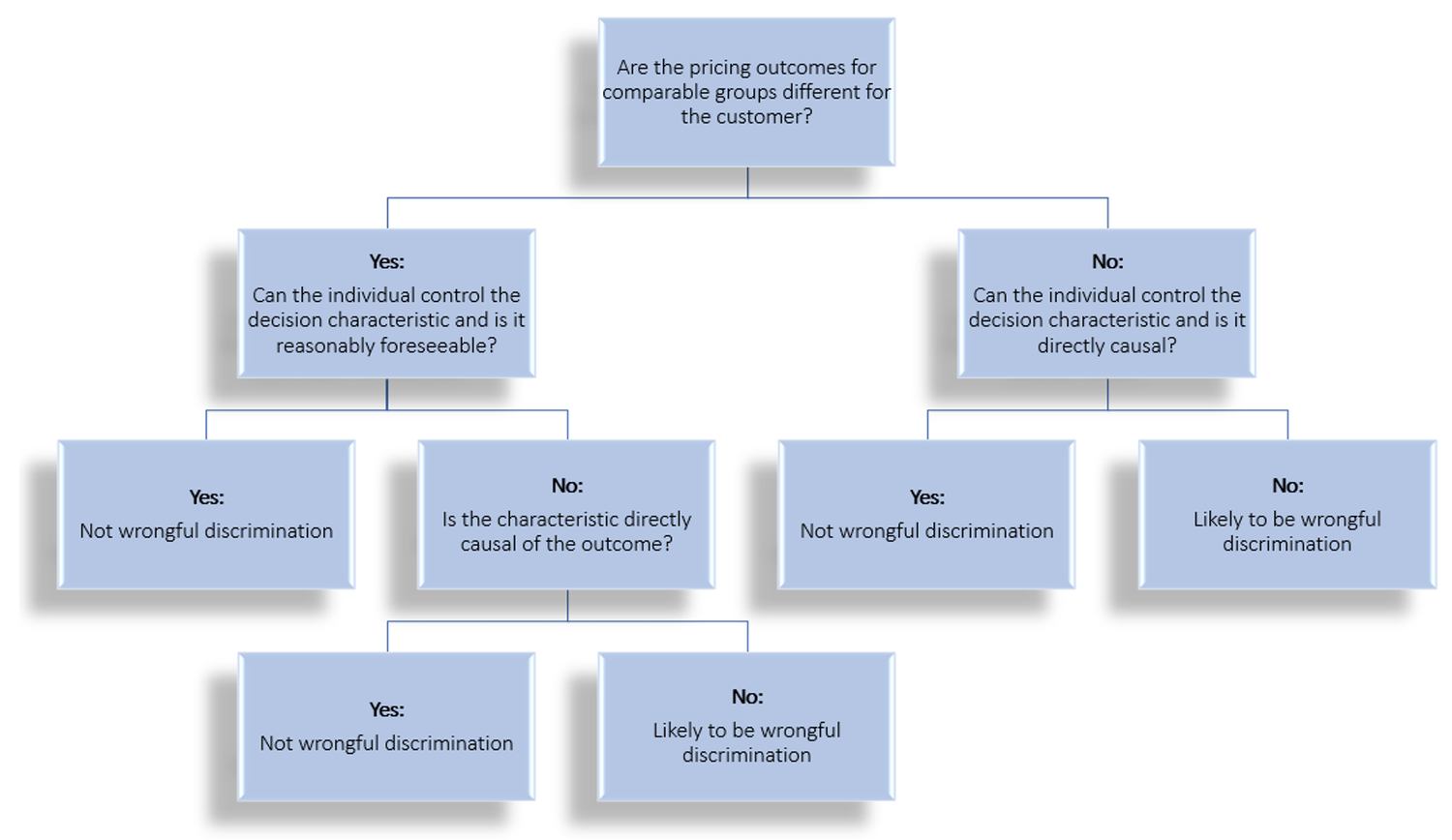

The line between factors 6. and 7. above can be unclear at times. Both factors are driven by price discrimination. The question then becomes which factors, or variables, are fair to use in price discrimination, or when defining granular pricing strategies and models. At 4most we have developed a high-level framework to identify discriminatory decisions:

Fair decisions may be less predictive (in terms of statistical measures of performance) but likely to be more robust and future-proof when the Duty comes into force.

The framework could be used to demonstrate fairness in pricing and decision making. Importantly for businesses, this approach also meets the key requirements of GDPR and the EU proposed legislation of Fair AI.

In summary, insurers and distributors should consider:

-

Are there data items that are reasonably available and causal of the pricing decision?

-

If so, then the feature MUST be used equitably in the decision process. Causality can be determined based on (e.g.) causal discovery algorithms and/or supported by human opinion

-

-

Are there data items that are reasonably foreseeable and volitional?

-

If so, then they MAY be used equitably in the decision process.

-

All other characteristics should not be used in a fair decision.

4most’s in-house algorithms and models enhance clients’ views of their customers, pricing outcomes, and that of the competitor landscape.

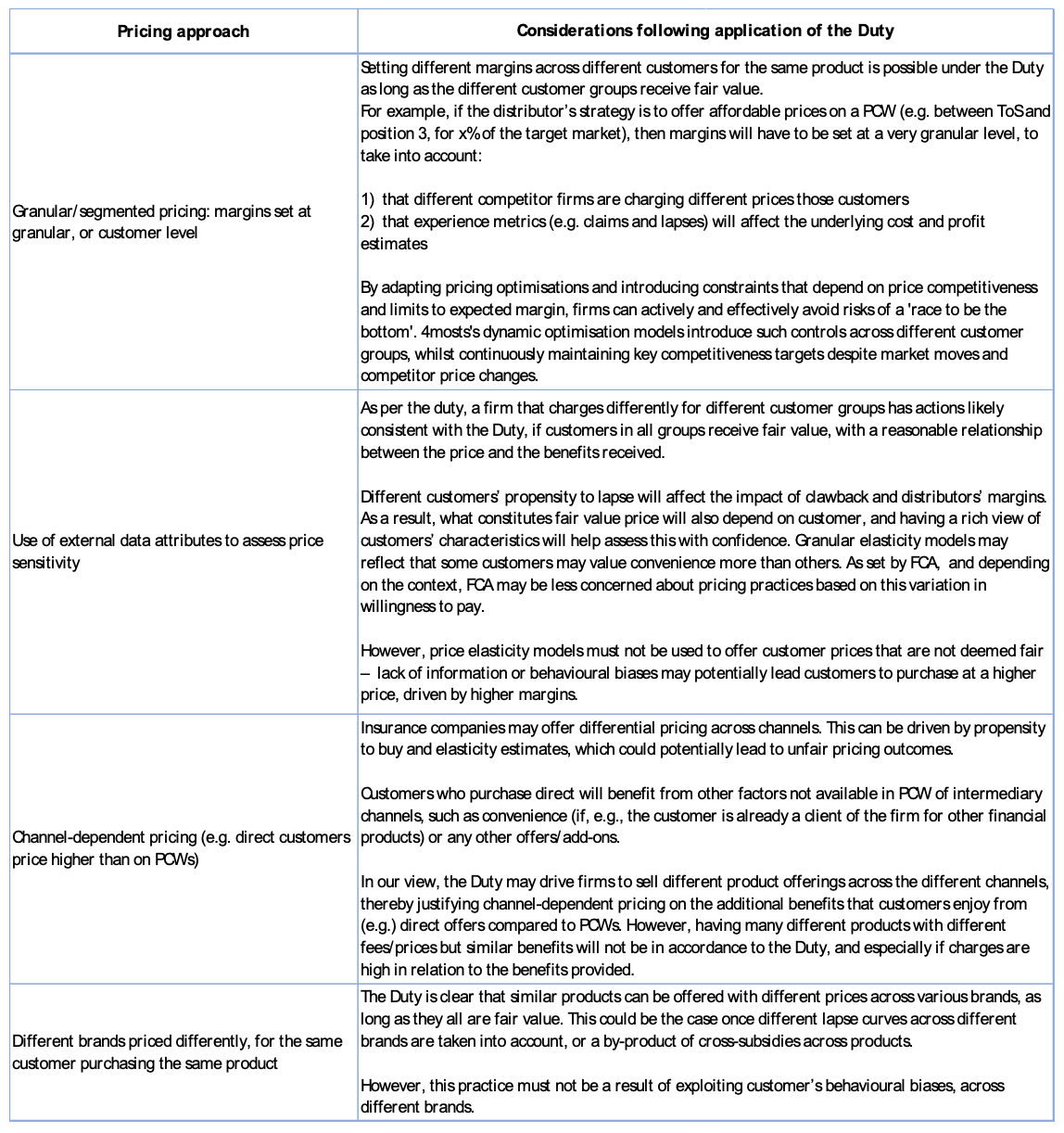

The table below indicates some of the considerations when designing and applying the Duty to the development of sophisticated pricing models and optimisations:

To learn more contact us at info@4-most.co.uk

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking