FRTB compliance: Options for UAE banks with small trading books

23 November 2023

The Fundamental Review of the Trading Book (FRTB) is a flagship market risk regulation that is a game changer for financial institutions. The options for FRTB compliance are the Internal Model Approach (IMA) and Standardised Approach (SA). There is proportionality in its application, banks with small trading books and less sophisticated risk management capabilities can opt for a Simplified Standardised Approach (SSA) if permitted by the regulator. The SSA does provide an entry level pathway for minimum FRTB compliance, due to its relative simplicity, low implementation effort and lower data requirements and computation burden. However, it still requires effort in terms of implementation, documentation, periodic validation and ongoing maintenance.

Context

The Fundamental Review of the Trading Book (FRTB) is a capital requirements framework for market risk that was put in place by the Basel Committee for Banking Supervision (BCBS), initially in January 2016, with revisions then introduced in February 2019 [1] . The implementation timeline has been pushed out globally, following the COVID crisis, with most jurisdictions (e.g., the European Union through CRR3 [2] and the UK through CP 16/22 [3] ) requiring compliance by January 2025. The FRTB measures were put in place in response to the Basel 2.5 measures that had the following shortcomings:

-

Lack of a clearly defined boundary between the trading book and banking book, with banks exploiting arbitrage opportunities between books to drive favourable capital treatment

-

Internal market risk capital models that were too complex, overlapping and causing unwarranted variability in Risk Weighted Assets (RWA)

-

A standardised approach that was not acting as a credible fallback to the Internal Model Approach (IMA)

-

Missing elements in the capital framework including tail risk, variable liquidity horizons and credit risk

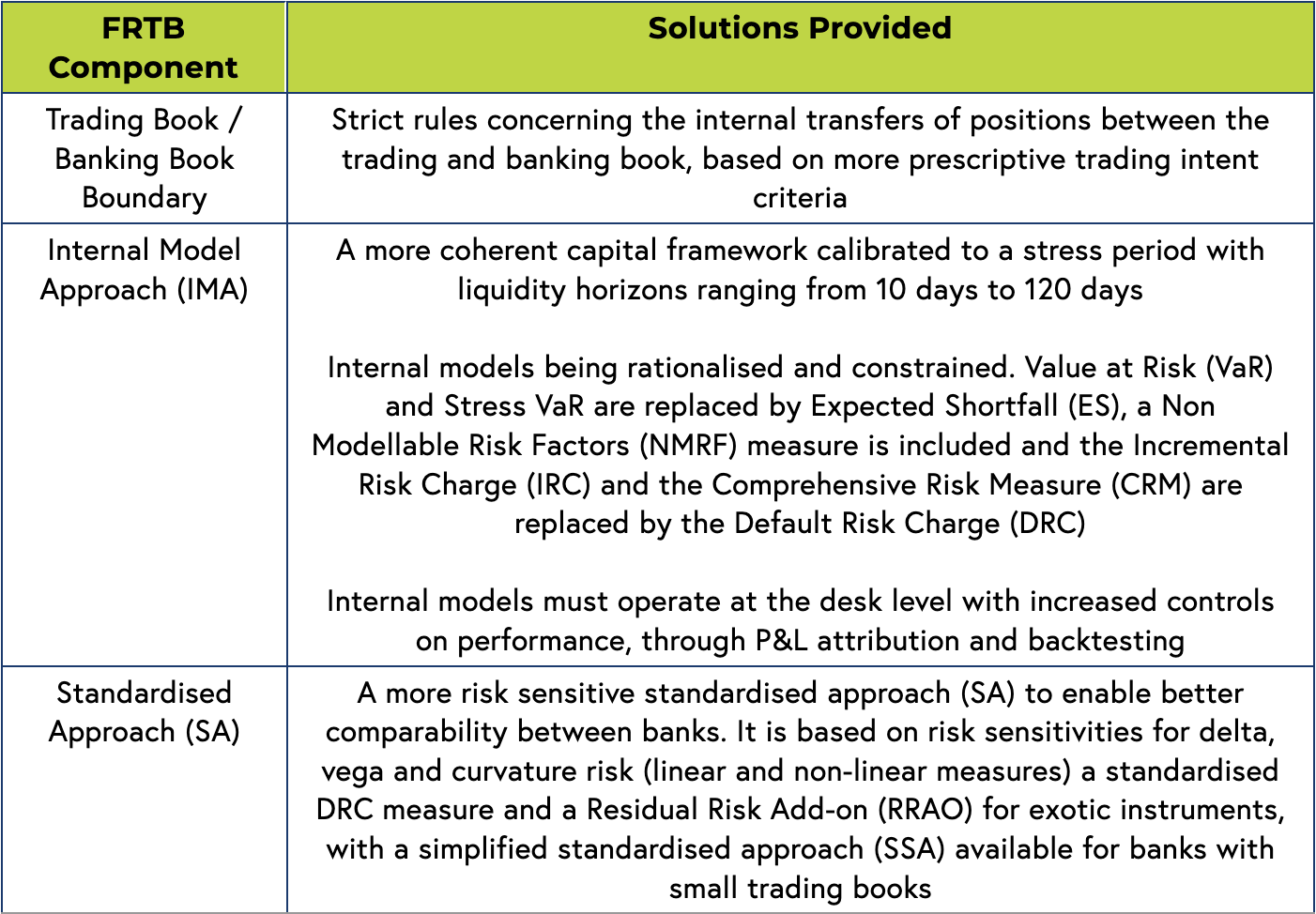

To address the Basel 2.5 shortcomings, the FRTB framework provides the following solutions:

In the following sections, we discuss the options available for banks with small trading books operating in the United Arab Emirates (UAE), the key challenges faced by financial institutions and how the industry should be responding.

FRTB compliance options for banks with small trading books

For FRTB compliance, banks have a choice between the Internal Model Approach (IMA) and the Standardised Approach (SA). Within the SA, banks have the option of an advanced approach based on risk sensitivities or a simplified standardised approach (SSA).

The decision for FRTB compliance should be thought through carefully and banks should consider factors such as risk management sophistication, RWA impact, along with the costs and complexity of implementation and ongoing maintenance.

IMA is more sophisticated and provides more accurate risk measurement and potentially significant RWA savings; but it is more complex and comes at a high maintenance cost.

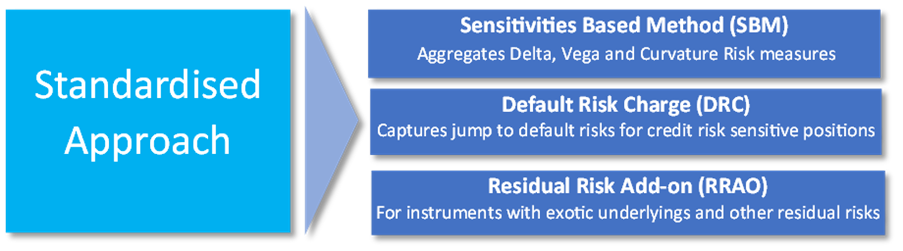

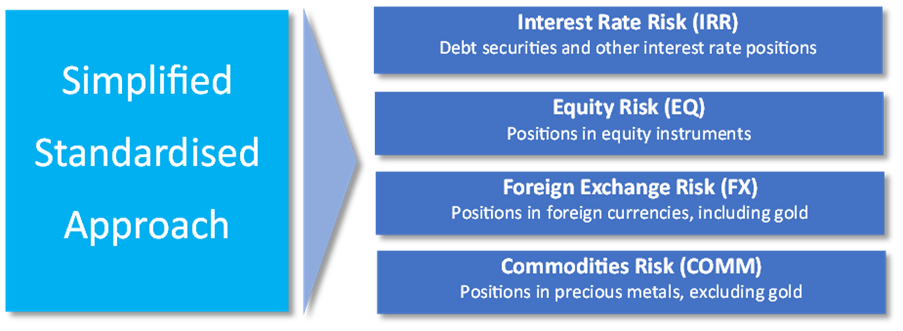

In contrast, the SA is less complex and is more accessible by banks with small trading books and less sophisticated risk management capabilities. The components of the SA approaches are summarised below.

For the standardised approach the total capital requirement is the sum of the SBM, DRC and RRAO components. For the simplified standardised approach, the IRR, EQ, FX and COMM components are each multiplied by regulatory provided scalars and added together to calculate the total capital requirement.

In the UAE, regulators can allow banks with small trading books who have limited market risk resources to opt for the simplified standardised approach (SSA), if below criteria are met:

-

The bank does not engage in complex trading activities (e.g., non-linear derivatives and structured products)

-

Does not hold correlation trading positions

-

Is not a globally systemically important bank (GSIB)

-

Does not use the FRTB IMA approach for any of its trading activities

The advantages of the SSA compared to the more advanced SA are that it is simple to calculate using standardised regulatory parameters, has a relatively low implementation effort with lower data requirements and computational burden. This approach provides a good entry point for minimum FRTB compliance. However, it does have the drawback of not fully capturing the risk profile of certain portfolios and will still require effort from banks in terms of implementation, documentation, validation, and ongoing maintenance.

Furthermore, the CBUAE model management standards [4] and guidance published in December 2022 has implications for banks in terms of data management, model development, implementation, validation, use and performance monitoring. These standards are applicable to the FRTB SSA models, which form part of the bank’s overall model inventory.

Challenges and the way forward for banks

There are different challenges facing banks with small trading books to achieve FRTB compliance. The key challenges and how the industry should respond are discussed below.

1. Completion of FRTB regulatory gap analysis in a timely manner

Banks should complete self-assessment against the FRTB SA Basel rules and CBUAE regulatory standards. Through this process they should identify any gaps in data management processes, model development, validation, management/regulatory reporting, performance monitoring and documentation. Banks should formulate effective roadmaps for timely gap remediation, socialise this with senior management. This will help in proactive communication with the regulator and will be key to achieving FRTB regulatory compliance in a timely manner.

2. Refining data governance practices

There is increased regulatory scrutiny of banks’ data governance practices. For their FRTB capital models. Banks should ensure they have:

-

Identified critical data elements (CDEs) covering trade, market and reference data.

-

Well documented data lineage with a clear linkage between FRTB capital numbers and CDEs.

-

Effective controls for the ongoing assessment of data quality Key Performance Indicators (KPIs) including completeness, accuracy, and timeliness.

3. Ensuring robust FRTB model governance and documentation is in place

The FRTB capital models will require robust documentation to be in place covering the following:

-

Methodology.

-

Process manuals/procedures.

-

Business/functional requirements.

-

Testing evidence.

These should be embedded into the bank’s overall risk management policy framework. The documentation should stand the test of internal audit and regulatory scrutiny and enable an independent party not involved in the development exercise to understand the model and perform an independent replication of the implementation. Furthermore, high quality documentation, metrics and communication throughout the model lifecycle is vital to enable senior management to make informed risk management decisions concerning regulatory capital.

4. Completing validation of FRTB capital models in a timely manner

To start with, banks should ensure that their Value at Risk (VaR) models are validated by a team that is independent of the 1st line model development team. Once a bank develops its FRTB SA capital model, the model validator should evaluate whether the model is fit for use by assessing conceptual soundness, design, implementation, usage, ongoing monitoring, data management practices, documentation quality and the robustness of the control framework. There should be effective challenge of the model to ensure that remedial actions are taken by the 1st line and the validation documentation should stand the test of internal audit and regulatory scrutiny. Furthermore, the model with associated validation findings and remedial actions should be presented at a model oversight committee for approval.

5. Ensuring strong training of internal resources and senior management

It is vital that there is a strong training programme in place to ensure that internal staff have a good grasp of market risk fundamentals, including FRTB regulatory requirements, measurement methodologies, risk management strategies and processes used to generate internal and regulatory metrics.

The challenge for senior management is often to understand the technical nature of FRTB capital models that drive strategic decisions. Without the appropriate technical knowledge some senior managers may simply fall back to managing the process. This will not suffice, as the CBUAE model management standards state that “the Board must also ensure that Senior Management possess an adequate level of technical knowledge to form a judgement on the suitability of material modelling decisions.” To address this requirement, banks will need to ensure that risk managers continually educate senior management through delivery of structured workshops to drive an understanding of:

-

The key strategic levers (e.g., portfolio composition, hedging and risk management activities) that influence regulatory capital.

-

The key elements of model design, assumptions/limitations, implementation, usage and performance.

Summary

FRTB is a game changer for the industry in terms of market risk capital requirements. The framework was put in place to address key shortcomings in the Basel 2.5 framework. Banks have a choice between IMA and SA, with banks that have small trading portfolios able to opt for the SSA if permitted by the regulator. In doing so, it is important for banks to carefully consider factors such as risk management sophistication, RWA impact, implementation/maintenance costs and complexity. In this regard, the SSA does provide an entry level pathway for minimum FRTB compliance; given its simplicity, low implementation effort, with lower data requirements and computation burden.

In achieving FRTB compliance, banks should:

-

Conduct timely gap analysis.

-

Ensure robust data governance is in place.

-

Improve model governance processes.

-

Enhance model, policy/procedure and process documentation.

-

Effectively train resources on regulations, methodologies and processes.

In this regard, senior management buy-in and understanding of the capital management and modelling framework are essential to facilitate robust risk management decisions.

How 4most can help

Founded in 2011, 4most have grown to become one of the leading independent credit risk, market risk and actuarial consultancies in Europe and the Middle East. 4most’s team of market risk experts can help banks in the UAE with FRTB gap analysis, data management, model development, model validation, documentation enhancement and delivering customised market risk training.

For further questions regarding FRTB implementation, please don’t hesitate to contact us.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking