Here’s why insurers should be harnessing the power of data lineage

03 April 2025

Data lineage visualises the movement of data through an organisation’s systems and applications, clarifying all dependencies in the data flow. It offers a detailed view of data origins, transformations, flows, and usage, ensuring traceability and accountability.

Why is data lineage important?

Data lineage is essential for organisations to maintain trust, transparency, and control over their data. It provides a clear understanding of the data’s journey, transformations, and usage, supporting decision-making, compliance, and operational efficiency.

It also reduces the risk of datasets being incomplete, inaccurate, and inconsistent by mapping the journey and relationships of an organisation’s data within complex systems. By providing a comprehensive view of how data flows and transforms within an organisation, data lineage empowers teams to leverage data responsibly and effectively while aligning with strategic and regulatory goals.

Benefits

Data lineage provides many advantages to businesses seeking clarity and consistency in their data environments:

- Data trust and quality: Data lineage improves comprehension and understanding of data, boosting confidence in its accuracy and helping to enhance data quality.

- Regulatory compliance: Data lineage is a process that stores data at a granular level which is key for compliance auditing, risk management, and ensuring data is stored and processed according to company’s rules and regulatory standards. Through data lineage areas of potential risk and non-compliance with internal or external regulatory policies can be easily highlighted.

- Data security and privacy: Data lineage strengthens data security and privacy by providing a transparent, end-to-end view of how data flows and transforms. In the event of a breach, data lineage can quickly show which systems, datasets, or reports were compromised, enabling faster and more targeted responses. This visibility helps enforce regulations, safeguard sensitive information, and build resilient data governance frameworks.

- Operational efficiency: Data lineage drives operational efficiency by making data processes transparent, streamlined, and collaborative. It minimises wasted resources, enhances productivity, and supports faster resolution of issues while enabling scalable and resilient data workflows.

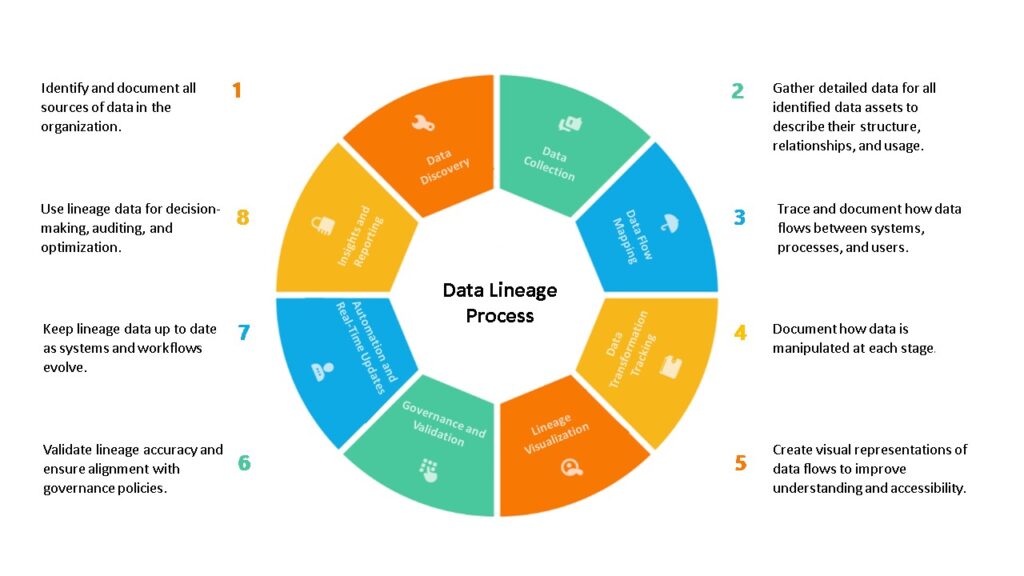

The data lineage process

The data lineage process involves systematically mapping, tracking, and managing the flow of data through an organisation’s systems, from its origin to its final destination. This process provides a detailed view of how data is created, transformed, moved, and used.

Challenges in the data lineage process

- Complexity: Organisations deal with increasingly complex data pipelines involving numerous sources, transformations, and destinations. The appetite for increased use of data means data systems include unstructured data, third-party feeds, real-time processing, and distributed architectures, making lineage harder to capture and visualise.

- Legacy systems and lack of metadata: Outdated systems or codebases often lack the capabilities to provide lineage or support its integration which leads to gaps in end-to-end lineage and reliance on manual processes for legacy systems. Metadata is critical for data lineage, but many systems do not provide sufficient or standardised metadata. Missing metadata leads to incomplete lineage tracking.

- Cost and resource constraints: Implementing and maintaining lineage tools, automation, and skilled resources can be expensive. Smaller organisations may struggle to prioritise data lineage over other business priorities.

- Data volume: Large volumes of data and increasing numbers of systems exacerbate lineage tracking challenges. This could lead to overwhelmed lineage systems and difficulties in maintaining up-to-date information

Use of data lineage in insurance

- Regulatory compliance and reporting

Insurers are subject to strict regulations and auditing requirements (e.g., Solvency II) which necessitate clear visibility into how data is sourced, processed, and used across various systems. Data lineage can:

- Maintain transparent records of data flow for compliance audits.

- Facilitate proper reporting, ensuring accurate data representation at each stage for regulatory filings.

- Support the management of sensitive data, ensuring compliance with privacy regulations.

- Risk management and fraud detection

The insurance industry relies heavily on data for assessing risk and detecting potential fraudulent claims. Data lineage can:

- Trace data from claim initiation through validation, underwriting, and payout processes to ensure consistency.

- Identify discrepancies or anomalies in the data that could indicate fraud, allowing for quicker investigations.

- Ensure that historical data used in modelling is valid and has been accurately processed.

- Claims processing optimisation

Claims data is central to insurers’ operations. Efficient claims processing is crucial for customer satisfaction and cost reduction. Data lineage can:

- Track claims data from submission to final payout, highlighting inefficiencies, delays, or errors in the system.

- Improve workflow transparency, helping streamline the end-to-end claims process by highlighting unnecessary steps or bottlenecks.

- Underwriting and pricing accuracy

Accurate underwriting and pricing rely on complex data models that include customer demographics, past claims, market conditions, and more. Data lineage can:

- Ensure that data from multiple sources (e.g., external risk data providers, internal claims history) is accurately integrated and transformed into the correct pricing models.

- Allow for historical traceability of how pricing algorithms have evolved over time and what data was used to generate a particular rate, increasing pricing transparency.

- Operational efficiency and cost reduction

Operational inefficiencies can lead to increased administrative costs and poor customer experience. Data lineage can:

- Provide transparency across systems to identify data flow inefficiencies, duplicate efforts, or underutilised resources.

- Help insurers optimise their processes (e.g., claims handling, data entry) by streamlining and eliminating redundant steps.

In summary

Data lineage plays an instrumental role in data validation by ensuring that data remains consistent, accurate, and compliant as it moves through complex systems and transformations. By tracing the flow of data and embedding validation checks throughout the pipeline, organisations can catch errors early, ensure data quality, and enhance trust in data-driven decisions, audits, and regulatory compliance.

For insurers, data lineage serves as a strategic tool that not only helps ensure regulatory compliance and data quality but also drives improvements across operational efficiency, risk management, and customer satisfaction.

How 4most can support

We have a team of experienced data and actuarial consultants that can help insurers harness the power of data lineage through:

- Data governance enhancement: Strengthen and formalise data governance frameworks, ensuring clear accountability and responsibility.

- Data quality improvement: Implement measures to enhance data quality throughout its lifecycle, including data validation, cleansing and establishing robust Data quality standards and controls.

- End to end data process: Deliver robust data lineage solutions that trace data from its origin through its lifecycle.

- Wider data aggregation and integration scope: Enhance capabilities for aggregating and integrating data across various sources and systems, achieving a single, comprehensive view of risk exposures.

- Technology and infrastructure upgrades: Advise and assess upgrades to the technology infrastructure, including data management systems, to support improved data aggregation, reporting, and analytics capabilities. 4most can build solutions that have data lineage and data quality capabilities by design, avoiding additional overheads.

- Risk reporting enhancements: Develop more robust and timely risk reporting frameworks.

Get in touch to learn more about how we can support your organisation – info@4-most.co.uk.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking