Here’s why your simplified IFRS 9 approach might need a rethink

29 August 2025

The IFRS 9 standards provide a simplified approach for calculating the expected credit losses (ECL) for trade receivables[1]. This allows entities to derogate from the three-stage approach and recognise lifetime expected losses to determine the appropriate impairment under IFRS 9. This simplified approach will typically use observed performance on historic exposures and then consider future conditions to fully reflect the IFRS 9 requirements.

This paper recommends that organisations critically evaluate whether their simplified approach models are overly basic and explore whether refining their data and model design could improve the accuracy of expected credit loss estimates and lead to better commercial and customer outcomes.

Segmentation considerations

The application of simple loss rates through provision matrices is common within the simplified approach to IFRS 9. Typically, entities will use historical data to determine the losses that have been incurred and translate this into a loss rate to apply to current balances. The time period used for this data is a modelling decision, reflecting the relative benefits of recent data (e.g. 1 year) vs. the potential stability of data observed over a longer period.

To improve the performance of the model, there may be segmentation e.g. product, region, or customer type. The aim of this segmentation should be to reflect the drivers of performance. The extent of this segmentation is dependent on a number of factors, availability of data, stability of segmentation and consideration of incremental performance vs. the overheads of managing more complex models.

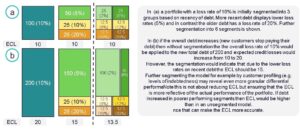

The benefits of having models which more closely reflect the drivers of performance are clear. A simplified example is shown below. A key consideration for auditors should be whether the segmentation is appropriate and whether the organisation has data that may contradict the current assessment and conclusions.

Figure 1: Impact of increased segmentation

With the growing emphasis on data, organisations should consider whether their current simplified approach truly reflects the most accurate view of exposure performance. Relying on the mindset of “if it ain’t broke, don’t fix it” risks overlooking two key issues:

- The current approach may indeed be “broke” if it fails to represent the best view of debt performance.

- “Fixing it” could unlock significant benefits—not only in terms of more accurate Expected Credit Loss (ECL) reporting, but also through broader commercial gains.

A key question to ask is, have existing models been reviewed in light of evolving data availability?

Cost of living

In recent years, people in the UK have faced increasing financial pressures. As a result, individuals or organisations that previously had no trouble meeting their financial commitments may now be finding it more difficult.

While the fundamentals of credit remain the same, centred on a customer’s ability and willingness to repay, there’s an important distinction to make. New customers experiencing financial strain may have seen their ability to repay affected in the short term, but their attitude towards debt may remain responsible. This means their engagement and eventual repayment performance could be significantly better than what we’ve seen historically with long-term or “hard core” debt.

Challenges presented by less sophisticated models

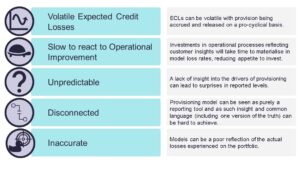

Figure 2: Simplified model challenges

Approaches to the simplified approach can vary. Overly simplistic models can be both volatile and inaccurate. One of the drivers for the introduction of IFRS 9 was to improve the reliability and transparency of reporting within financial statements. The retention of overly simplistic provision/loss rate models could undermine these aims.

As shown in Figure 1, in deteriorating periods a previously small pool of primarily poor performing debt is increased by better performing debt, but the historic high loss rates are applied to this larger pool. The model indicates higher ECL and the need to increase provision at the time when realised losses will also be increasing.

Increased model integration

IFRS 9 models are often detached from the business and operate like a thermometer, they offer a view on the temperature of the organisation without supporting a diagnosis. Utilising a wider range of data may present challenges but often the data that is likely to provide insight into performance already forms part of operational processes. Operational areas used for the recovery of debt are likely to have insight on the drivers of performance of debt. By bringing the model closer to the operational environment fluctuations in ECL can be better understood. A common language and understanding across the organisation can support a symbiotic relationship between operations and financial reporting.

Complex models can also be more challenging to manage, and there can be reluctance or inertia within an organisation to consider alternative approaches. The general direction of travel is clear and organisations that are slow to appreciate the benefits of utilising more sophisticated models and data are likely to experience considerable drags on their commercial performance in comparison to their peers.

More closely integrating provisioning within the business and the same conversations as operational processes aligns to model risk management best practice, bringing models and stakeholders closer together. More sophisticated models can better support more accurate forecasting and financial and operational planning.

Figure 3: Integrated models

Other considerations

Forward-looking information

Consideration of macro-economic forecasts and correlations with this information and loss rates is typical. This may take the form of a number of probability weighted scenarios. The availability of data over longer periods to evidence the correlation between macro-economic data and loss rate performance can be a challenge for some organisations especially where models and data have changed over time. However, a more sophisticated model developed with the intention of applying macro scenarios will allow for incorporation of forward-looking information more easily and reduce the reliance on judgmental intervention in achieving the final ECL numbers.

Model risk management

Consideration of best practice is advised and whilst they may not be directly applicable, depending on the organisation, an understanding of the SS1/23 Model Risk Management principles for banks can act to provide a broad best practice framework to base governance and controls upon. A review of provisioning models and data environment can provide important insight on areas for improvement or provide assurance on the suitability of existing approaches. As attention increases on ECL a passive stance on IFRS 9 simplified models runs the risk of being considered neglectful.

Conclusion

Policy decisions can often lead to unintended consequences. In banking, capital regulations contributed to the amplification of systemic risks before the financial crisis. Since then, efforts to level the playing field have introduced such complexity that many firms struggle to understand the intent behind the rules or how to comply effectively. For example, the IASB’s IFRS 9 standard for reporting expected credit losses has always been a compromise. At first, the focus was on balancing national interests. But a less obvious issue was the simplified approach, which made it easier for firms to comply but also introduced risks. And now, those risks have become a problem.

Firms that follow the simplified approach may not fully appreciate the fundamental role of data, modelling, forecasting and stress testing. These elements are essential not only for managing risk effectively but also for improving customer outcomes, reducing costs, increasing revenue, and creating sustainable value. Firms that adopted the full-scale IFRS 9 approach are now years ahead, having laid the foundation to embrace innovations in modelling and generative AI. If your firm believes the simplified approach removes the need to invest in data and modelling, it may be time to take another look.

There are advantages and opportunities in improving the sophistication of the methodologies typically adopted at present under the IFRS 9 simplified approach. A more accurate provisioning mechanism and alignment to operational processes would lead to better forecasting and planning, while allowing the models to stand up to increasing scrutiny.

Need more guidance?

Get in touch if you would like to learn more about how our experienced team of consultants can support your organisation’s IFRS 9 strategy – info@4-most.co.uk.

Footnote(s)

- [1] Where any account receivable contains a financing component (typically terms extended to the customer exceed 12 months) there is a policy choice to be made between the simplified or 3 stage approach.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking