Implications of Coronavirus for stress testing

28 February 2020

Key Facts

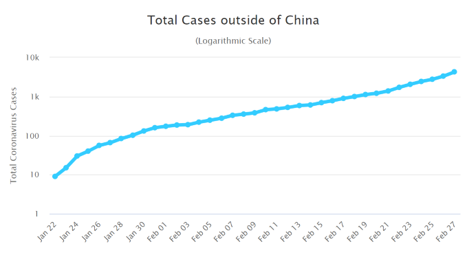

Although the COVID-19 virus has not been recognised as a pandemic by the World Health Organisation (WHO), by 28 February there were 83,726 confirmed cases worldwide (19 in the UK) and 2,859 deaths (1 UK citizen). England’s chief medical officer regards transmission between people in the UK as “just a matter of time”. (BBC: 28 February).

The current estimated death rate (c.3% of those infected; Lancet Jan 24) is low by the standards of some previous pandemics like SARS (9.6%) but the rate of infection is much higher. Consequently, the scope for disruption is large.

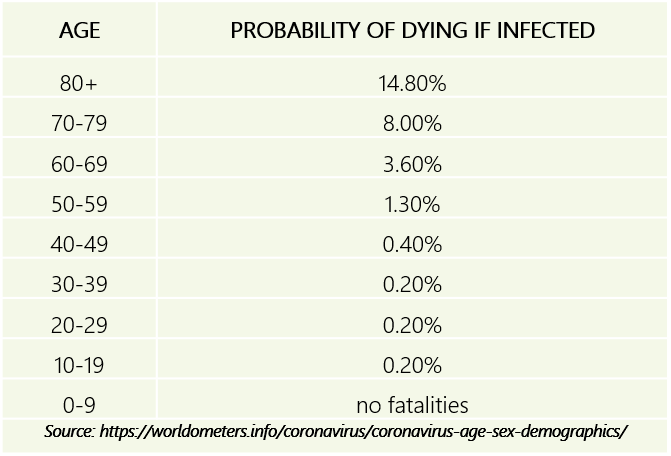

As with most flu epidemics the disease is more likely to affect those with existing health conditions. Current death rates (defined as deaths among the population with the infection), are much higher among the elderly population.

Stress testing assumptions for pandemics

Firms’ stress tests should cover a ‘reasonable worst case’

A pandemic would raise operational risk questions about firms’ (including banks) ability to function in a period where many employees are on sick leave.

The Department of Health’s 2011 pandemic preparedness report is a useful guide to how firms might model this stress.

The key characteristics of its reasonable worst case (which assumes no mitigation) are:

-

50% of the population develop symptoms over a 15-week period.

-

A death rate of 2.5% among those that develop symptoms.

-

Up to 50% of the workforce may require time off. On average, those infected may be absent from work for 1.5 weeks. Some with caring responsibilities will require extra time off due to ill relatives or because schools are closed etc.

-

Small organisation units or small teams within larger organisations are likely to see higher levels of absence. A stressed planning assumption should assume 35-50% absence is possible on a given day.

Firms should consider their exposure to high-risk sectors

While the macroeconomic impacts of a potential pandemic are not trivial, they are unlikely to be as severe as the shock covered by annual regulatory stress tests.

-

The level of GDP could reduce by 1.75% (based on a 50% infection rate and 1.5 week average loss per infected worker) but typically, economies rebound strongly after pandemics pass. However, this could temporarily push the unemployment rate up by approx. 1% point.

-

Supply chains will be affected, placing a strain on those firms reliant on parts from east-Asia. A shortage of goods would put upward pressure on inflation and hurt household finances.

-

Financial markets have already priced in some disruption and central banks could be expected to supply extra liquidity.

-

There are 896,000 people on zero-hour contracts in the UK – they have no access to sick pay and could suffer an immediate income shock.

-

Older age groups will be affected more than the general population.

-

Sectors based around face-to-face interactions will suffer disproportionately. Travel will be curtailed. Large sporting events and other places where groups gather will have to be postponed. Some business models, such as those that rely on rental income from overseas students, will be disrupted.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking