Overcoming modelling challenges in a low-default environment

12 March 2020

With increasing regulatory and competitive pressure, the ability to build reliable credit risk models is critical to understanding your portfolio.

Author: Jonathan Hooson

In recent years, additional competition has seen lenders launch new products to generate revenue from niches. This has created an emerging credit landscape with limited outcome data. Paired with a benign economic environment, this presents a significant modelling challenge at a time when accurate models could be crucial to understanding potential losses and building a sustainable portfolio.

Within their individual portfolios, many lenders do not have sufficient default data to build quantitative credit risk models. External data is difficult to source and expensive to purchase, leaving lenders reliant upon expert judgement to build models.

Whilst the portfolio-specific knowledge to understand key risk drivers exists within underwriting and leadership teams, processes for eliciting knowledge have often been subjective. This has restricted the ability to reflect expertise in model constructs and has given expert judgement models a notoriety for being unreliable and unrepeatable. As such, validation teams are examining them with increased scrutiny, often leading to significant rework and model recalibration.

How do you build compliant models using expert judgement?

Banks can overcome this challenge by using an objective process to elicit knowledge from their internal experts to create statistical expert judgment scorecards and compliant Probability of Default (PD) models with or without outcome data.

-

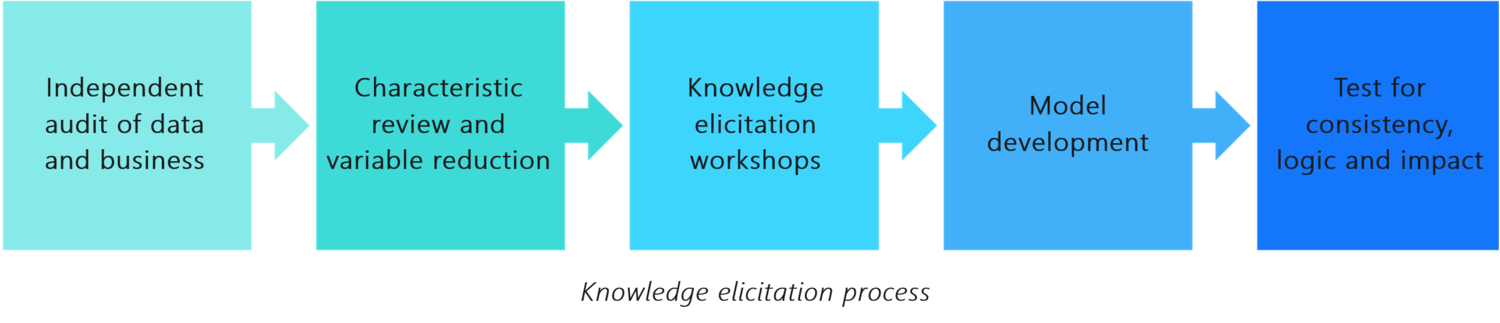

In order to ascertain what would be the most suitable approach for extracting knowledge from the experts, the following must be considered: the portfolio profile, availability of and access to internal knowledge and availability of data. This will be reviewed during an initial audit.

-

A characteristic review is conducted to identify key indicators of risk as well as highlight variables which may not be suitable or do not benefit the model.

-

The data insights from the characteristic review are presented back to the experts through knowledge elicitation workshops, to help inform decisions during the variable reduction exercise.

-

The experts are then asked to conduct variable or scenario comparisons to rank perceived importance and risk. This method can also be applied where the lender has no data at all.

-

The output from the knowledge elicitation process is converted into risk grades, which are used to build a statistically derived model akin to the traditional scorecard methodology. This includes consistency checks to ensure the expert’s comparisons are not illogical.

-

Once the final scorecards are built, a strategy to maximise the efficiency gains from the scorecard is developed or industry benchmarks are used to convert it to a compliant PD model.

With increasing regulatory and competitive pressure, the ability to build reliable credit risk models is critical to understanding your portfolio.

By leveraging 4most’s objective and statistical approach to eliciting expert knowledge, it is possible to build robust models, even in low default environments. The 4most Knowledge Elicitation Tool can be used to aid the experts in making their paired comparisons.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking