PRA Climate Change Thematic Review

03 November 2022

Introduction

Through a series of recent announcements, and following supervisory encouragement, the PRA has made no secret of its intention to start monitoring the responsive actions, or inactions, of regulated firms to demonstrate their capability to manage climate-related financial risk exposure.

In a letter released on 21st October 2022, the PRA, through describing representative practical examples, provides an overview of the current observed capabilities of firms to embed climate-related financial risks into Governance, Risk Management, Scenario Analysis, Disclosure and Data processes.

In this article, we have summarised the themes covered in the PRA’s letter:

-

Expectations when assessing the level of embeddedness in the industry

-

Observations on firms’ progress and examples of effective practice

-

An update on the PRA and Bank of England’s own efforts

The letter as published by the PRA can be read in its entirety here.

Expectations when assessing the level of embeddedness in the industry

Supervisory Statement (SS3/19) published by the PRA on 15th April 2019 sets out the regulator’s expectations concerning management of climate risks for both the banking as well as the insurance sectors. The PRA’s expectations have been classified into the following five categories which together constitute a holistic approach to understanding financial implications of climate change.

GOVERNANCE

-

Board oversight – strategy makers should exhibit adequate knowledge and be supplied regularly with instructive, consistent internal management information to allow climate risks to be integrated into business planning and strategic decision-making.

RISK MANAGEMENT

-

Frameworks and tolerances – the comprehension of climate-related financial risk should be integrated into risk management and directive risk appetite structures using both quantitative and qualitative metrics.

-

Modelling – using appropriate data, firms should demonstrate an ability to build climate-related risk exposure into financial models to quantify balance sheet effects.

-

Counterparties’ exposures – to develop an all-encompassing climate strategy, firms should consider how they can work with their counterparties to develop arrangements that facilitate the transition to a greener economy.

-

Capital – insurers should be disclosing adequate information regarding stressing methodologies, assumptions, risk calibrations and underlying climate risk measurement techniques within the ORSA to allow regulators to ascertain whether sufficient capital is held to protect against emerging climate risks.

SCENARIO ANALYSIS

-

Embedding – regulated firms need to be able to show the PRA that scenario testing, covering a range of climate pathways, is integrated into risk management frameworks yielding a means to illustrate how current weaknesses will be understood and controlled.

DISCLOSURE

-

Adequacy and sufficiency of disclosures – regulated firms should ensure that climate risks are adequately and sufficiently disclosed in “mainstream filings” such as annual reports, SFCR etc. together with ensuring a harmony in the messaging and conclusions between various sources.

DATA

-

Approach to address gaps – where they exist and limit climate risk management, data gaps must be clearly identified, and plans formed, to enhance data quality or source proxy data which can be utilised alongside suitable judgement and assumptions.

Observations on firms’ progress and examples of effective practice

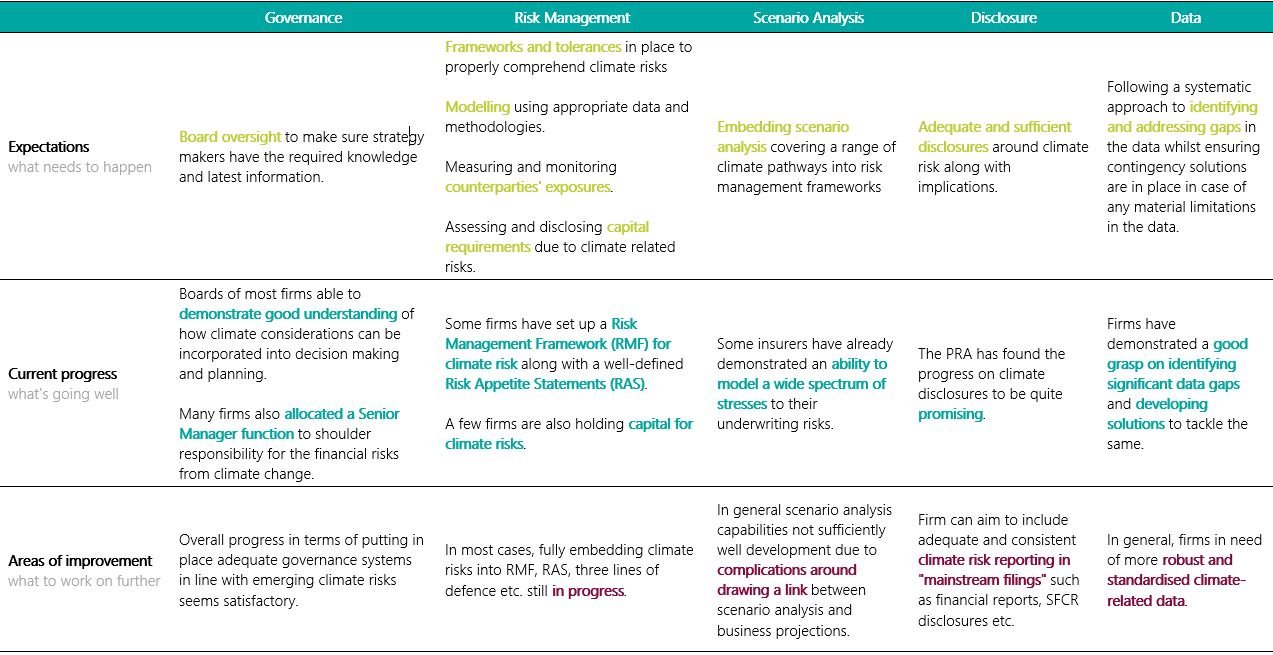

The table below summarises the key observations by the PRA on firms’ progress across all the five facets of climate-related financial risks.

These salient points have been expanded further below along with examples of effective practice demonstrated by firms.

GOVERNANCE

Overall, the PRA observed that firms have made significant progress in embedding its supervisory expectations on governance for climate risks.

-

Firms have implemented strong Board oversight. Boards and Executives demonstrating effective practice were able to show that they understand how their firm is integrating climate considerations into their decision making across business strategies, planning, governance, and risk management processes. The most effective firms supported their approach using appropriate metrics and risk appetites.

-

Most firms have allocated a Senior Manager Function, which holds the responsibility for the financial risks from climate change. These individuals are charged with providing effective oversight of climate risks in a holistic manner. Some firms have even incorporated climate-related objectives into remuneration packages.

RISK MANAGEMENT

It was noted that, although firms had made progress on risk management, some have developed their climate risk management capabilities far more than others. Some of the leaders in this space have demonstrated effective practice:

-

The PRA observed that some firms had a Risk Management Framework (RMF) in place for climate and were implementing well-defined, quantitative Risk Appetite Statements (RAS), which effectively supported the firm in the identification, measurement, monitoring, management, and reporting of climate risks.

-

As part of the RMF, some firms were able to demonstrate that climate risk had been appropriately factored into their models to provide quantitative analysis into climate risk.

-

Some firms are even holding capital for climate risks. The most effective firms have taken a reasonable consideration of how climate risks could impact capital, allowing them to justify why they are (or are not) holding specific capital for those risks.

SCENARIO ANALYSIS

The PRA has observed a large degree of variability in firms’ loss modelling.

-

Firms demonstrating effective practice considered the uncertainty in their climate risk analysis and took this into account when using the results. For example, using prudent assumptions, manual adjustments, or sensitivity analysis to test the impact of different scenarios.

DISCLOSURE

The PRA found that progress on climate disclosures has been promising but highlighted that the disclosures are very dependent on the other areas of SS3/19 (e.g., risk management and scenario analysis). As each area progresses, disclosures should continue to improve.

-

An example of effective practice is, in line with the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations, firms included climate disclosures in ‘mainstream filings’ and employed a consistent and integrated approach across all forms of annual reporting. For example, aligning their messaging across financial reports, climate disclosures, and SFCR / Pillar 3 disclosures.

DATA

As expected, although data is being used effectively by some firms, all firms need more robust, standardised climate-related data. Most firms were reliant on third parties for data, models, and other components of risk management.

-

To allow for this, some have used a best endeavours approach to address the data gaps. Some firms have considered the requirements for reliance on third party providers and balanced the use of those providers with strategic development of in-house capabilities over the short/medium/long-term.

-

Interim measures are being utilised while the data gaps are being addressed. Conservative assumptions and proxies are used to provide estimates that can be used to understand and disclose the climate risks facing the company, which is far preferred to excluding the risks altogether due to the lack of data.

An update on the PRA and Bank of England’s own efforts

In addition to communicating its findings on the embeddedness around climate risks of regulated firms, the Bank of England, following its engagement with firms and discoveries from the Climate Biennial Exploratory Scenario, provides an update on how its own efforts to progress market-wide understanding are going.

The Bank has been making progress in the following areas:

-

Climate and regulatory capital – after publishing the Climate Change Adaption Report, the PRA is scrutinising the treatment of climate change risks within regulatory capital structures. Additionally, the Bank has examined the relationship between climate change in the banking and insurance regulatory capital regimes to understand where they are aligned, and where they could make improvements in the future.

-

Climate and accounting – there are expectations that firms will continue to apprise, supplement, and progress their financial reporting capabilities as climate risks are fully integrated into risk management and strategic decision-making processes.

-

Resources to assist firms in embedding the SS3/19 expectations – the PRA is acting to guarantee that ample resources are available to large and small firms alike; ensuring they are equipped with the knowledge to meet the objectives of SS3/19 (i.e., enhancing approaches to manage financial risks posed by climate change).

In terms of next steps for the PRA, regardless of efforts taken to date to improve monitoring and business-wide understanding of climate risk, regulatory scrutiny and engagement will continue so long as there remains an anticipation that firms can and will work towards enhancing climate-related risk management approaches. Where the PRA deems unsatisfactory progress is made, firms will need to form a strategy to overcome shortcomings. It is also implied that, if deemed appropriate, the PRA may make use of other supervisory tools where necessary. Although there are no definitive statements, it seems as though an under investment in climate capabilities could be treated in the same way as any other regulatory breach, bringing with it the same penalties.

Closing remarks

The progress made by firms in respect of identifying, measuring, and monitoring risks surrounding the financial impacts of climate change has been quite promising. Boards have shown initiative to be on top of latest developments and governance controls around the same. Some firms have even started setting up well-defined and structured risk appetite statements to manage the emerging risks from climate change together with holding additional solvency capital against it.

However, carrying out scenario and sensitivity analyses to cover a broad spectrum of stresses has been wanting particularly due to the difficulties in drawing a connection between stress testing and business projections. Similarly, almost all firms have expressed a need to put in place more robust and standardised processes to collate and manage climate-related data.

At 4most, one area of particular interest to the Insurance team is the appropriateness of scenario or stress testing approaches developed by life insurance firms to analyse the resilience of balance sheets to climate-induced liability risks and quantify the potential impact.

We believe life insurers should start to stress their liabilities for the realisation of future climate change scenarios, particularly where mortality rates are affected by increasingly common extreme temperature patterns. The 4most Insurance team has performed research into this area, producing mortality analysis from demonstrable modelling techniques and publicly disclosed death data. You can read more about the same in our article published in the November 2022 issue of The Actuary magazine.

Firms have commenced disclosing assumptions, methodology, and conclusions around their approach to tackling the financial impacts surrounding climate risks in annual reports and other bespoke climate reports. Although, there is a greater desire from the regulator to encourage firms to disclosure such information in more mainstream filing together with ensuring consistency in the messaging across the various sources. The PRA has also expressed its commitment to continue with its concerted efforts to enable and promote an industry-wide embeddedness around climate risks as part of its overarching supervisory objectives.

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking