Global

Summary of Upcoming Regulatory Initiatives

09 January 2024

4 minute read

Introduction

We summarise the seventh edition of the Regulatory Initiatives Grid published in November 2023. These initiatives provide the flexibility to modify the regulatory framework proactively, ensuring the ability to protect consumers in cases of harm and promote the smooth operation of financial services. Additionally, these changes align with statutory objectives, including the recently introduced secondary international competitiveness and growth objective for both the FCA and PRA.

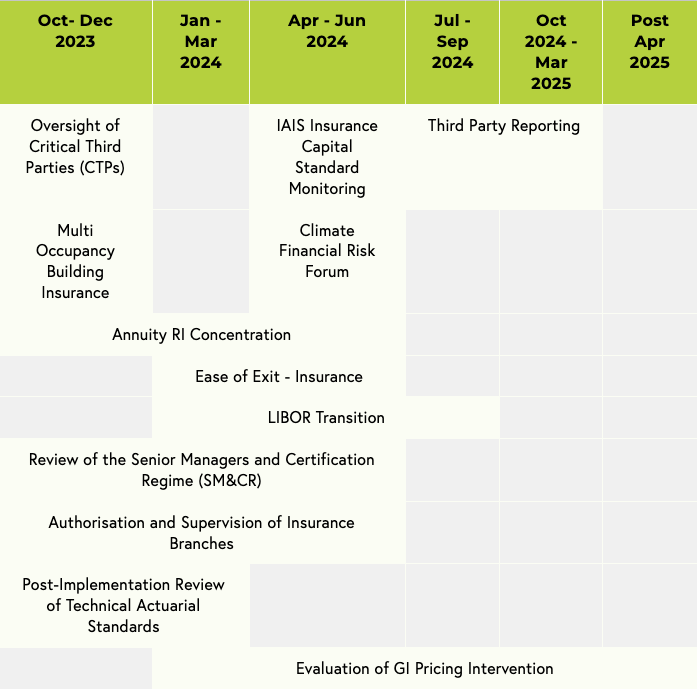

Upcoming Regulatory Initiatives Timeline

Overview of Initiatives (1)

- Ease of Exit – Insurance (Jan’24 -Jun’24): A consultation paper is planned to be published for H12024 aiming to enhance confidence and capabilities to facilitate solvent exits in the insurance sector.

- LIBOR Transition (Jan’24 – Sep’24): The FCA aims to achieve a secure transfer from LIBOR to robust risk-free rates. With low volume of underlying transactions, use of LIBOR is declining and agreed to be replaced by risk free rate – SONIA (Secured Overnight Index Average Benchmark), published by Bank of England. The FCA published synthetic LIBORs to be used temporarily. It is crucial for market participants to ready themselves for the discontinuation of the final synthetic LIBOR settings by the end of March and the end of September 2024.

- IAIS Insurance Capital Standard Monitoring Period (Apr’24 – Jun’24): The Insurance Capital Standard (ICS) is being developed as a consolidated capital standard for Internationally Active Insurance Groups (IAIGs are insurance groups that operate on a global scale and are considered systemically important in multiple jurisdictions). ICS includes three components—valuation, qualifying capital resources, and a standardized method for the capital requirement. The ICS aims to provide a common framework for supervisory discussions on group solvency, fostering global convergence in group capital standards. The data submission for the large international insurance group was scheduled for Q3’23.

- Climate Financial Risk Forum (Apr’24 – Jun’24): The Climate Financial Risk Forum (CFRF) was formed in 2019 as a platform for senior representatives from the financial sector to exchange insights and experiences in navigating climate-related risks and opportunities. The forum is actively working on delivering outputs as part of Session 4, with plans to publish them in the summer of 2024.

- Annuity Reinsurance Concentration (Oct’23 – Jun’24): The ongoing initiative is dedicated to scrutinizing the rising concentrations in annuity reinsurance, with a specific focus on assessing the necessity for additional guidance or regulatory modifications. It is expected that the conclusive consultation paper addressing these considerations will be released by the first half of 2024.

- Oversight of Critical Third Parties (CTPs) (Oct’23 -Dec’23): In July 2022, a collaborative Discussion Paper (DP) was released by The Bank, PRA, and FCA aiming to provide insights for forthcoming regulatory suggestions concerning Critical Third Parties, with a specific focus on intricate aspects like resilience testing. The Treasury also released a Policy Statement that outlined proposals aimed at reducing risks associated with critical third parties in the finance sector. Regulators plan to seek input on Critical Third Parties proposals in Q4 2023.

Overview of Initiatives (2)

- Third Party Reporting (Jul’24 – Mar’25): The initiative aims at minimising the impact of operational disruption in terms of scale, severity, and time to remediate. The Consultation Paper concerning is planned for H2 2024.

- Multi Occupancy Buildings Insurance (Oct’23 -Dec’23): Significant challenges have been observed in the multi-occupancy building insurance market, resulting in unfavourable consequences for leaseholders. A consultation paper has been released, presenting proposed remedies to address issues related to transparency, product design, and remuneration practices. The updated rules will come into force on 31 December 2023.

- Review of the Senior Managers and Certification Regime (SM&CR) (Oct’23 – Jun’24): In March 2023, the Government and regulators began reviewing the SM&CR. A Call for Evidence was launched, and a joint Discussion Paper by the FCA and PRA was issued. Feedback is under assessment, and collaborative proposals for potential improvements and reforms are forthcoming. Consultation paper is due to be published in 2024.

- Authorisation and Supervision of Insurance Branches (Oct’23 -Jun’24): The consolidation and formalization of the PRA’s approach to insurance branch supervision involve the release of a new Statement of Policy (SoP), which will replace the existing SS2/18, along with modifications to SS44/15. The forthcoming SoP will specifically outline the PRA’s stance on reinsurance arrangements and the branch’s scale relative to the legal entity. The final policy is expected in Q2’24.

- Post-Implementation Review of Technical Actuarial Standard (Oct’23 -Mar’24): The FRC conducted a review of Technical Actuarial Standards (TASs) to uphold high-quality actuarial work and the Reliability Objective. Revised TAS 100 and TAS 400 were published, effective from July 2023. Final TAS 300 and TAS 310 to be published in Q3 2023 – Q1 2024.

- Recovery and Resolution Plan (Firm Specific): Supervisory policy measures are being designed to improve overall resilience of the insurance sector. Its overarching goal is to proactively mitigate vulnerabilities and exposures within the insurance industry, preventing them from escalating into systemic risks. Insurers are now expected to develop their recovery plans. The PRA also aims to develop resolution plans basing inputs received from the insurance firms.

- Liquidity Risk Management (Firm Specific): Insurers are now expected to report their liquidity management plans. The metric serves to enhance understanding by providing further insights into insurers’ liquidity exposures as an integral component of the Individual Insurer Monitoring process.

- Global Monitoring Exercise (Firm Specific): The Global Monitoring Exercise (GME) is structured to evaluate trends and advancements in the worldwide insurance market, aiming to identify potential signs of systemic risk accumulation within the global insurance sector.

Further reading: FCA Regulatory Initiatives Grid

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking