Using Risk Analytics to Realise Value in an M&A Boom

23 November 2021

The final quarter of 2020 saw a bout of increased consolidation in the Retail Banking sector. Unfulfilled demand for M&A and ambitious strategic plans means this boom is continuing as we emerge from the Covid-19 pandemic in 2021. This along with the following factors are continuing to drive increased consolidation and divestment across the banking sector:

-

Margin compression – Low base rates and increased impairments are squeezing the net interest margins; the current position is driving a relentless focus on the cost resulting in increasing consolidation and divestment activity across the banking sector to not only improve CER but improve overall asset quality.

-

New capabilities – Increased adoption of digital channels and reduced use of the branch network during the pandemic is shifting the balance in the Banking industry. Incumbents can no longer rely on the prevalence of their branch network. The less digitally enabled banks need to invest in or acquire enhanced capability including AI and Analytics to meet changes in consumer behaviour and digital engagement.

-

Sustainability – Environmental, Social and Governance is fast becoming the hot topic at board level in banking, with the introduction of the new ESG reporting requirements and fiduciary responsibility. Coupled with increasing public sentiment and press coverage on changing weather patterns and associated climate change, it is no surprise that executives are highlighting environmental risk as one of the greatest threats to business growth. As the banking industry continues to progress measurement and understanding of the emerging climate risks, ESG will increasingly play a critical role in M&A decisions.

With the above dynamics playing an increasing role in the M&A activity, support from Specialist Credit and Risk Modelling teams during due diligence and integration planning phases of the M&A process is now more important than ever in helping to secure and execute a successful deal.

During the M&A process, the acquiring firms make assumptions that link directly to the commercial value of the deal – it is vital that teams adequately test these and other benefits assumptions. Other key themes to test at due diligence stage are asset quality, financial implications of acquisition and the costs to integrate.

The deal and due diligence are only the first hurdle. Integration is a top reason why M&As fail in capturing the commercial value, usually due to inadequate planning. Poor planning of deals can lead to delays or poor execution, eroding the commercial value of the deal.

For the different types of consolidation, teams need to approach the planning of integrations differently. Here are some of the different types and how they may impact your planning efforts:

-

Level 1: Coexistence – This is the least integrated option whereby lenders can operate in a brand-differentiated manner. Typically, this would involve minimal integration in most areas. However, overarching management and policies should be reflective of the buyer’s strategies. There is likely to be a data flow to allow for group management and reporting processes to take place. The buyer would still need to see that their prior assumptions and due diligence were accurate and act accordingly

-

Level 2: Absorption – Often initiated through an ambitious strategic vision such as cost synergies, market share or technical capabilities, this is where a buyer absorbs the target company, portfolio, or asset (e.g., forward flow of accounts, customers, or IP). Because of the importance of the assumptions in this type of integration, further work will be done to investigate the assumptions and due diligence. A significant amount of the planning should be apportioned to assessing the best strategy for integration of each function including customer, financial and regulatory models, decisioning and account management systems, and data transitioning.

-

Level 3: Best of Both – This is often the most complex to plan, control and realise the value of. A full review of data and systems should be planned and executed including for acquisition, pricing, customer, financial and regulatory models, financial outputs transition and deployment, and Decisioning and account management strategies, processes, and systems.

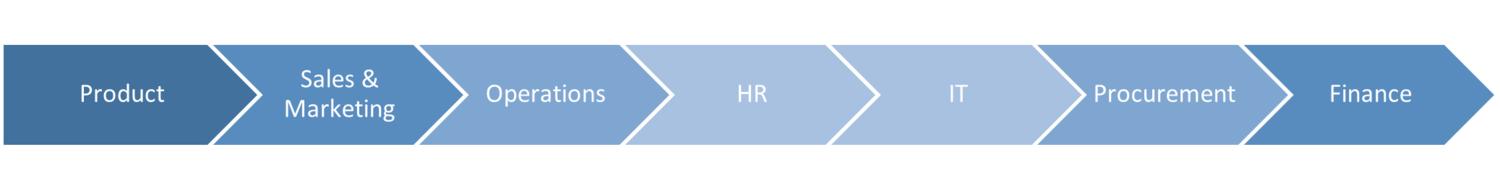

For each of these, credit risk plays a critical part in every aspect of a deal including product, operations, IT and systems, procurement, and finance.

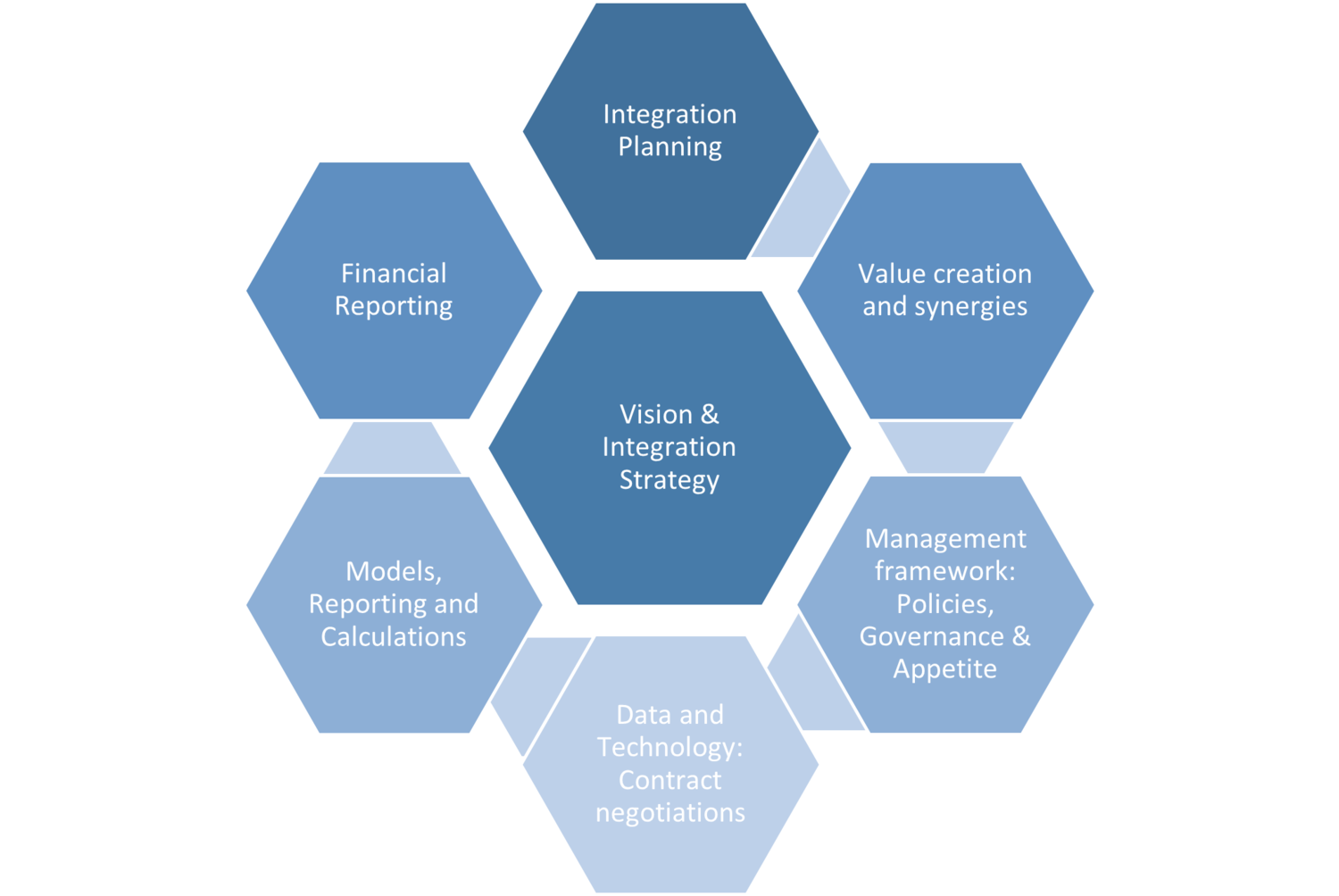

Engaging specialist credit risk experts in your integration planning and execution can help to plan the details of integrating policies, oversight and governance, risk appetite, data, lending criteria, models, reporting and regulatory calculations, all the while monitoring the deal’s sources of value and the desired depth of integration.

At 4most we appreciate that each deal is unique, and the depth of the integration may range from light i.e. brand differentiated to a full front and back book integration. However, there is no doubt that each involves a significant credit and risk undertaking.

So, whether you’re conducting

-

The brand differentiated approach and need help to develop a new overarching operating model, group policies and combining data and output for your financial and regulatory reporting.

Or

-

Completing a best of both approach involving full integration and need support planning activity covering the full credit lifecycle including the above plus the underpinning data alignment and lineage, risk decisioning and calculation systems, models, and credit strategies

4most will work collaboratively with you to plan the credit activity needed and support you and your company in delivering the expected control, synergies, and benefits from the deal.

For more information or help on due diligence or post-M&A integration planning, contact Emma.Heathcote@4-most.co.uk

Interested in learning more?

Contact usInsights

Ruya Bank partners with 4most to deliver IFRS 9 ECL framework and ongoing execution support

24 Feb 26 | Banking

4most named as a supplier on Crown Commercial Service’s Digital Outcomes Specialist 7 RM1043.9 framework

23 Feb 26 | Data

Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 Feb 26 | Insurance

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking