Matching Adjustment adoption in Ireland: Why 2026 could be the breakthrough year

20 February 2026

There are certainly easier ways to spend a year than preparing a Matching Adjustment (MA) application. But there are fewer ways to improve a solvency story, and a series of recent developments suggest that Ireland’s first use of the MA could be just around the corner.

These include:

- Regulatory changes under the EU’s Solvency II 2020 Review (to be implemented in 2027) are creating a more MA-friendly framework, with targeted revisions like allowing greater diversification benefits for MA portfolios.

- Market trends in Ireland – notably the growth of the bulk annuity (pension buy-out) market – are making the MA increasingly attractive.

- The experience of UK insurers provides a compelling case study: UK life companies have harnessed the MA to achieve substantial capital relief and investment flexibility, which has underpinned their booming annuity market.

This paper explores the regulatory, strategic and market factors that are aligning to make 2026 a likely year for Ireland’s first MA application. We begin with background context on the MA itself and its significance. We then examine the regulatory backdrop, the market context in Ireland and the lessons from the UK. Finally, we discuss the strategic implications for Irish insurers and conclude on why this year appears to be a tipping point.

What is the MA and Why Does It Matter?

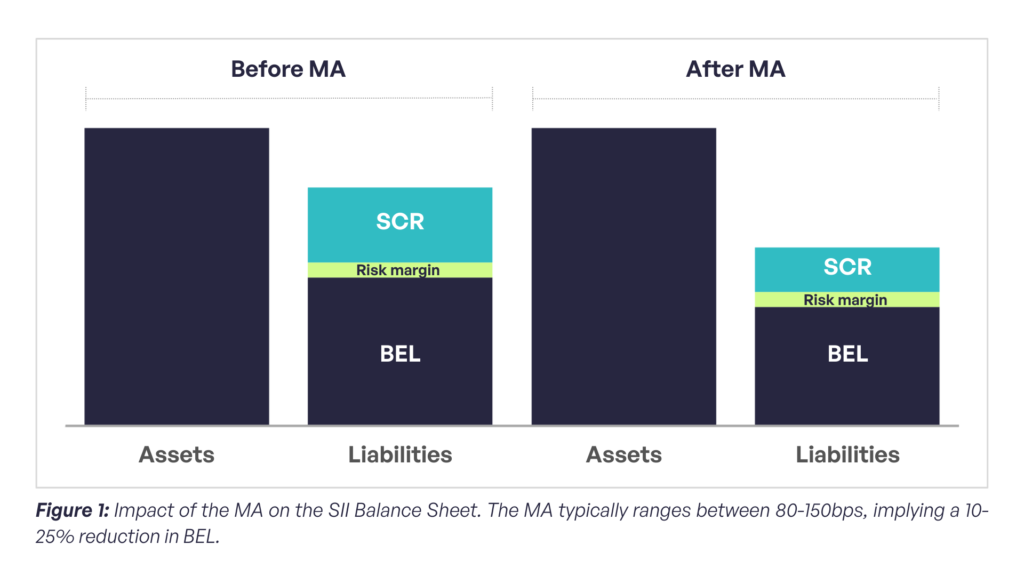

The MA is a mechanism under Solvency II that allows insurers to discount certain long-term liabilities (mainly annuities) at a higher rate than the basic risk-free rate, effectively recognising an illiquidity premium. The illiquidity premium reflects the extra return insurers can earn by holding bonds to maturity, avoiding the impact of short‑term price movements. Applying the MA results in a lower value of the liabilities, meaning the insurer holds lower technical provisions and typically less capital for that business. There are strict eligibility conditions related to matching liability cash flows with a dedicated portfolio of fixed-income assets to benefit from the MA. This higher discount rate is determined based on the assets, with the fundamental spread being deducted to reflect the residual risk of defaults and downgrades on the assets.

Key benefits of the MA include:

- Lower capital requirements: By reducing the stated value of liabilities, the MA can boost an insurer’s solvency ratio and free up capital. UK insurers using the MA have seen significant increases in their surplus capital. This is capital that can be deployed elsewhere.

- Reduced balance sheet volatility: The MA insulates insurers from short-term market swings. If credit spreads widen, under a pure risk-free discounting approach (i.e., without VA or MA) the liabilities wouldn’t change, so the balance sheet would deteriorate. But with the MA, the liability valuation moves in step with asset spreads, dampening volatility.

- Encourages long-term investment: Because the MA makes it capital-efficient to hold higher-yielding assets, insurers have an incentive to invest in long-term bonds, infrastructure loans and other illiquid assets that they might avoid otherwise.

To use the MA, insurers must meet eligibility criteria and get prior approval from the regulator. The assets must have relatively fixed cash flows that reliably cover the liability outgoings; the liabilities must be predictable; and the firm must maintain cash-flow matching and not stray from its strategy.

Up to now, no Irish life insurer has used the MA. Instead, most large insurers have relied on the volatility adjustment, which is easier to implement but offers significantly less capital relief. This is not surprising: Ireland’s life insurance market historically had a limited amount of business that would qualify. However, conditions are changing. Irish insurers are now looking at much larger potential books of annuity-like liabilities, and regulators are signalling more openness to the MA. The Central Bank of Ireland (CBI) issued guidance on MA applications back in 2018, laying out how an insurer should apply and what evidence is required. The framework for MA exists, it’s permitted by law, and the process is defined. It’s just that no company has pulled the trigger yet.

Regulatory developments: Solvency II 2020 review and a more MA-friendly framework

Regulation can make or break the appeal of the MA. In the EU, Solvency II is the governing regime, and its rules around MA have historically been somewhat conservative. The Solvency II 2020 Review is introducing several key changes that will encourage MA adoption. These amendments are due to take effect in 2027.

The changes are described as “targeted” rather than revolutionary, but they directly address some of the previous hurdles associated with using the MA. Below is a summary of the most relevant regulatory changes for the MA:

| Key Change | Implication for MA Adoption |

| Risk Margin Reduction (Cost-of-Capital from 6% to 4.75%) | Lowers the risk margin (a component of technical provisions) for long-term liabilities, which particularly benefits annuity business and reduces the capital strain of long-duration guarantees. |

| Diversification Allowance between MA portfolio and rest of firm | Relaxes the current restriction on recognising diversification effects between MA portfolios and the rest of the undertaking in the SCR calculation (subject to ring‑fencing treatment). |

| Eligibility of assets | Clarifies/updates MA asset eligibility (including conditions for restructured assets), which may widen feasible MA backing assets. |

In addition to the above, the Solvency II review includes broader measures to encourage long-term investment by insurers, with the overall intent being to reduce undue volatility and does not discourage insurers from holding long-term risky assets. This philosophy aligns with the MA’s purpose.

The UK has already transitioned to a less restrictive framework for MA (under “Solvency UK”). As part of Solvency UK reforms, the PRA widened MA asset eligibility (effective 30 June 2024) and reduced the risk margin significantly. While those UK-specific changes don’t apply in Ireland, they serve as a real-world experiment demonstrating the benefits of “relaxing” MA rules.

The Central Bank of Ireland will implement the Solvency II changes locally. Ireland’s regulator is already familiar with MA concepts and has been observing the UK developments closely. We can expect that now in 2026 the CBI will likely be more receptive to MA applications, possibly even encouraging insurers to consider them if it improves risk management.

Ireland’s bulk annuity market: Growth spurt and competitive pressure

A major driver strengthening the case for MA adoption is the changing market landscape in Ireland, particularly the growth of the bulk purchase annuity (BPA) or pension risk transfer market. Bulk annuities are insurance contracts where an insurer takes over a pension scheme’s liabilities in exchange for an upfront premium. For life insurers, this is a prime business line for applying the MA due to the long-term, predictable payouts involved.

Timeline of the Irish BPA market:

- 2010 – 2021: Aside from 2017, little to no activity in the Irish BPA market

- 2022: Irish BPA market saw a large increase in transactions amounting to €500m

- 2022 – 2025: Since 2022, Irish market averaged approx. c€400m p.a.

- 2026: Expected to exceed value of previous years’ transactions due to a variety of factors outlined in this article

In the early 2010s and even through 2018–2019, bulk annuity deals in Ireland were rare and typically small. However, 2017 stands out as an exceptional year, with approximately €650m of transactions completed – the highest level recorded. After this spike, activity dipped again until the market re‑accelerated in 2022, when volumes reached around €500m and have since stabilised at approximately €400m per year, signalling a more consistent and scalable market pattern.

Market commentary suggests annual volumes could reach around €1bn in some years as the market matures, leading to large accumulations of annuity business on insurers’ books, representing a higher proportion of their overall technical provisions.

A combination of factors is fuelling the demand from pension schemes in Ireland: improved funding levels, employers wanting to offload pension risk and regulatory changes like the IORP II directive increasing governance costs for pension funds.

Initially, only a few Irish insurers actively wrote bulk annuity business, primarily Irish Life and Aviva Ireland. However, with the market now scaling up, competition is heating up. There are also indications that new entrants may be preparing to enter Ireland’s bulk annuity market. Some possibilities include international insurers who have set up EU subsidiaries or specialist firms entering through reinsurance or partnerships. Deferred annuities are also expected to emerge as a significant part of the market, with multiple insurers ready to transact once regulatory hurdles and ALM challenges (particularly around CPI hedging) are overcome. Any insurer that seriously competes in bulk annuities will want to use the MA – otherwise they are at a huge disadvantage. In the UK, every major bulk annuity provider uses the MA. If an outside player enters Ireland with MA capabilities, they could potentially undercut local insurers on price or take on larger deals that a non-MA user would struggle to finance.

From a technical standpoint, bulk annuity liabilities have the qualities that make them perfect for the MA. They involve a fixed series of payments often spanning decades. Insurers typically invest the single premium in a bond portfolio whose cash flows match those payouts. The MA was designed for exactly this scenario.

In Ireland, the first MA application will almost certainly be motivated by bulk annuity business. Irish Life, for instance, might apply to use MA for its growing portfolio of bulk annuities. Aviva or others could follow. It might also happen the other way around: a new entrant with MA capability forces the incumbents’ hand.

The UK experience: Lessons from a mature MA market

Although the UK market differs significantly in structure and scale, there are still many lessons the Irish market can take from it. In the UK, there are several BPA‑only writers whose entire focus is on pension risk‑transfer business and the associated investment strategies. In contrast, Irish providers typically write a broader mix of product lines. For context, the UK bulk annuity market is a global leader: recent annual volumes have been in the £40–50bn range (for example, £49.1bn in 2023 and £47.8bn in 2024) – excluding the longevity swap market which can reach up to a further £20bn per year. The UK’s market is over 50 times the size of Ireland’s in absolute terms. It offers a clear preview of the benefits and challenges associated with the MA, which UK insurers have been applying extensively since 2016.

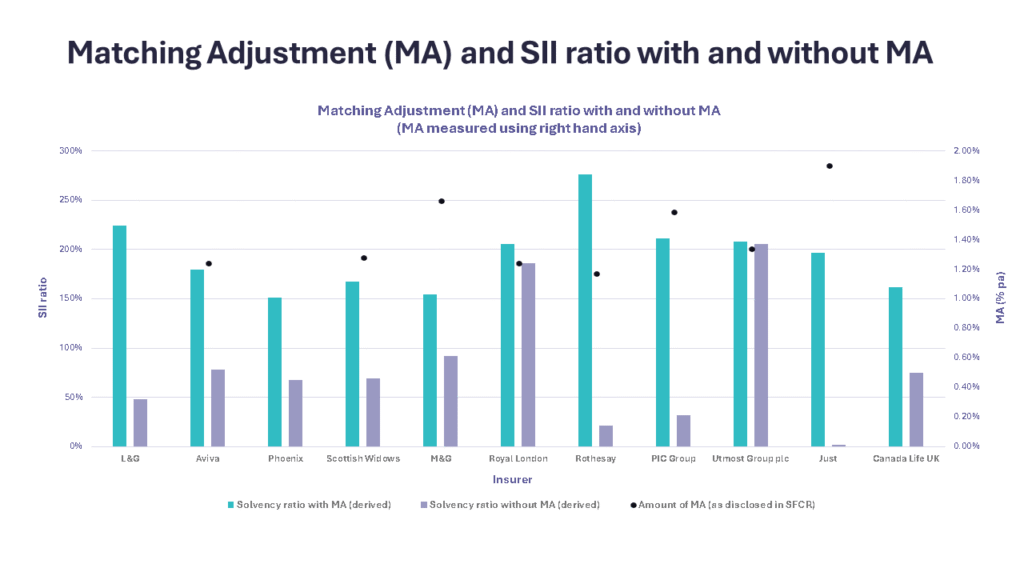

Figure 2: Impact of the MA on the main UK insurers solvency ratios at year end 2023

Key lessons include:

- Significant capital and solvency benefits: As above, UK insurers have reported materially stronger solvency positions due to the MA. The MA delivers exactly what it promised: it stabilises balance sheets and frees up capital to be used productively.

- Ability to invest in illiquid assets safely: MA has enabled investment in long-term assets like infrastructure projects, commercial real estate loans, and equity-release mortgages. These assets offer better yields than government bonds, and with the MA, insurers can hold them more capital-efficiently.

- Regulatory trust and refinement: The UK authorities’ stance over time has been increasingly supportive of the MA. They retained the MA post-Brexit and even relaxed some rules in 2024 after extensive analysis. The regulator’s trust in the MA grew as they saw it in action.

- Competitive necessity in annuities: All major UK annuity providers use MA to compete. If anything, the competition is about whose MA portfolio is more optimised.

- Managing risks – downgrades and default resilience: UK insurers have navigated periods of stress without major issues in their MA portfolios. They typically hold diversified, mostly investment-grade assets and act if credit quality deteriorates.

The UK’s experience demonstrates that the MA is a powerful tool for life insurers managing long-term liabilities. It has become entrenched in how they do business. For Ireland, this should provide confidence that adopting the MA is a logical step.

Strategic implications for Irish insurers

Adopting the MA is a major strategic shift that touches many aspects of a company:

- Reallocating investment strategy: An insurer eyeing the MA will orient its investment strategy towards long-duration, fixed-income assets. This is a shift from a more liquid or short-term strategy to an asset-liability matching focus.

- Product and market focus: Choosing to use the MA typically goes hand-in-hand with a decision to grow certain lines of business, chiefly annuities, and pension de-risking solutions.

- Capital management and growth: The explicit benefit of the MA is capital relief, giving management greater flexibility, for example, reducing reliance on internal reinsurance. An insurer adopting the MA in 2026 will likely find its Solvency II ratio jumps once the MA is approved.

- Operational and governance demands: Using the MA imposes operational complexity. Insurers will need to upgrade their risk management framework and perform regular stress tests on the MA portfolio.

- Regulator and stakeholder communication: Insurers will want to ensure they bring along key stakeholders on the journey. This means engaging early with the Central Bank and communicating with other relevant stakeholders.

There is a strategic decision on timing. The first mover in Ireland to get MA approval might gain a reputation boost and win early deals. Once the first approval happens, other insurers in the bulk purchase annuity market will be playing catch up. It could trigger a domino effect of MA applications among the main providers to remain competitive, unless they can achieve capital efficiencies elsewhere via cross border reinsurance arrangements, for example.

Conclusion: Why 2026 could be “the year” for MA in Ireland

All indicators suggest that this year will be the year an Irish life insurer seriously considers or finally takes the plunge and applies for the MA.

- Regulatory stars are aligning: Ireland will be on the cusp of implementing the Solvency II review changes that explicitly favour MA usage.

- Market stars are aligning: the bulk annuity business is growing to levels that simply make it too costly to remain on Solvency II’s standard basis without the adjustment.

- Strategic stars are aligning: Irish insurers are always striving to boost returns, innovate in asset strategies, unlock capital, and meet competitive challenges – all of which the MA can help address.

Insurers in Ireland will also have had the advantage of observing the UK’s post‑2024 Solvency UK regime in action. If UK firms continue to thrive under these less restrictive MA conditions, it will provide further evidence and confidence for Irish insurers considering the MA. In addition, Irish insurers with UK counterparts may benefit even more, as they can directly draw upon the established MA expertise within their UK teams.

From a regulatory approval standpoint, an application made in mid-2026 could be approved by end-2026 or early 2027, nicely aligning with the Solvency II updated rules taking effect. That timing makes sense, get approval under current rules, then immediately benefit from the improved rules.

In conclusion, all the core drivers – regulatory change, market growth, competitive necessity, and accumulated experience – point to 2026 being the tipping point. It seems likely that at least one Irish life insurer will break the ice and apply. Once the first entrant proves it can be done, others could quickly follow, and the MA will become a standard feature for Ireland’s main BPA providers.

How 4most can help?

4most supports insurers at every stage of their MA journey – from initial feasibility assessments and asset-liability matching diagnostics, through to regulatory application support and integration. With deep expertise in Solvency II, actuarial modelling, and investment strategy, we help clients design MA portfolios that are both capital-efficient and operationally sustainable. Our experience across the UK and EU markets ensures that clients navigate the evolving regulatory landscape with confidence and clarity.

Send us an email if you want to learn more about how we can support your organisation – info@4-most.co.uk.

Interested in learning more?

Contact usInsights

Interest-only mortgages under review: Increased regulatory scrutiny for Dutch banks

29 Jan 26 | Banking

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance