Our most comprehensive model validation report

Born in the UAE, with a history that dates back to 1972, DP World has grown into a global force over the years. The company now boasts over 110,000 employees across 75+ countries, all committed to a shared mission of “making trade flow and change what’s possible for everyone,” going above and beyond for their clients.

DP World is currently going through a transformational journey of becoming a leading global logistics provider. As part of its transformation journey, DP World launched DP World Trade Finance in 2021 to address one of the biggest barriers to trade, allowing access to affordable working capital solutions. DP World Trade Finance launched its own lending activity in 2022. As part of its lending activity, they developed a sophisticated credit rating model that supports lending decisions by evaluating both qualitative and quantitative factors.

The DFSA, DP World Trade Finance’s regulator, requires a formal validation process to ensure they remain accurate and fit for purpose, which is where 4most entered the equation.

Enter 4most’s specialists

To conduct a truly comprehensive validation of the model, DP World Trade Finance enlisted 4most and our market-leading expertise within credit risk analytics. Our objectives were two-fold:

- Produce a detailed validation report, with an emphasis on actionable findings.

- Provide a mapping between DP World Trade Finance’s internal credit rating scores and external agency ratings, aligning internal assessments with widely recognised external benchmarks.

“As a team, we’re always delighted to receive amazing feedback about our dedication and commitment to delivering exceptional results — and this project was no different.”

Working as one from start to finish

We deployed a specialist team of seasoned validation experts and junior analysts, and set about understanding the nuances of DP World Trade Finance’s credit and model risk interactions. By collaborating closely from the start, we were able to adapt our proprietary commercial validation framework to suit the specific requirements of the project.

Clear and precise results

Despite the tight turnaround, we delivered the final validation report on time, at which point it was praised for its clarity and precision. By providing a structured and traceable validation process, with each finding meticulously explained and justified, we were able to successfully validate DP World Trade Finance’s credit rating model — using a methodology they could trust.

Plus, by including a detailed mapping of credit rating scores compared with external agency ratings, we presented the chosen methodology along with a number of alternative approaches. This ensured we hit both of our original goals, while ultimately strengthening DP World Trade Finance’s credit risk management capabilities and positioning them well for their expanded role in trade finance.

Can 4most support your organisation in a similar way? Let us know how we can help you by completing our short contact form.

Interested in learning more about our case studies?

Get in touchInsights

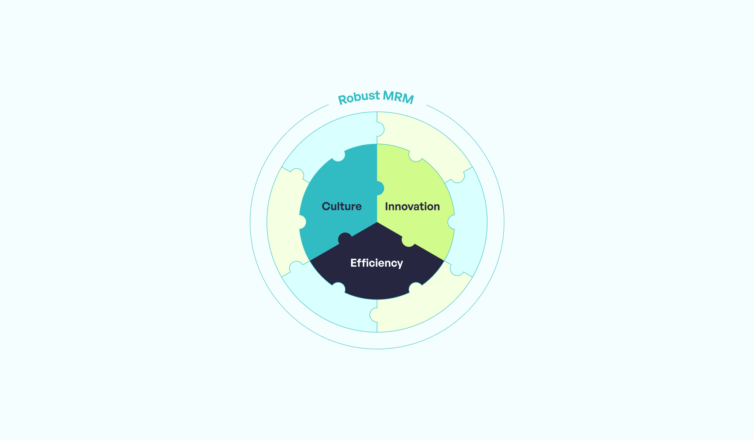

[Watch online] Model risk management: Regulatory landscape, industry challenges, and moving forward

17 Oct 25 | Banking

Leveraging controlled innovation — the second core element of robust Model Risk Management

25 Nov 24 | Banking