Model Risk Management (MRM)

Model risk is embedded across financial services, wherever models are used, and the importance of models is growing. With regulatory scrutiny on the rise, we’re here to help our clients manage and monitor their model landscape, and align with evolving regulatory requirements.

What we offer

Model identification

We enable businesses to implement robust frameworks and processes to identify models used in decision making, management and reporting throughout the traditional risk scope.

Model inventory management

By collaborating closely with clients, we provide fully auditable and flexible solutions with role specific workflow tools that can host all aspects of a model inventory – such as our Model Management Tool (Focus). This includes governance controls, documentation, linkages, findings and ongoing monitoring results.

Model frameworks and standards

Conduct current state assessments and develop frameworks for all aspects of the model risk lifecycle. Our skills cover model development, independent model reviews and model governance, in addition to the overall model risk management policy.

Model risk reporting

Design and implement model risk reporting frameworks to assess and monitor model risk across the model lifecycle. We tailor everything to the end user, and provide training to ensure all stakeholders understand the models, their limitations and key areas of uncertainty.

Training and people augmentation

Increase company agility and respond to rapidly developing regulatory requirements with our model risk management experts. We’ll complement your existing resource pool and provide training to any areas that are less exposed to analytics and model risk management.

Model Risk Management for AI & ML

Comprehensive support for model risk management of non-traditional techniques, including use case identification and management; validation of ML, LLM and vendor models and robust policies and procedures for the development and validation of models.

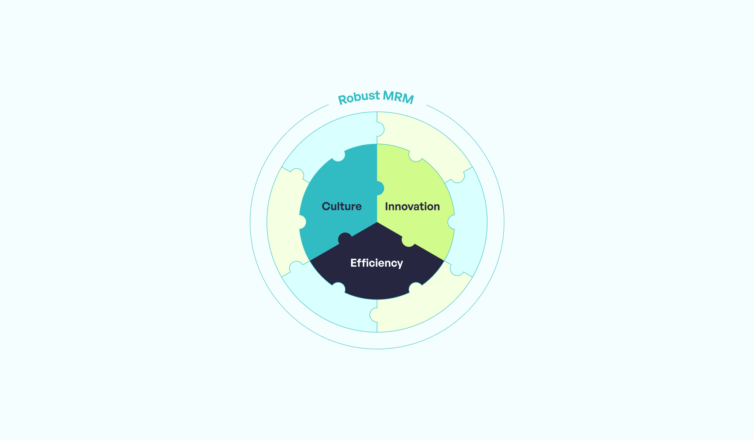

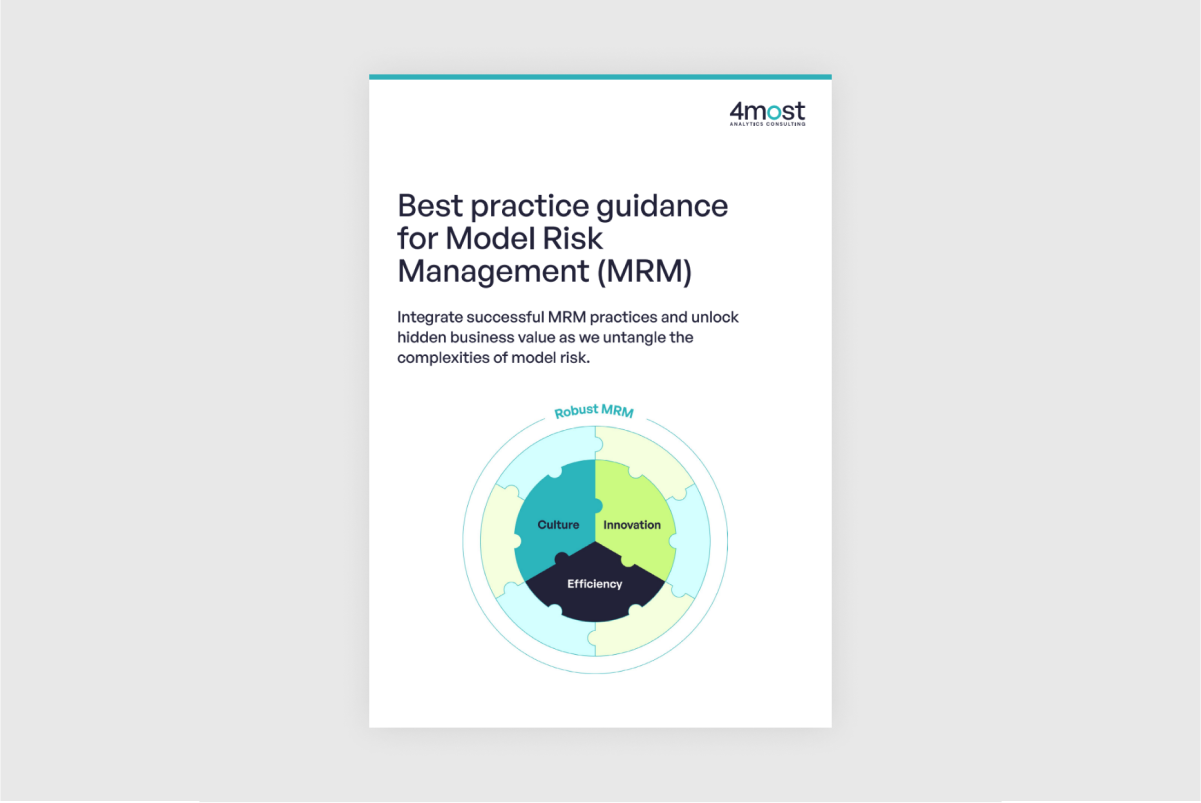

Struggling to prioritise Model Risk Management?

Our latest best practice guidance provides all the expert advice you need to create, embed, and train key aspects of MRM in your organisation.

Read it, share it with your team, and discover the significant business benefits of robust MRM.

Read the guideWhy choose 4most?

250+ consultants

Each with our own specialisms, experience, and insights. When you work with one of us, you work with all of us.

Trusted 100%

Our track record speaks for itself. In our most recent Client Satisfaction Survey, every single one of our clients recommended us.

Tailored to you

We take the time to understand your unique challenges so that we can deliver bespoke solutions that truly make a difference.

True specialists

There’s experts, and then there’s specialists. We live and breathe risk analytics consulting every day, which means we stay in tune with the latest trends.

Key contacts

“4most has an excellent array of industry experts who have a great breadth of knowledge when it comes to Model Risk Management and the impacts of new regulations.”

Got a question about our Model Risk Management service?

Get in touchInsights

[Watch online] Model risk management: Regulatory landscape, industry challenges, and moving forward

17 Oct 25 | Banking

Leveraging controlled innovation — the second core element of robust Model Risk Management

25 Nov 24 | Banking